Introduction

Health insurance provides financial protection against unexpected medical expenses. However, filing an insurance claim can be confusing for first-time policyholders. This guide will help you understand the claim process, ensuring a smooth experience.

What is a Health Insurance Claim?

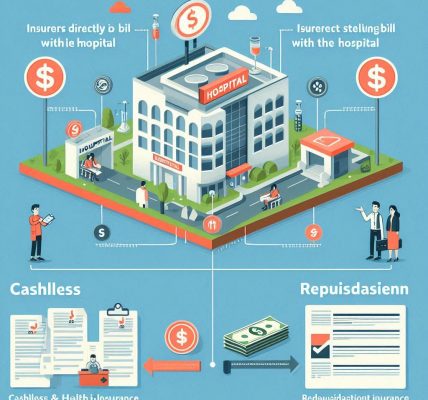

A health insurance claim is a formal request submitted by the policyholder to the insurance company to cover medical expenses. Claims are generally of two types:

- Cashless Claim: The insurer directly pays the hospital for medical expenses.

- Reimbursement Claim: The policyholder pays first and gets reimbursed later.

Step-by-Step Guide to Filing a Health Insurance Claim

Step 1: Review Your Policy Terms

Before filing a claim, read your policy document carefully to understand what is covered, any exclusions, and the claim process.

Step 2: Notify Your Insurance Provider

Timely notification is crucial:

- Planned Hospitalization: Inform your insurer 48-72 hours in advance.

- Emergency Hospitalization: Notify within 24 hours of admission.

Step 3: Cashless vs. Reimbursement Claim Process

Cashless Claim Process

- Get admitted to a network hospital.

- Submit a pre-authorization form at the insurance desk.

- Hospital sends the request to the insurer.

- Once approved, the insurer settles the bill directly.

Reimbursement Claim Process

- Pay the medical expenses yourself.

- Collect all original bills, medical reports, and prescriptions.

- Fill out the claim form and attach required documents.

- Submit the claim form to your insurer within the stipulated time.

- Once verified, the insurer reimburses the approved amount.

Step 4: Documents Required for Claim Approval

- Completed claim form

- Policyholder’s ID proof

- Original hospital bills and payment receipts

- Doctor’s prescription and medical reports

- Discharge summary

- Investigation and diagnostic test reports

- Pharmacy bills (if applicable)

Step 5: Follow Up on Claim Status

After submitting the claim, track its status through the insurer’s portal or customer support. Insurers usually provide a reference number for updates.

Step 6: Claim Settlement

- Cashless Claim: The insurer settles the bill with the hospital.

- Reimbursement Claim: The insurer transfers the approved amount to your bank account.

Common Reasons for Claim Rejection

- Incomplete Documentation: Ensure all required documents are submitted.

- Policy Exclusions: Some treatments may not be covered.

- Delayed Submission: Submit claims within the insurer’s deadline.

- Pre-Existing Conditions: Claims related to pre-existing diseases may have a waiting period.

- Non-Network Hospital: Cashless claims are applicable only in network hospitals.

Tips for a Smooth Claim Process

- Keep copies of all submitted documents.

- Maintain a digital record of bills and prescriptions.

- Understand your policy coverage and limitations.

- Contact your insurer for clarifications before hospitalization.

- Have an emergency fund for initial payments in case of delays.

Conclusion

Filing a health insurance claim is a straightforward process if you follow the right steps. Understanding your policy, maintaining proper documentation, and being proactive in claim submission can ensure a hassle-free experience. If you have any doubts, always reach out to your insurer for assistance.