Life insurance is a crucial financial tool that provides security and peace of mind to your loved ones. However, a standard life insurance policy may not always cover all your specific needs. This is where life insurance riders come into play. Riders are optional add-ons that can enhance your policy by offering additional benefits tailored to your unique situation. In this guide, we will explore the most valuable life insurance riders, their benefits, and how they can improve your coverage.

What Are Life Insurance Riders?

Life insurance riders are customizable provisions added to your primary insurance policy. These riders allow policyholders to extend their coverage beyond the basic death benefit, providing financial assistance in various circumstances like critical illness, disability, or accidental death. While adding riders may increase your premium, they can offer significant financial protection that justifies the cost.

Top Life Insurance Riders to Consider

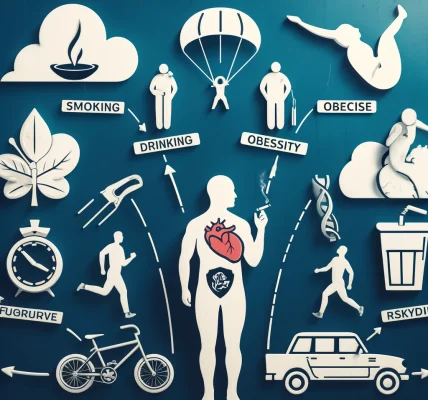

1. Accidental Death Benefit (ADB) Rider

- What It Does: Pays an additional sum if the insured dies due to an accident.

- Who Should Consider It: Individuals with high-risk jobs or frequent travelers.

- Why It’s Useful: Ensures extra financial security for your beneficiaries in the event of an unforeseen accident.

2. Critical Illness Rider

- What It Does: Provides a lump-sum payout upon diagnosis of a severe illness such as cancer, heart attack, or stroke.

- Who Should Consider It: Those with a family history of critical illnesses.

- Why It’s Useful: Covers medical expenses, treatment costs, or loss of income due to illness.

3. Waiver of Premium Rider

- What It Does: Waives future premium payments if the policyholder becomes disabled or critically ill.

- Who Should Consider It: Anyone seeking financial security in case of income loss due to disability.

- Why It’s Useful: Ensures continuous coverage even when you are unable to work.

4. Disability Income Rider

- What It Does: Provides a regular income if the insured becomes disabled and unable to work.

- Who Should Consider It: Primary breadwinners or individuals in physically demanding jobs.

- Why It’s Useful: Helps cover daily expenses and maintain financial stability.

5. Return of Premium (ROP) Rider

- What It Does: Refunds all premiums paid if the insured outlives the policy term.

- Who Should Consider It: Those who want a savings component with their term insurance.

- Why It’s Useful: Ensures that policyholders receive financial benefits even if they do not make a claim.

6. Long-Term Care (LTC) Rider

- What It Does: Covers long-term care costs for chronic illnesses or disabilities.

- Who Should Consider It: Older adults or those planning for assisted living care.

- Why It’s Useful: Reduces the financial burden of long-term medical care and nursing facilities.

7. Spouse and Child Term Rider

- What It Does: Provides coverage for a spouse or children under the same policy.

- Who Should Consider It: Parents and couples looking for affordable coverage for their dependents.

- Why It’s Useful: Saves the cost of purchasing separate policies for family members.

8. Term Conversion Rider

- What It Does: Allows policyholders to convert a term policy into a permanent policy without a medical exam.

- Who Should Consider It: Individuals uncertain about long-term financial needs.

- Why It’s Useful: Offers flexibility to extend coverage later without additional health assessments.

9. Accelerated Death Benefit (ADB) Rider

- What It Does: Provides an advance payout if the insured is diagnosed with a terminal illness.

- Who Should Consider It: Anyone seeking financial support for end-of-life care.

- Why It’s Useful: Helps cover medical expenses and provides financial relief during difficult times.

10. Guaranteed Insurability Rider

- What It Does: Allows policyholders to purchase additional coverage without undergoing a medical exam.

- Who Should Consider It: Young professionals or individuals with changing financial needs.

- Why It’s Useful: Enables an increase in coverage to match life events like marriage or having children.

How to Choose the Right Riders for Your Life Insurance Policy

1. Assess Your Financial Needs

- Consider your income, family obligations, and potential risks.

- Identify areas where additional financial security is necessary.

2. Compare Costs and Benefits

- Riders add extra costs to your premium, so evaluate whether they align with your financial goals.

- Analyze the long-term benefits versus the additional premiums paid.

3. Understand Policy Terms

- Read the fine print and understand the exclusions and limitations.

- Check if the rider benefits expire at a certain age or policy duration.

4. Work with a Financial Advisor

- A licensed advisor can help tailor your insurance policy with the right riders.

- Get professional guidance to ensure you don’t pay for unnecessary add-ons.

5. Review Your Policy Regularly

- Life changes, and so do your insurance needs. Reassess your policy every few years.

- Modify or add riders based on life events like marriage, childbirth, or career advancements.

Final Thoughts

Life insurance riders can significantly enhance your coverage by offering additional financial security, flexibility, and peace of mind. Choosing the right riders depends on your lifestyle, financial goals, and family needs. By carefully evaluating the available options, you can tailor your policy to provide the best possible protection for your future and your loved ones.

Before purchasing a policy, make sure to compare rider options, consult with an expert, and choose benefits that align with your long-term financial plan. The right riders can transform a standard life insurance policy into a comprehensive safety net that truly meets your needs.