Payday loans are often marketed as quick and easy solutions for financial emergencies. They promise fast cash without the hassle of credit checks or lengthy application processes. However, beneath the surface, payday loans come with high-interest rates and hidden fees that can trap borrowers in a cycle of debt. In this comprehensive guide, we will uncover the truth about payday loans, how they work, their risks, and whether they are a good option for you.

What Are Payday Loans?

A payday loan is a short-term, high-cost loan typically designed to be repaid on the borrower’s next payday. These loans are generally small, ranging from $100 to $1,500, and are offered by payday lenders, both online and in physical stores.

How Payday Loans Work:

- Application: Borrowers apply for a payday loan by providing proof of income, a valid ID, and a bank account.

- Approval Process: Unlike traditional loans, payday lenders do not perform hard credit checks. Approval is quick, often within minutes.

- Loan Disbursement: Once approved, the loan amount is deposited into the borrower’s bank account, usually within 24 hours.

- Repayment: The borrower must repay the full loan amount, along with fees and interest, on their next payday (usually within two weeks to a month).

The Hidden Costs of Payday Loans

While payday loans may seem like a convenient solution, they come with excessive costs that can make repayment difficult.

High Interest Rates and Fees

Payday loans have some of the highest interest rates in the lending industry. The annual percentage rate (APR) on payday loans can range from 300% to 700% or more. For comparison, credit cards usually have an APR of 15%–30%.

For example:

- Borrowing $500 with a 15% fee means you owe $575 in two weeks.

- If you can’t repay and roll over the loan, you pay another 15% fee on the new balance, leading to more debt.

Debt Cycle Trap

Many borrowers struggle to repay payday loans in full by the due date. Lenders allow borrowers to roll over their loans, meaning they extend the due date for an additional fee. This practice keeps borrowers stuck in a cycle where they continuously owe more money.

Hidden Fees and Automatic Withdrawals

Some lenders include hidden fees, such as late payment fees and insufficient funds fees. Additionally, payday lenders may have automatic withdrawal agreements, meaning they can take money directly from your bank account, even if you don’t have sufficient funds, leading to overdraft fees.

Who Uses Payday Loans?

Payday loans are often used by individuals who:

- Have poor or no credit history and cannot access traditional loans.

- Need urgent cash for emergency expenses, such as medical bills or rent.

- Live paycheck to paycheck and struggle with financial stability.

- Do not understand the full terms and risks of payday loans.

Real-Life Example

Sarah, a single mother, borrowed $300 from a payday lender to cover an unexpected car repair. The lender charged a 15% fee ($45), meaning she owed $345 on her next payday. When she couldn’t repay the full amount, she rolled over the loan, paying another $45 fee. After three months, she had paid $180 in fees but still owed the original $300 loan.

Are Payday Loans Worth the Risk?

While payday loans can provide immediate cash, they are often not worth the risk due to the following reasons:

1. Extremely High Costs

A payday loan can cost you several times the amount you borrowed, making it one of the most expensive ways to borrow money.

2. Debt Cycle Danger

Many borrowers end up taking out new loans to cover the previous ones, leading to long-term financial struggles.

3. Negative Impact on Credit

Most payday lenders do not report positive payments to credit bureaus, meaning your credit score does not improve. However, missed payments may be sent to collections, damaging your credit.

4. Legal and Ethical Concerns

Some payday lenders engage in predatory lending practices, misleading borrowers about fees and repayment terms.

Alternatives to Payday Loans

Instead of turning to payday loans, consider these safer financial options:

1. Personal Loans from Banks or Credit Unions

- Lower interest rates (typically 5%–36% APR)

- Longer repayment terms

- May require a credit check, but more affordable than payday loans

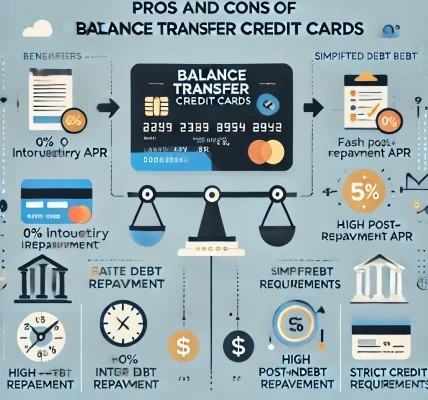

2. Credit Card Cash Advances

- Lower APR than payday loans (typically 20%–30%)

- No fixed repayment date (minimum payments required)

3. Borrow from Friends or Family

- Interest-free or low-interest borrowing

- Flexible repayment terms

4. Payment Plans with Creditors

- If facing a financial emergency, ask your landlord, utility company, or medical provider for a payment plan.

5. Earn Extra Income

- Take up side gigs (freelancing, food delivery, online tutoring) to cover urgent expenses without borrowing.

Final Thoughts: Should You Get a Payday Loan?

Payday loans may seem like a quick fix, but they come with severe financial risks. The high costs, debt traps, and negative impact on credit make them a dangerous financial choice for most people.

Key Takeaways:

✅ Avoid payday loans whenever possible—the high fees and debt cycle can worsen your financial situation. ✅ Explore safer alternatives such as personal loans, credit card advances, and payment plans. ✅ Improve your financial habits to avoid emergency cash needs—build an emergency fund, budget wisely, and increase income sources.

If you are considering a payday loan, carefully review the terms, fees, and repayment conditions. Making informed financial decisions will help you avoid falling into a cycle of debt and build a stable financial future.