Introduction

Retirement planning is a crucial part of financial security, yet many individuals struggle with the question: “How much should I save for retirement?” The answer is not one-size-fits-all, as it depends on various factors like lifestyle goals, expected retirement age, income, inflation, and market returns.

In this comprehensive guide, we will explore the right savings rate for retirement, factors influencing your retirement savings, and strategies to maximize your savings potential. By the end, you’ll have a clear roadmap for securing a financially stable retirement.

Why Retirement Savings Matter

Saving for retirement ensures that you can maintain your standard of living after you stop working. Without proper planning, retirees may face financial stress, reliance on social security benefits, or even the risk of outliving their savings.

A well-structured retirement savings plan allows you to:

✔ Maintain financial independence

✔ Cover healthcare expenses

✔ Enjoy your desired lifestyle

✔ Prepare for unforeseen emergencies

How Much Should You Save? The 15% Rule & Beyond

1. The 15% Rule

Financial advisors commonly recommend saving at least 15% of your gross income annually for retirement. This includes contributions to employer-sponsored plans (like a 401(k)), IRAs, and other retirement savings accounts.

Example:

- If you earn $60,000 per year, saving 15% means contributing $9,000 per year (or $750 per month).

However, the 15% rule is just a general guideline. The right savings rate for you depends on several factors.

2. Age-Based Savings Benchmarks

To help individuals gauge their retirement preparedness, financial experts suggest aiming for specific savings milestones based on income and age.

| Age | Target Retirement Savings (as a multiple of annual income) |

|---|---|

| 30 | 1x annual salary saved |

| 40 | 3x annual salary saved |

| 50 | 6x annual salary saved |

| 60 | 8x-10x annual salary saved |

| 67 | 10x-12x annual salary saved |

🔹 Example: If your salary is $80,000, by age 40, you should aim to have $240,000 saved for retirement.

Factors Influencing Your Retirement Savings Rate

1. Retirement Age

The earlier you plan to retire, the more you need to save. Retiring at 55 instead of 67 means needing a larger nest egg to cover additional years without income.

2. Lifestyle Expectations

Do you plan to travel extensively, own multiple properties, or downsize? Your retirement lifestyle significantly impacts how much you need to save.

3. Expected Healthcare Costs

Medical expenses often increase with age. Consider a Health Savings Account (HSA) or additional savings for long-term care.

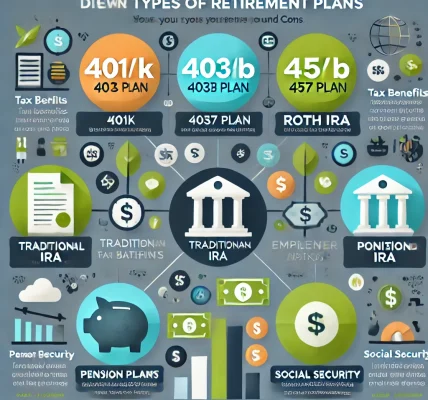

4. Social Security & Pension

Estimate how much you will receive from Social Security and whether you have any pension income. These can supplement, but should not replace, your retirement savings.

5. Inflation & Market Returns

A 3% inflation rate erodes purchasing power over time. Ensure your investments outpace inflation by choosing growth-oriented portfolios early in your career.

Strategies to Maximize Your Retirement Savings

1. Start Early & Leverage Compound Interest

The earlier you start saving, the less you need to contribute each month due to compound interest.

Example:

- Investing $500/month at 7% annual return starting at age 25 grows to $1.2 million by age 65.

- If you start at age 40, the same investment grows to only $400,000.

2. Max Out Employer-Sponsored Retirement Accounts

If your employer offers a 401(k) match, contribute enough to maximize this benefit—it’s free money!

3. Diversify Your Investments

Invest in a mix of:

✔ Stocks (growth potential)

✔ Bonds (stability)

✔ Real estate (passive income)

4. Use Tax-Advantaged Accounts

Consider contributing to:

- Traditional IRA (tax-deferred growth)

- Roth IRA (tax-free withdrawals)

- Health Savings Account (HSA) (triple tax advantage)

5. Increase Contributions Over Time

Whenever you get a raise or bonus, increase your savings percentage.

Common Retirement Savings Mistakes to Avoid

🚨 Waiting Too Long to Start – The later you start, the harder it becomes to reach your goal.

🚨 Not Taking Advantage of Employer Match – Leaving free money on the table reduces your savings potential.

🚨 Being Too Conservative with Investments – A low-risk portfolio might not generate enough returns over time.

🚨 Ignoring Inflation – Make sure your savings outpace inflation to maintain purchasing power.

🚨 Not Having a Withdrawal Strategy – Without a proper withdrawal plan, you risk depleting your savings too quickly.

Conclusion

So, how much should you save for retirement? While 15% of income is a strong starting point, your personal savings rate depends on:

✔ Your desired retirement age

✔ Lifestyle expectations

✔ Healthcare costs

✔ Other income sources (Social Security, pensions, etc.)

The key is to start early, invest wisely, and adjust your strategy as needed. By planning ahead and staying disciplined, you can secure a financially stable retirement and enjoy your golden years stress-free!

🔹 Need personalized retirement planning guidance? Consult a certified financial planner to tailor a savings strategy that aligns with your goals.