Introduction

With the rapid advancements in technology, the financial sector has undergone a significant transformation, and pension schemes are no exception. The digitalization of pension schemes has enhanced accessibility, efficiency, and transparency, making it easier for individuals to plan their retirement securely.

In this guide, we will explore how digital transformation has revolutionized pension schemes, the various online services available, and the numerous benefits for pension holders.

The Role of Digital Transformation in Pension Schemes

Digital transformation in pension schemes involves the integration of technology to simplify pension-related processes, reduce paperwork, and provide a seamless user experience. Some key innovations include:

- Online pension accounts and dashboards

- Automated fund management and AI-driven advisories

- Digital KYC (Know Your Customer) and online verification

- Mobile applications for real-time pension tracking

- Automated customer support through AI chatbots

These innovations have made pension management more efficient, secure, and user-friendly, ultimately benefiting pension scheme subscribers across the globe.

Key Online Services in Pension Schemes

1. Online Pension Account Management

Most government and private pension providers now offer online portals where users can:

- Check their pension balance

- Track contributions and investment performance

- Update personal details

- Download account statements

Example: The National Pension System (NPS) e-portal in India allows users to manage their pension accounts online, reducing the need for physical visits.

2. Digital KYC & e-Verification

Gone are the days of submitting physical documents. Now, pension scheme subscribers can complete their KYC verification online through:

- Aadhaar-based authentication (India)

- e-KYC via banking portals

- Biometric authentication

This has sped up the enrollment process and reduced fraud risks.

3. Online Pension Contributions & Payments

Subscribers can make real-time contributions through digital payment methods such as:

- Net banking & UPI payments

- Credit/debit card transactions

- Auto-debit from linked bank accounts

This ensures timely investments, reducing the risk of missing pension contributions.

4. Mobile Apps for Pension Tracking

Many pension providers have developed mobile applications that allow users to:

- Track pension growth

- Receive alerts on contributions and withdrawals

- Access investment advisory services

Example: The EPFO Mobile App in India helps Employees’ Provident Fund (EPF) members check their pension balance on the go.

5. AI-Powered Pension Advisory Services

With the integration of artificial intelligence (AI), pension holders can now receive personalized investment advice, helping them optimize their savings based on risk appetite and retirement goals.

6. Digital Pension Withdrawal & Fund Transfer

Subscribers can initiate pension withdrawals or transfer funds from one scheme to another through online platforms, reducing paperwork and long processing times.

Benefits of Digital Pension Schemes

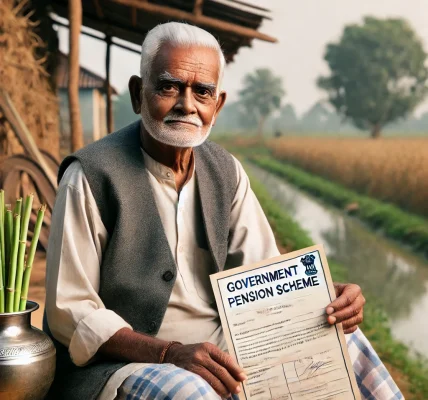

1. Enhanced Accessibility

- Subscribers can access their pension accounts anytime, anywhere through web portals and mobile apps.

- Rural and remote area pensioners can easily manage their pensions without visiting offices.

2. Increased Transparency & Security

- Digital records reduce errors and fraud in pension schemes.

- Blockchain technology is being explored for secure pension transactions.

3. Faster Processing & Reduced Paperwork

- Online processing eliminates delays caused by manual paperwork and approvals.

- Transactions such as fund transfers and withdrawals are processed instantly.

4. Cost Savings for Pension Providers & Governments

- Reducing physical infrastructure and staff dependency results in lower operational costs.

- Automated processes improve efficiency, reducing administrative burdens.

5. Better Customer Experience

- AI-powered chatbots and virtual assistants provide instant query resolution.

- Online grievance redressal mechanisms ensure quicker resolutions to subscriber issues.

6. Environmentally Friendly

- Elimination of paperwork contributes to a sustainable and eco-friendly pension system.

Challenges in Digital Pension Transformation

Despite its benefits, digital transformation in pension schemes faces some challenges:

- Digital Literacy: Some users, especially senior citizens, may struggle with technology.

- Cybersecurity Risks: Online platforms are vulnerable to cyber threats, requiring strong security measures.

- Technical Glitches: System downtime or software bugs may hinder seamless operations.

- Data Privacy Concerns: Protecting sensitive pension data is crucial for user trust.

Governments and financial institutions are continuously working on solutions to enhance digital literacy, improve cybersecurity, and streamline online pension services.

Future of Digital Pension Schemes

The future of pension schemes will likely see:

- Blockchain-based pension transactions for enhanced security

- AI-driven investment advisory to maximize returns

- Integration with central bank digital currencies (CBDCs) for seamless fund management

- Voice-enabled pension services for accessibility

These advancements will further simplify pension management, making it more inclusive, efficient, and secure.

Conclusion

The digital transformation of pension schemes has revolutionized the way people plan for their retirement. By leveraging online services, mobile apps, AI, and secure digital payments, pension management has become more transparent, efficient, and accessible.

While challenges exist, continuous technological advancements will further streamline pension processes, reduce fraud, and enhance user experience. Embracing digital pension schemes ensures a hassle-free and financially secure retirement.