A poor credit score can cost you more than just loan approvals—it can impact various aspects of your financial life, from higher interest rates to limited housing options. Many people don’t realize just how expensive bad credit can be until they experience the consequences firsthand.

In this guide, we will uncover the hidden costs of bad credit and provide practical DIY strategies to fix your credit and regain financial stability.

Understanding Bad Credit

What Is a Bad Credit Score?

A credit score is a numerical representation of your creditworthiness. Scores typically range as follows:

- Excellent (750 – 850)

- Good (700 – 749)

- Fair (650 – 699)

- Poor (550 – 649)

- Very Poor (300 – 549)

A bad credit score (below 650) indicates a high risk to lenders, leading to unfavorable financial outcomes.

Common Causes of Bad Credit

- Late or missed payments

- High credit card balances (high credit utilization)

- Defaulting on loans

- Too many hard inquiries (applying for too much credit at once)

- Bankruptcy or foreclosure

- Having no credit history

Now that we understand what bad credit is, let’s dive into its hidden costs.

The Hidden Costs of Bad Credit

1. Higher Interest Rates on Loans and Credit Cards

Lenders charge higher interest rates to individuals with bad credit to offset the risk of potential defaults. This means you could end up paying thousands more in interest over the life of a loan.

💡 Example: A person with good credit may get a 5% interest rate on a $20,000 car loan, while someone with bad credit may get 15% or higher. This could mean paying $5,000+ extra in interest over the loan term.

2. Difficulty Getting Approved for Loans

With bad credit, banks and lenders may reject your loan applications, making it harder to finance major purchases like a home, car, or even personal loans.

3. Higher Insurance Premiums

Many insurance companies use credit scores to determine rates. Those with bad credit often pay higher premiums for car, home, and even life insurance.

💡 Example: If your credit is poor, your car insurance premium could be $500 – $1,000 higher per year compared to someone with good credit.

4. Limited Housing Options

Landlords check credit scores when evaluating rental applications. A low credit score can result in:

- Higher security deposits

- Limited rental choices

- Rejection from competitive housing markets

5. Difficulty Getting a Job

Some employers check credit reports as part of the hiring process, especially for jobs in finance, government, or security-sensitive positions. Bad credit could hurt your job prospects.

6. More Expensive Utility Deposits

Utility companies (electricity, water, internet, etc.) may charge a security deposit to customers with bad credit since they are considered a higher risk for non-payment.

💡 Example: Someone with bad credit may need to pay a $200 – $500 deposit for utility services, while someone with good credit may not have to pay anything.

7. Stress and Financial Insecurity

Living with bad credit can cause constant financial stress, limiting your ability to build wealth and plan for the future. It can make it harder to secure emergency funds, forcing you to rely on high-interest payday loans.

How to Fix Bad Credit: A DIY Guide

1. Check Your Credit Report and Score

Start by checking your credit report for errors or inaccuracies. You can get a free credit report from:

- AnnualCreditReport.com (official U.S. site)

- Credit monitoring services like Experian, Equifax, and TransUnion

If you find errors, dispute them immediately with the credit bureau.

2. Pay Your Bills on Time

Payment history accounts for 35% of your credit score. Set up automatic payments or use reminders to avoid late payments.

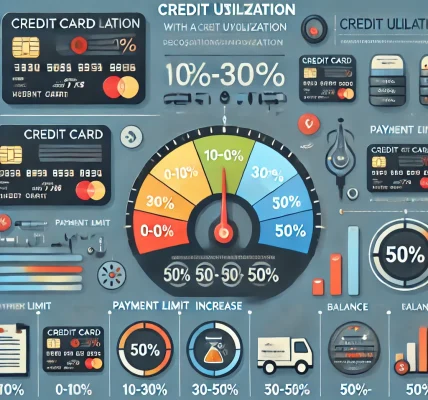

3. Lower Your Credit Utilization Ratio

Credit utilization (the amount of credit you’re using compared to your limit) should stay below 30%.

💡 Example: If you have a $5,000 credit limit, try to keep your balance below $1,500.

Quick Fix: Pay down balances, request a credit limit increase, or distribute charges across multiple cards.

4. Avoid Applying for Too Much New Credit

Each credit application results in a hard inquiry, which can lower your score. Only apply for new credit when necessary.

5. Become an Authorized User

Ask a trusted family member with good credit to add you as an authorized user on their credit card. This helps improve your credit history without requiring new credit.

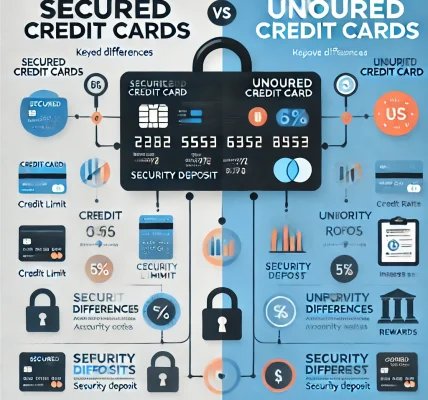

6. Consider a Secured Credit Card

A secured credit card requires a refundable deposit and helps build or rebuild credit. Choose one that reports to all three major credit bureaus.

7. Negotiate with Creditors

If you have outstanding debts, contact your creditors to negotiate:

- Lower interest rates

- Payment plans

- Settlement offers

8. Use Credit-Boosting Tools

- Experian Boost: Adds utility and phone payments to your credit history.

- Self Credit Builder Loan: Helps you establish a positive payment history.

9. Keep Old Credit Accounts Open

The length of your credit history affects your score. If you have old accounts in good standing, keep them open to maintain a longer credit history.

10. Seek Professional Help If Needed

If you’re struggling with debt, consider working with a nonprofit credit counseling service. Avoid scammy “credit repair” companies that promise quick fixes.

Final Thoughts

Bad credit can be costly, but the good news is that it’s fixable. By following this DIY guide, you can take control of your credit, reduce financial stress, and open the doors to better opportunities.