Introduction

The world is rapidly moving towards digitalization, and pension schemes are no exception. With advancements in technology, digital pension schemes are making retirement planning more accessible, transparent, and efficient. Government pension schemes are also evolving to incorporate digital features, ensuring that retirees can manage their savings with ease. This blog explores how technology is transforming retirement plans and making pension schemes more user-friendly.

The Shift Towards Digital Pension Schemes

Traditionally, pension schemes required paperwork, in-person visits to government offices, and lengthy approval processes. However, with digital advancements, pension management has become more seamless. Here are some key ways digitalization is revolutionizing pension schemes:

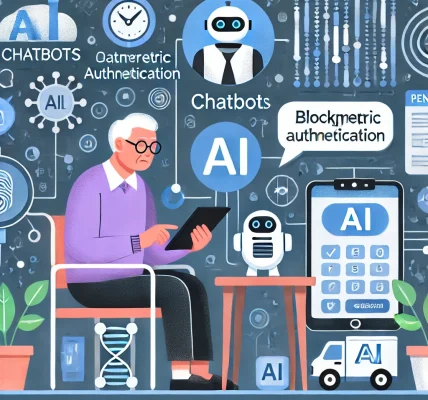

- Online Registration & Application

Many government pension schemes now allow individuals to apply online, reducing paperwork and saving time. - E-KYC Verification

Biometric authentication and Aadhaar-based verification streamline the process, eliminating the need for physical documentation. - Automated Pension Disbursal

Pension funds are transferred directly to retirees’ bank accounts through digital payment systems like Direct Benefit Transfer (DBT). - Mobile Apps & Web Portals

Pensioners can check their contributions, withdrawal status, and pension credits via dedicated mobile apps and portals. - Blockchain for Security

Blockchain technology ensures secure transactions and prevents fraudulent activities. - AI-Powered Advisory Services

Artificial Intelligence (AI) helps individuals choose the best pension plans based on their financial goals and risk tolerance.

Government Initiatives in Digital Pension Schemes

Governments worldwide, including India, have been proactive in digitizing pension schemes. Some notable initiatives include:

- National Pension System (NPS) Online

- Users can register, contribute, and track their pension corpus through the NPS online portal.

- Employees’ Provident Fund (EPF) Digital Services

- EPFO offers an online portal for easy access to account details, withdrawals, and monthly contributions.

- Pradhan Mantri Shram Yogi Maan-dhan (PM-SYM)

- A pension scheme for unorganized workers with an online registration process.

- Jeevan Pramaan Digital Life Certificate

- Retirees can submit their life certificates online using biometric authentication, eliminating the need for physical visits.

Benefits of Digital Pension Schemes

Digital pension schemes offer numerous advantages:

- Convenience & Accessibility: Users can manage their pensions from anywhere, anytime.

- Transparency: Online portals provide real-time updates on contributions and payouts.

- Reduced Fraud: Digital verification minimizes the risk of fraudulent claims.

- Faster Processing: Automated systems speed up approvals and disbursals.

- Financial Inclusion: Even workers in rural areas can access pension schemes via mobile apps.

Challenges & Future Prospects

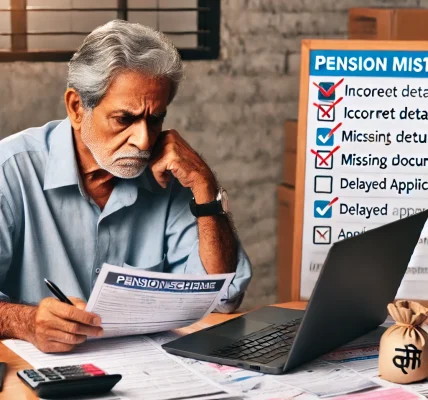

Despite the benefits, there are challenges in implementing digital pension schemes:

- Digital Literacy: Many retirees may not be comfortable using online platforms.

- Internet Connectivity: Rural areas may face issues with stable internet access.

- Cybersecurity Concerns: Ensuring data protection and preventing cyber fraud is crucial.

To address these challenges, governments and financial institutions must focus on:

- Conducting digital literacy programs for senior citizens.

- Expanding internet infrastructure in remote areas.

- Strengthening cybersecurity frameworks to protect user data.

Conclusion

Digital pension schemes are revolutionizing the way retirees plan their financial future. By leveraging technology, these schemes are becoming more efficient, transparent, and user-friendly. As digital adoption increases, the future of pension schemes looks promising, ensuring financial security for retirees with minimal hassle. If you haven’t yet explored digital pension options, now is the time to do so!