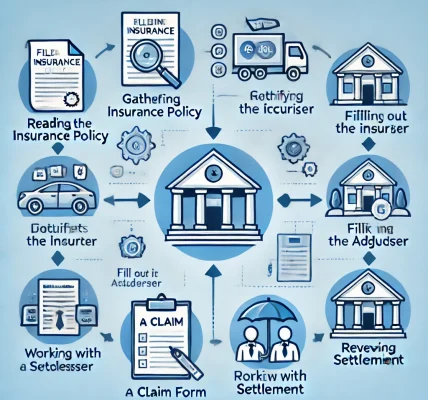

When it comes to insurance claims, receiving a low settlement offer from your insurance company can be frustrating and disappointing. Whether it’s related to car insurance, health insurance, or property insurance, insurance companies often try to minimize their payout to save money. However, it’s important to remember that you have rights, and there are steps you can take to ensure you receive a fair settlement.

In this guide, we’ll walk you through the essential steps to take if your insurance company offers you a low settlement.

1. Understand Your Policy and Coverage

Before taking any action, the first thing you need to do is carefully review your insurance policy. Understanding the details of your coverage is crucial because it allows you to compare the offer with what your policy promises. Check for any exclusions, limits, and deductibles that could impact your settlement.

- Key Takeaway: Know exactly what you’re entitled to before challenging the settlement offer.

2. Document the Damage or Loss

If you haven’t already, gather all documentation related to your claim. This could include medical records, repair bills, photographs of damage, or loss receipts. The more evidence you can provide, the stronger your case will be.

- Tip: Create a timeline of events to back up your claim, showing the sequence of actions and damages.

3. Assess the Settlement Offer

Review the offer in detail. Is it significantly lower than your estimated costs? Does it cover all your expenses, including lost wages, medical bills, and any future expenses? If the offer seems insufficient, it’s time to take action.

- Tip: Compare the settlement to your own calculations. Use online tools or consult experts to estimate the true cost.

4. Negotiate with Your Insurance Company

Don’t be afraid to negotiate with your insurer. Often, low settlement offers are just starting points, and many insurance companies are willing to increase their offer once you push back. Be polite but firm, and present your documented evidence and calculations to justify why you deserve a higher payout.

- Tip: Have a clear target in mind and be prepared to explain why the initial offer is not adequate.

5. Seek Professional Help if Needed

If the negotiations don’t lead to a satisfactory outcome, consider hiring a professional to assist you. This could be an insurance adjuster, attorney, or claims consultant who specializes in dealing with insurance companies. They can help you navigate the process and ensure your rights are protected.

- Tip: Having an expert on your side can level the playing field with the insurance company.

6. File a Complaint with Your State Insurance Department

If you believe the insurer is acting in bad faith or violating your rights, you can file a complaint with your state’s insurance department. Each state has a regulatory body that oversees the conduct of insurance companies. This step can be an effective way to put pressure on the company to offer a fair settlement.

- Tip: Complaints are often handled swiftly, especially if there’s evidence of unfair treatment.

7. Consider Legal Action

As a last resort, you may need to consider filing a lawsuit. If the insurance company is unwilling to offer a reasonable settlement, taking legal action may be the only way to secure the compensation you deserve. Consulting with an attorney specializing in insurance law can help you understand your chances of winning the case.

- Tip: Weigh the cost of legal fees against the potential settlement before proceeding with a lawsuit.

8. Stay Patient and Persistent

The insurance claim process can be long and exhausting, but don’t give up. Be persistent in following up with your insurer and stay organized. Remember, insurance companies will often offer a low settlement hoping that claimants will accept it without challenge.

- Tip: Stay calm and keep communication lines open. Your persistence could pay off in the end.

Final Thoughts

Getting a low settlement offer from your insurance company can feel like a setback, but it doesn’t have to be the end of the road. By understanding your policy, documenting your losses, negotiating effectively, and seeking professional help, you can significantly improve your chances of securing a fair settlement.