Introduction

Financial freedom is a goal many aspire to, but few truly understand how to achieve it. While investing, saving, and budgeting play key roles, life insurance is often overlooked as a crucial component of financial security. A well-structured life insurance plan ensures long-term stability, safeguards loved ones, and provides financial leverage for future planning.

This DIY guide will help you understand how life insurance contributes to financial freedom and how to choose the right policy for your needs.

1. Understanding Financial Freedom

Financial freedom means having sufficient financial resources to cover your expenses without depending on a paycheck. It involves:

- Passive Income Streams (Investments, Rental Income, etc.)

- Debt-Free Living

- Emergency Fund & Retirement Security

- Comprehensive Risk Management

Life insurance plays a pivotal role in achieving these goals by ensuring that financial stability is maintained even in unforeseen circumstances.

2. How Life Insurance Supports Financial Freedom

2.1. Income Protection for Dependents

If you are the primary breadwinner, your unexpected passing could create financial distress for your family. A life insurance policy provides a lump sum payout (death benefit) that replaces lost income, allowing your dependents to sustain their lifestyle.

2.2. Debt Repayment and Liability Coverage

A well-structured life insurance plan can help cover:

- Mortgage Loans

- Car Loans & Personal Loans

- Credit Card Debt

- Education Loans

This ensures that your family is not burdened by unpaid liabilities in your absence.

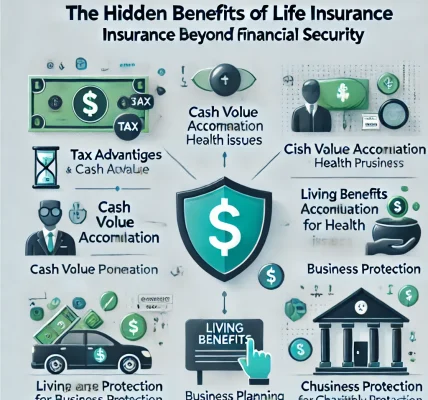

2.3. Long-Term Wealth Creation

Certain life insurance policies, such as whole life and universal life insurance, come with an investment component. These policies:

- Accumulate cash value over time

- Can be borrowed against for financial emergencies

- Provide dividends or market-linked returns (depending on the policy type)

2.4. Tax Benefits & Wealth Preservation

Most life insurance policies come with tax advantages, depending on your country’s tax laws. Common tax benefits include:

- Tax-free death benefits for beneficiaries

- Tax-deferred growth on cash value policies

- Premium payment deductions (in some jurisdictions)

Consulting a tax professional can help you maximize these benefits while ensuring compliance with tax regulations.

3. Choosing the Right Life Insurance for Financial Freedom

3.1. Term Life vs. Whole Life Insurance

| Feature | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Duration | Fixed Term (10, 20, 30 years) | Lifetime Coverage |

| Premiums | Lower | Higher |

| Cash Value | No | Yes |

| Ideal For | Income Protection | Wealth Building & Estate Planning |

If you’re looking for affordable protection, a term life policy is ideal. For long-term financial planning, whole life insurance may be a better option.

3.2. How Much Coverage Do You Need?

A simple rule of thumb is the 10x Rule: Your life insurance coverage should be 10 times your annual income. However, a more precise calculation considers:

- Current Debts & Future Expenses

- Dependents’ Living Costs

- Education & Retirement Goals

- Existing Savings & Investments

3.3. Adding Riders for Extra Protection

Life insurance riders enhance your policy by offering additional benefits. Some popular riders include:

- Accidental Death Benefit Rider: Additional payout in case of accidental death

- Critical Illness Rider: Provides a lump sum if diagnosed with a severe illness

- Disability Income Rider: Ensures income replacement in case of disability

- Premium Waiver Rider: Waives premiums if the policyholder becomes disabled

Adding the right riders can maximize protection without significantly increasing premiums.

4. DIY Steps to Secure Financial Freedom with Life Insurance

Step 1: Assess Your Financial Goals

- Do you need coverage for income replacement, debt repayment, or wealth building?

- Are you looking for temporary or lifetime coverage?

Step 2: Compare Different Life Insurance Policies

- Research top-rated insurance providers

- Compare premium rates, benefits, and exclusions

- Read customer reviews and claims settlement ratios

Step 3: Determine the Right Coverage Amount

- Use an online life insurance calculator

- Factor in inflation and future financial needs

Step 4: Choose a Reliable Insurance Provider

- Look for companies with high claim settlement ratios

- Consider customer service quality and policy flexibility

Step 5: Customize Your Policy with Riders

- Add riders based on your lifestyle and financial needs

Step 6: Regularly Review and Update Your Policy

- Adjust your coverage based on life events (marriage, children, career changes)

- Upgrade your policy to match inflation and changing financial goals

5. Common Myths About Life Insurance and Financial Freedom

Myth #1: Life Insurance Is Only for the Elderly

Reality: Buying life insurance at a younger age means lower premiums and better coverage.

Myth #2: Employer-Provided Life Insurance Is Enough

Reality: Group insurance coverage is often insufficient and non-transferable if you change jobs.

Myth #3: Life Insurance Is a Bad Investment

Reality: Permanent life insurance can be a great wealth-building tool when used wisely.

Conclusion

Achieving financial freedom requires a strategic approach to wealth management, and life insurance plays a vital role in securing that freedom. Whether you’re protecting your family, building wealth, or planning your estate, the right life insurance policy can ensure long-term financial stability.

By following this DIY guide, you can make informed decisions that bring you closer to financial independence. Start today and take control of your financial future!

Call to Action

✅ Evaluate your financial needs

✅ Compare life insurance policies

✅ Secure your future with the right coverage