A strong credit score is essential for financial stability, influencing everything from loan approvals to interest rates. However, many misconceptions surround credit scores, leading people to make mistakes that can negatively impact their financial health.

In this DIY guide, we will debunk common credit score myths and provide factual insights into what truly affects your credit rating. By understanding these factors, you can take control of your credit and build a strong financial foundation.

Understanding Credit Scores

A credit score is a numerical representation of your creditworthiness, typically ranging from 300 to 850. Lenders use this score to assess the risk of lending money to you. The higher the score, the more likely you are to receive favorable loan terms.

Key Credit Score Ranges:

- Excellent (750–850) – High chances of loan approval with low interest rates.

- Good (700–749) – Favorable terms and decent interest rates.

- Fair (650–699) – May qualify for credit, but with higher interest rates.

- Poor (600–649) – Limited credit opportunities and higher costs.

- Very Poor (300–599) – High risk, often leading to loan rejections.

Now, let’s uncover the biggest myths about credit scores and set the record straight.

Top Credit Score Myths Debunked

Myth 1: Checking Your Credit Score Lowers It

Reality: Checking your own credit score, known as a soft inquiry, does not impact your score. Only hard inquiries, which occur when lenders check your credit for loan approvals, can slightly lower your score.

Tip: Regularly monitor your credit report through official sources like credit bureaus or financial institutions to stay updated on your credit health.

Myth 2: You Need to Carry a Balance on Your Credit Card to Build Credit

Reality: Carrying a balance on your credit card is not necessary to build credit. In fact, carrying a high balance can lead to increased interest payments and negatively impact your credit utilization ratio.

Tip: Pay off your credit card balance in full each month to avoid unnecessary interest and maintain a low credit utilization ratio.

Myth 3: Closing Old Credit Accounts Improves Your Credit Score

Reality: Closing old accounts can actually harm your credit score by reducing your overall available credit and shortening your credit history length, both of which are factors in your credit score calculation.

Tip: Keep old accounts open, especially if they have a long credit history and no annual fees, to maintain a stronger credit profile.

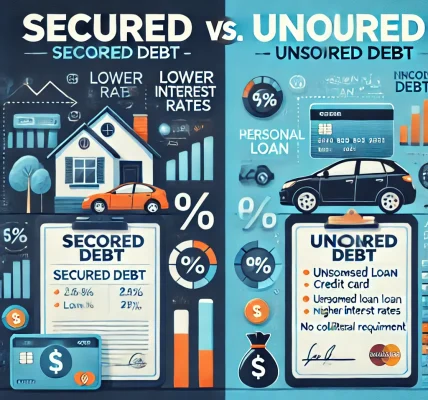

Myth 4: All Debts Are Bad for Your Credit Score

Reality: Not all debt negatively impacts your credit score. Responsible borrowing and timely payments on loans, such as mortgages and student loans, can help build your credit.

Tip: Focus on managing debt wisely and making payments on time rather than avoiding credit entirely.

Myth 5: Paying Off a Debt Removes It from Your Credit Report Immediately

Reality: While paying off debt is beneficial, the account history remains on your credit report for a set period. Positive accounts stay for up to 10 years, while negative items (e.g., missed payments) can remain for up to 7 years.

Tip: Continue making timely payments to establish a positive credit history over time.

Myth 6: Income Affects Your Credit Score

Reality: Your income level does not directly affect your credit score. However, it can influence your ability to pay bills, which indirectly impacts your score if payments are missed.

Tip: Maintain good financial habits regardless of your income level to ensure strong credit health.

Myth 7: You Can Pay to Instantly Improve Your Credit Score

Reality: Any company promising to instantly fix your credit score for a fee is likely a scam. Credit repair takes time, and only legitimate steps—like paying bills on time and reducing debt—can improve your score.

Tip: Avoid credit repair scams and focus on genuine credit-building strategies.

Myth 8: Debit Cards Help Build Credit

Reality: Debit card transactions do not affect your credit score since they do not involve borrowing money. Only credit card usage and loans contribute to your credit history.

Tip: If you don’t have a credit history, consider using a secured credit card to start building your credit.

Myth 9: Being Married Merges Your Credit Scores

Reality: Marriage does not automatically merge your credit scores. Each person maintains an individual credit score, though shared accounts (like joint credit cards or loans) can impact both partners.

Tip: Maintain good credit habits individually and discuss financial plans with your partner to manage joint financial responsibilities effectively.

Myth 10: A High Credit Limit Harms Your Score

Reality: Having a high credit limit is not harmful if you maintain a low credit utilization ratio (i.e., the percentage of available credit you use). A higher limit can actually help lower utilization, which is beneficial for your score.

Tip: Request a credit limit increase if you can manage credit responsibly, but avoid excessive spending.

What Really Affects Your Credit Score?

Now that we’ve debunked common myths, let’s focus on the key factors that actually influence your credit score:

- Payment History (35%) – Consistently making on-time payments is the biggest factor.

- Credit Utilization (30%) – Keeping your credit usage below 30% of your total credit limit.

- Credit History Length (15%) – Older credit accounts contribute positively.

- New Credit Inquiries (10%) – Multiple hard inquiries in a short time can lower your score.

- Credit Mix (10%) – A diverse mix of credit accounts (e.g., credit cards, mortgages, auto loans) can be beneficial.

Conclusion

Understanding the truth about credit scores is essential for maintaining financial health. By avoiding myths and focusing on proven credit-building strategies, you can improve your score and enhance your financial opportunities.

Remember:

- Regularly check your credit report for errors.

- Pay bills on time to maintain a positive payment history.

- Keep your credit utilization low.

- Use credit responsibly to build a solid financial foundation.