Car accidents can be stressful and overwhelming, but knowing the right steps to take can make the insurance claim process smoother. Proper documentation and prompt reporting can help you get the compensation you deserve while avoiding legal complications. Here’s a comprehensive guide on what to do after a car accident to successfully file an insurance claim.

1. Ensure Safety First

- Check yourself and passengers for injuries. Seek medical attention immediately if anyone is hurt.

- Move your vehicle to a safe location if it is blocking traffic and it’s safe to do so.

- Turn on hazard lights to alert other drivers and prevent further accidents.

2. Call Emergency Services

- Dial emergency services (911 or the local helpline) to report the accident.

- A police report can serve as crucial evidence when filing your insurance claim.

- If there are injuries or significant vehicle damage, an official report is highly recommended.

3. Exchange Information with the Other Party

- Collect details from the other driver, including:

- Full name and contact information

- Driver’s license number

- Vehicle make, model, and license plate number

- Insurance company name and policy number

- Avoid admitting fault or blaming the other driver, as this can complicate your claim.

4. Gather Evidence from the Scene

- Take clear photos and videos of:

- Vehicle damages (yours and the other driver’s)

- Road conditions, traffic signs, and skid marks

- Any visible injuries

- If there are eyewitnesses, collect their contact information and statements.

- Note the date, time, and location of the accident.

5. Notify Your Insurance Company

- Contact your insurer as soon as possible and provide:

- Details of the accident

- Police report number (if applicable)

- Photos and witness statements

- Follow the insurer’s instructions regarding the claims process.

6. Get a Copy of the Police Report

- Request a copy of the official accident report for reference.

- This document can help prove fault and support your claim.

7. Seek Medical Evaluation

- Even if you feel fine, get checked by a doctor as some injuries may not be immediately noticeable.

- Keep records of medical visits, treatments, and prescriptions for insurance purposes.

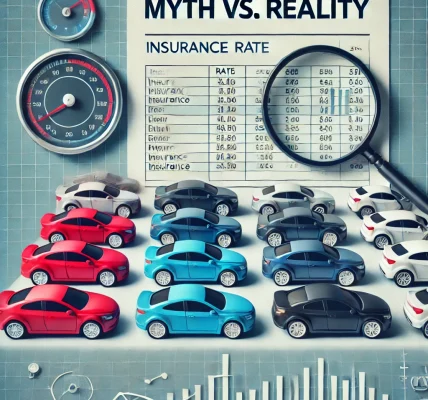

8. Understand Your Policy Coverage

- Review your insurance policy to understand coverage limits and deductibles.

- Determine whether your policy includes:

- Collision coverage

- Medical expenses

- Uninsured/underinsured motorist protection

9. Cooperate with the Insurance Adjuster

- An insurance adjuster may inspect your vehicle and assess damages.

- Provide truthful information and necessary documentation.

- Keep a record of all communications with the insurer.

10. Get Repair Estimates

- Obtain repair estimates from authorized service centers.

- Your insurer may recommend a list of approved mechanics.

- Compare quotes before proceeding with repairs.

11. Consider Legal Advice if Necessary

- If the claim is denied or the settlement is insufficient, consult a lawyer specializing in car insurance claims.

- A legal expert can guide you through negotiations or litigation if needed.

12. Follow Up on Your Claim

- Regularly check the status of your claim with your insurer.

- Keep track of emails, claim numbers, and payout details.

- Ensure all paperwork is completed to avoid delays.

Final Thoughts

Filing an insurance claim after a car accident requires prompt action, thorough documentation, and adherence to legal guidelines. By following these steps, you can streamline the process and increase the likelihood of a favorable outcome. Always stay informed about your policy coverage and be prepared in case of emergencies.