Introduction

White-collar crimes refer to non-violent, financially motivated crimes committed by individuals, businesses, or government officials. These crimes typically involve deceit, fraud, or breach of trust to gain a financial advantage. Unlike street crimes, white-collar offenses often occur in corporate or professional settings, making them harder to detect and prosecute.

This article explores common types of white-collar crimes, including fraud and embezzlement, their legal consequences, and how individuals and businesses can prevent these offenses.

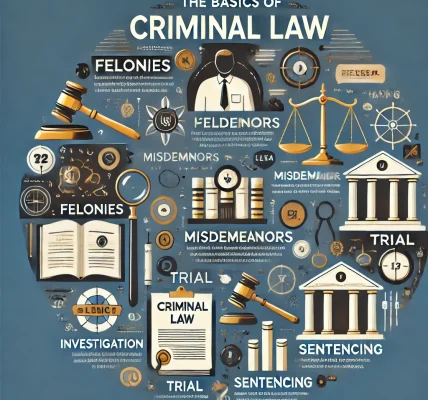

1. Understanding White-Collar Crimes

White-collar crimes are financially driven offenses that involve deception, misrepresentation, or abuse of power. These crimes can be committed by individuals or organizations and may have severe economic and reputational consequences.

Common Types of White-Collar Crimes:

- Fraud – Deception intended to result in financial gain.

- Embezzlement – Misappropriation of funds entrusted to an individual.

- Insider Trading – Illegally using confidential information for financial gain.

- Money Laundering – Concealing illegally obtained money.

- Identity Theft – Using another person’s information for fraudulent purposes.

- Tax Evasion – Illegally avoiding tax payments.

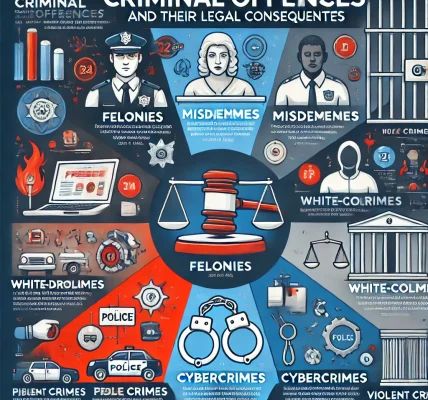

2. Fraud: A Major White-Collar Crime

Fraud is one of the most common white-collar crimes, encompassing various illegal activities involving deception for financial gain.

Types of Fraud:

- Wire Fraud: Use of electronic communication (emails, calls) for fraudulent activities.

- Securities Fraud: Misleading investors with false financial statements.

- Healthcare Fraud: Filing false claims with insurance companies or government programs.

- Mortgage Fraud: Providing false information to obtain a loan or mortgage.

Legal Consequences of Fraud:

Fraud is a serious offense, leading to consequences such as:

- Heavy fines and restitution payments.

- Criminal charges, including imprisonment.

- Loss of professional licenses and reputational damage.

3. Embezzlement: Misappropriation of Funds

Embezzlement occurs when an individual entrusted with funds or property misuses them for personal gain. This crime often occurs in corporate or nonprofit organizations.

Examples of Embezzlement:

- An employee siphoning funds from a company account.

- A financial advisor misusing client investments.

- A charity director diverting donations for personal use.

Legal Consequences of Embezzlement:

- Criminal charges leading to imprisonment.

- Restitution payments to compensate victims.

- Civil lawsuits and damage to professional reputation.

4. Investigating and Prosecuting White-Collar Crimes

How Are White-Collar Crimes Investigated?

Government agencies, such as the FBI, SEC, and IRS, investigate white-collar crimes using forensic accounting, digital tracking, and informants.

Legal Proceedings:

- Grand Jury Indictment: Prosecutors present evidence to determine if a case goes to trial.

- Criminal Trial: A court evaluates evidence to determine guilt.

- Civil Lawsuits: Victims may sue for financial compensation.

5. Preventing White-Collar Crimes

For Individuals:

- Monitor financial statements for suspicious activity.

- Use strong passwords and secure personal information.

- Report suspicious activities to authorities.

For Businesses:

- Implement internal financial controls and audits.

- Educate employees on ethical practices.

- Establish clear whistleblower policies.

6. Conclusion

White-collar crimes, including fraud and embezzlement, have severe financial and legal consequences. Governments and organizations actively investigate and prosecute these offenses to maintain financial integrity. By understanding these crimes and implementing preventive measures, individuals and businesses can protect themselves from becoming victims or unintentional perpetrators of white-collar offenses.