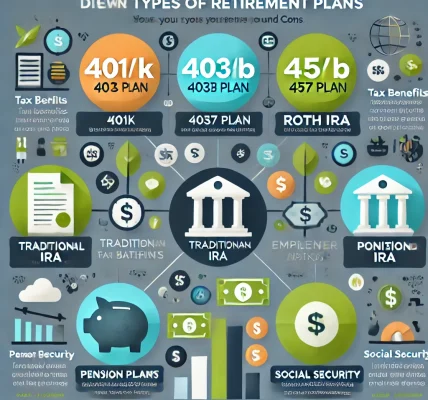

Planning for retirement is one of the most crucial financial decisions you can make. With various retirement savings options available, it can be challenging to determine which plan best suits your needs. Among the most popular choices are Pensions, 401(k) plans, and Individual Retirement Accounts (IRAs). Each comes with unique advantages and considerations, making it essential to understand the differences before deciding.

In this guide, we’ll compare Pension vs. 401(k) vs. IRA, analyzing their features, benefits, and potential drawbacks to help you choose the best retirement plan.

What Is a Pension?

A pension plan is an employer-sponsored retirement plan that provides a fixed monthly income after retirement. Also known as a defined benefit plan, it is funded by the employer, though some may require employee contributions.

Pros of Pension Plans:

✔ Guaranteed Income – Provides a predictable income stream for life. ✔ Employer-Funded – Many pension plans are funded primarily by employers. ✔ Less Risk for Employees – The employer bears investment risks, ensuring financial security. ✔ Lifetime Benefits – Pensions often provide lifelong benefits, sometimes including spousal benefits.

Cons of Pension Plans:

✘ Limited Control – Employees cannot manage or influence pension investments. ✘ Lack of Portability – Pensions may not transfer easily if you change jobs. ✘ Risk of Underfunding – Some pension funds run the risk of being underfunded by the employer or government.

What Is a 401(k)?

A 401(k) plan is an employer-sponsored, tax-advantaged retirement savings plan where employees contribute a portion of their salary. Employers may match contributions up to a certain limit.

Pros of 401(k) Plans:

✔ Tax Advantages – Contributions are made pre-tax, reducing taxable income. ✔ Employer Matching – Many employers match a percentage of employee contributions. ✔ Investment Options – Employees have control over investment choices, typically mutual funds, stocks, and bonds. ✔ High Contribution Limits – 401(k) plans allow higher annual contributions than IRAs.

Cons of 401(k) Plans:

✘ Market Risk – Investment returns are not guaranteed and may fluctuate. ✘ Early Withdrawal Penalties – Withdrawing before age 59½ incurs a penalty (except for certain hardship cases). ✘ Fees and Costs – Some 401(k) plans come with high administrative and investment fees.

What Is an IRA?

An Individual Retirement Account (IRA) is a tax-advantaged retirement savings account that individuals can open independently. There are two main types:

- Traditional IRA – Contributions are tax-deductible, but withdrawals in retirement are taxed.

- Roth IRA – Contributions are made with after-tax dollars, but withdrawals in retirement are tax-free.

Pros of IRAs:

✔ Tax Benefits – Traditional IRAs reduce taxable income, while Roth IRAs provide tax-free withdrawals. ✔ Investment Flexibility – IRAs allow a broad range of investment options, including stocks, bonds, and ETFs. ✔ No Employer Needed – Anyone with earned income can open and contribute to an IRA. ✔ Portability – Unlike employer-sponsored plans, IRAs are not tied to a job.

Cons of IRAs:

✘ Lower Contribution Limits – IRAs have lower contribution limits compared to 401(k) plans. ✘ Income Restrictions – Roth IRA eligibility is based on income limits. ✘ Early Withdrawal Penalties – Similar to 401(k)s, withdrawing before age 59½ may incur penalties (except for specific exemptions).

Pension vs. 401(k) vs. IRA: A Side-by-Side Comparison

| Feature | Pension | 401(k) | IRA |

|---|---|---|---|

| Type of Plan | Employer-funded | Employer-sponsored | Individual account |

| Tax Treatment | Tax-deferred | Tax-deferred | Tax-deferred (Traditional) / Tax-free (Roth) |

| Contribution Limit | Set by employer | $23,000 (2024) | $7,000 (Traditional & Roth, 2024) |

| Investment Control | None (managed by employer) | Employee-directed | Full control by account holder |

| Portability | Limited | Somewhat portable | Fully portable |

| Risk Level | Low (employer-managed) | Moderate to high (market-dependent) | Varies based on investments |

| Withdrawal Rules | Fixed payments for life | Subject to RMDs (Required Minimum Distributions) at 73 | Traditional: RMDs apply; Roth: No RMDs |

Which Retirement Plan Is Best for You?

The best retirement plan depends on your employment status, risk tolerance, tax preferences, and financial goals.

Who Should Choose a Pension?

✔ Ideal for government employees, union workers, and those in long-term jobs with pension benefits. ✔ If you prefer a guaranteed, risk-free income stream and don’t want to manage investments. ✔ If you plan to stay with an employer offering a pension for the long term.

Who Should Choose a 401(k)?

✔ Best for employees with access to employer-sponsored plans, especially with matching contributions. ✔ If you want to take advantage of pre-tax contributions and higher contribution limits. ✔ If you’re comfortable making investment decisions and handling some market risks.

Who Should Choose an IRA?

✔ Great for self-employed individuals, freelancers, and those without employer-sponsored plans. ✔ If you want greater investment flexibility and tax advantages based on income. ✔ A Roth IRA is best if you prefer tax-free withdrawals in retirement.

Can You Have More Than One Retirement Plan?

Yes! Many people combine different plans to maximize benefits. Some common strategies include:

- Having a 401(k) and an IRA – Contribute to your employer’s 401(k) while also funding an IRA for extra tax advantages and investment choices.

- Rolling Over a Pension – If you leave a job, you may be able to roll over a pension into an IRA or 401(k) for more control.

- Using a Roth IRA for Tax-Free Income – If you expect to be in a higher tax bracket later, a Roth IRA can provide tax-free retirement income.

Conclusion

Choosing between a Pension, 401(k), or IRA depends on your financial situation, employment benefits, and long-term retirement goals. If you have access to a pension, it can provide financial security. A 401(k) is a great option if your employer offers matching contributions. Meanwhile, an IRA is perfect for individuals seeking tax advantages and investment flexibility.

The best approach? Diversify your retirement savings across multiple accounts to maximize your financial security.