Introduction

Retirement planning is an essential aspect of financial security, but many people overlook the role of life insurance in this process. Life insurance isn’t just about providing financial support to your loved ones after your passing—it can also be a strategic tool for ensuring a stable and comfortable retirement.

In this guide, we’ll explore how life insurance can complement your retirement plan, offering security, tax benefits, and wealth-building opportunities.

1. Why Consider Life Insurance for Retirement Planning?

Life insurance can help you in multiple ways as you prepare for retirement:

✅ Income Replacement: Provides financial support for your spouse or dependents if something happens to you. ✅ Tax-Free Death Benefits: Ensures your beneficiaries receive money without tax deductions. ✅ Cash Value Growth: Some policies accumulate cash value that you can use in retirement. ✅ Long-Term Care Coverage: Certain policies offer riders that cover medical expenses. ✅ Estate Planning Benefits: Helps cover estate taxes and ensures smooth wealth transfer.

Unlike traditional savings methods, life insurance can protect and enhance your retirement assets.

2. Types of Life Insurance for Retirement Planning

There are several types of life insurance policies, but not all are suitable for retirement planning. Here’s a breakdown of the most relevant options:

🔹 Term Life Insurance

- Provides coverage for a specific term (e.g., 10, 20, or 30 years).

- More affordable but does not accumulate cash value.

- Best for temporary income protection before retirement.

🔹 Whole Life Insurance

- Offers lifetime coverage with a guaranteed death benefit.

- Accumulates cash value, which can be used during retirement.

- Premiums are higher but remain fixed throughout the policy.

🔹 Universal Life Insurance

- Provides flexible premiums and death benefits.

- Accumulates cash value that can grow based on investment performance.

- Ideal for those who want adjustable coverage in retirement.

🔹 Indexed Universal Life Insurance (IUL)

- Cash value grows based on stock market performance (with limits).

- Potential for higher returns compared to traditional policies.

- Provides flexibility in premium payments and withdrawals.

Each policy serves a different purpose in retirement planning. Choosing the right one depends on your financial goals and risk tolerance.

3. How Life Insurance Supports Retirement Income

🔸 Building Tax-Free Wealth with Cash Value

Permanent life insurance policies accumulate cash value over time. This can be withdrawn or borrowed tax-free, making it an excellent supplemental income source during retirement.

💡 Example: If you have a whole life policy with a $100,000 cash value, you can withdraw funds without facing traditional income taxes, unlike 401(k) or IRA withdrawals.

🔸 Using Policy Loans for Retirement Expenses

Most permanent policies allow you to borrow against the accumulated cash value without selling investments or incurring penalties.

✔️ No impact on Social Security benefits. ✔️ No early withdrawal penalties (unlike 401(k) before age 59½). ✔️ Flexible repayment terms.

🔹 Example: If you need $50,000 for healthcare costs, you can take a loan from your policy instead of liquidating assets.

🔸 Supplementing Pension or Social Security Gaps

With rising living costs an

d unpredictable market fluctuations, relying solely on Social Security or pensions may not be enough. Life insurance can provide an additional layer of security by offering guaranteed income streams.

🔹 Example: If your pension covers 60% of your expenses, a whole life insurance payout can fill the gap.

4. Tax Advantages of Life Insurance in Retirement

One of the biggest advantages of life insurance in retirement planning is its tax efficiency.

🔵 Tax-Free Death Benefit: Beneficiaries receive the payout without income tax liability. 🔵 Tax-Deferred Growth: Cash value within a policy grows tax-free. 🔵 Tax-Free Loans & Withdrawals: You can borrow from the cash value without tax penalties. 🔵 Estate Tax Reduction: Helps offset inheritance taxes, ensuring more wealth is passed on.

💡 Compared to traditional retirement accounts (401(k)s and IRAs), life insurance allows for greater flexibility and fewer tax burdens.

5. How to Choose the Right Life Insurance Policy for Retirement

To maximize the benefits of life insurance in retirement, follow these steps:

✅ Assess Your Financial Goals

- Do you need income replacement for your spouse?

- Are you looking for cash value growth?

- Do you want long-term care coverage?

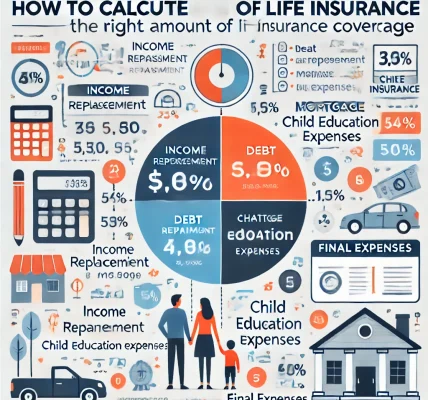

✅ Calculate Your Coverage Needs

- Use the DIME Method (Debt, Income, Mortgage, Education) to estimate the necessary coverage amount.

- Consider potential healthcare costs and inflation.

✅ Compare Different Policy Types

- If you need simple coverage, choose term insurance.

- For cash value growth, opt for whole life or universal life.

✅ Work with a Financial Advisor

- Consult a licensed insurance expert to find the best plan.

- Review your policy every 5-10 years to adjust for lifestyle changes.

6. Common Mistakes to Avoid

🔴 Buying Too Much Coverage: High premiums can eat into your retirement savings. 🔴 Ignoring Cash Value Policies: If used wisely, these can enhance your retirement income. 🔴 Not Updating Your Policy: Life circumstances change—adjust your coverage accordingly. 🔴 Waiting Too Long: Buying life insurance earlier ensures lower premiums and higher cash accumulation.

Conclusion

Life insurance plays a vital role in retirement planning by offering financial security, tax benefits, and income supplementation. Whether you need income replacement, estate planning, or long-term care funding, the right life insurance policy can help you achieve a stress-free retirement.