Introduction

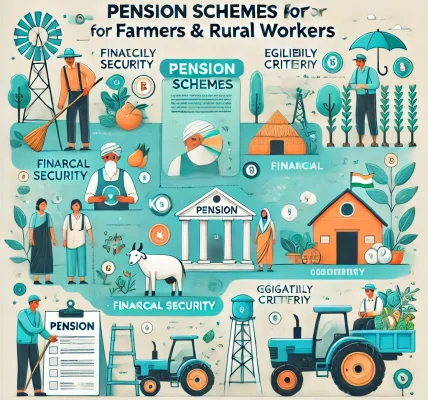

Farmers and rural workers form the backbone of India’s economy, contributing significantly to agriculture and allied sectors. Despite their crucial role, financial security during retirement remains a major concern. To address this, the Government of India has introduced several pension schemes designed specifically for farmers and rural workers, ensuring they have a stable income in their old age.

In this blog, we will explore the best government-backed pension schemes for farmers and rural workers in India, their benefits, eligibility criteria, and how to apply for them.

1. Pradhan Mantri Kisan Maandhan Yojana (PM-KMY)

Overview

Launched in 2019, the Pradhan Mantri Kisan Maandhan Yojana (PM-KMY) provides financial security to small and marginal farmers by ensuring a fixed pension after retirement.

Key Features

- Provides a monthly pension of ₹3,000 after the age of 60.

- Farmers aged 18-40 years can enroll.

- Requires a monthly contribution of ₹55 to ₹200, depending on the age of entry.

- The government provides an equal matching contribution.

- Life Insurance Corporation of India (LIC) manages the scheme.

- In case of the subscriber’s death, the spouse receives 50% of the pension.

Eligibility Criteria

- Must be a small or marginal farmer (landholding up to 2 hectares).

- Age between 18-40 years.

- Not enrolled in other pension schemes like EPFO, NPS, or PM-SYM.

How to Apply?

- Visit the nearest Common Service Center (CSC).

- Carry Aadhaar card, bank details, and land ownership documents.

- Fill out the application form and select the contribution amount.

- Submit biometric authentication to complete registration.

2. Pradhan Mantri Shram Yogi Maandhan Yojana (PM-SYM)

Overview

The Pradhan Mantri Shram Yogi Maandhan (PM-SYM) Yojana is a pension scheme for unorganized sector workers, including rural laborers and agricultural workers.

Key Features

- Provides ₹3,000 per month after 60 years of age.

- Monthly contributions range from ₹55 to ₹200, based on the entry age.

- The government contributes an equal amount.

- Managed by LIC.

- Spouse receives 50% pension in case of the subscriber’s demise.

Eligibility Criteria

- Age between 18-40 years.

- Monthly income should be below ₹15,000.

- Should not be covered under EPFO, NPS, or ESIC.

How to Apply?

- Visit the nearest CSC center.

- Provide Aadhaar card and bank account details.

- Enroll and start contributing monthly.

3. Atal Pension Yojana (APY)

Overview

The Atal Pension Yojana (APY) is a government-backed pension scheme available for all unorganized sector workers, including farmers.

Key Features

- Provides a guaranteed monthly pension of ₹1,000 to ₹5,000 after retirement.

- Contribution depends on the pension amount chosen and entry age.

- Government co-contributes 50% or up to ₹1,000 per year for eligible subscribers.

- Tax benefits under Section 80CCD.

Eligibility Criteria

- Age between 18-40 years.

- Should not be a taxpayer.

- Must have a savings bank account.

How to Apply?

- Visit a bank or post office.

- Fill out the APY registration form.

- Provide Aadhaar and bank details.

- Select the contribution amount and set up auto-debit.

4. Indira Gandhi National Old Age Pension Scheme (IGNOAPS)

Overview

IGNOAPS is part of the National Social Assistance Programme (NSAP) and provides financial aid to elderly individuals in rural areas.

Key Features

- Provides a monthly pension of ₹200 to ₹500, depending on age.

- Funded by both central and state governments.

- Available to below-poverty-line (BPL) families.

Eligibility Criteria

- Age 60 years or above.

- Belong to a BPL family.

How to Apply?

- Apply at the local Panchayat office or Social Welfare Department.

- Provide age proof, BPL card, and Aadhaar details.

5. State-Specific Pension Schemes

Many Indian states offer additional pension schemes for farmers and rural workers. Some examples include:

- Rythu Bandhu (Telangana) – Provides financial aid to farmers.

- KALIA Pension Scheme (Odisha) – ₹5,000 per month for elderly, disabled, and landless farmers.

- YSR Pension Kanuka (Andhra Pradesh) – Offers financial assistance to old-age farmers.

6. How to Choose the Right Pension Scheme?

Factors to Consider

- Age and eligibility criteria – Choose a scheme that suits your age and category.

- Monthly contribution affordability – Pick a plan that fits your budget.

- Government co-contribution – Opt for schemes with matching government contributions.

- Pension benefits – Consider the monthly payout and spousal benefits.

7. Common Mistakes to Avoid

- Not enrolling early – Delayed enrollment results in higher contributions.

- Ignoring documentation – Ensure all required documents are submitted.

- Withdrawing before maturity – Avoid premature withdrawals to secure maximum benefits.

Conclusion

Government pension schemes provide financial security to farmers and rural workers, ensuring they have a stable income post-retirement. By enrolling in the right pension scheme early, rural workers can secure their future without financial stress.

If you are a farmer or rural worker, apply today and take a step towards a secure retirement!