Introduction

Planning for retirement is one of the most critical financial decisions an individual can make. A well-chosen pension scheme ensures financial stability and security during post-retirement years. However, many people make mistakes while applying for pension schemes, which can lead to financial losses, reduced benefits, or even rejection of their applications.

To help you navigate the process smoothly, this article outlines the top mistakes to avoid while applying for a pension scheme and provides practical tips to make informed decisions.

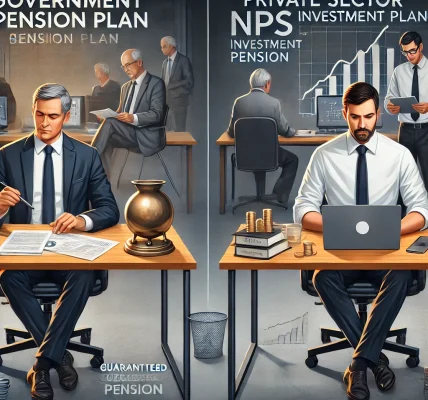

1. Not Researching the Right Pension Scheme

Many applicants fail to research different pension schemes before choosing one. There are multiple pension plans available, including:

- Government-backed pension schemes (e.g., NPS, SCSS, EPS, PMVVY)

- Private pension schemes offered by financial institutions

- Market-linked pension plans that provide higher returns but carry some risks

How to Avoid This Mistake?

- Compare different pension schemes, their benefits, eligibility, and tax implications.

- Assess your financial needs and risk appetite before making a decision.

2. Ignoring the Eligibility Criteria

Each pension scheme has specific eligibility requirements based on age, income, employment status, and contribution period. Applying for a scheme without meeting these criteria can lead to rejection.

How to Avoid This Mistake?

- Carefully check the eligibility criteria for the chosen pension scheme.

- Ensure you fulfill the age and income requirements before applying.

3. Delaying the Application Process

One of the biggest mistakes is postponing the pension scheme application until later years. Delayed enrollment often leads to:

- Higher contribution requirements

- Reduced returns and benefits

- Fewer investment options

How to Avoid This Mistake?

- Start investing in a pension scheme as early as possible to maximize benefits.

- Use financial calculators to estimate how much you need to save for retirement.

4. Not Considering Inflation While Estimating Retirement Needs

Many applicants fail to account for inflation when determining the amount they need post-retirement. The purchasing power of money decreases over time, and insufficient planning may lead to financial difficulties.

How to Avoid This Mistake?

- Use inflation-adjusted calculations to determine future financial needs.

- Opt for pension schemes that offer cost-of-living adjustments.

5. Choosing the Wrong Pension Payment Option

Pension schemes offer different payout options, including:

- Lump sum withdrawals

- Annuity payments (monthly, quarterly, yearly)

- Combination of both

Choosing an unsuitable payout option may lead to liquidity issues or financial instability.

How to Avoid This Mistake?

- Assess your post-retirement financial needs before selecting a payout option.

- If you have regular expenses, opt for an annuity rather than a lump sum.

6. Not Verifying Documents Properly

Many applications get rejected due to incomplete or incorrect documentation. Common errors include:

- Mismatched personal details (Name, DOB, PAN, Aadhaar, etc.)

- Missing financial proofs

- Incorrect nominee details

How to Avoid This Mistake?

- Double-check all documents before submission.

- Ensure all personal details match across documents.

- Keep scanned copies for easy access.

7. Ignoring the Tax Implications

Different pension schemes have different tax benefits and liabilities. Not considering tax implications can lead to unnecessary tax burdens.

How to Avoid This Mistake?

- Understand the tax deductions available under Sections 80C, 80CCD(1B), and 80CCD(2).

- Consider tax-free pension withdrawal options to maximize savings.

8. Not Naming a Nominee or Choosing the Wrong One

Failure to add a nominee or choosing the wrong nominee can cause complications in case of an unforeseen event.

How to Avoid This Mistake?

- Always nominate a legal heir or trusted person.

- Update nominee details periodically.

9. Overlooking Withdrawal Rules & Penalties

Some pension schemes have strict withdrawal rules. Premature withdrawal may lead to penalties or loss of benefits.

How to Avoid This Mistake?

- Read the withdrawal and exit rules before enrolling in a scheme.

- Avoid premature withdrawals unless necessary.

10. Falling for Fraudulent Pension Schemes

Many individuals fall prey to fraudulent pension schemes promising unrealistic returns. Investing in such schemes can lead to financial losses.

How to Avoid This Mistake?

- Choose pension schemes regulated by RBI, SEBI, IRDAI, or EPFO.

- Verify details through official government or bank websites.

- Be cautious of schemes that promise exceptionally high returns.

Conclusion

Avoiding these common mistakes while applying for a pension scheme can help you secure a financially stable retirement. By researching the right plan, verifying documents, considering tax implications, and planning withdrawals strategically, you can maximize your pension benefits.