Introduction

Retirement planning is crucial for everyone, but it can be especially challenging for self-employed individuals who don’t have access to employer-sponsored retirement plans like a 401(k) or pension. However, being your own boss doesn’t mean you have to compromise on a secure future. There are several smart retirement options available that allow self-employed individuals to build a strong financial foundation for their golden years.

In this blog, we’ll explore the best retirement plans for self-employed individuals, their benefits, contribution limits, tax advantages, and how to choose the right one for your needs.

Why Retirement Planning Matters for the Self-Employed

Unlike traditional employees, self-employed professionals do not receive automatic retirement benefits. This means that they must take proactive steps to save for retirement. Without proper planning, they risk financial insecurity in their later years.

Benefits of a Self-Employed Retirement Plan

✔ Tax Advantages – Contributions to retirement accounts often reduce taxable income. ✔ Financial Security – A well-funded plan ensures a comfortable retirement. ✔ Compound Growth – Investing early leads to higher returns over time. ✔ Flexible Contribution Limits – Many plans allow flexible contributions based on earnings.

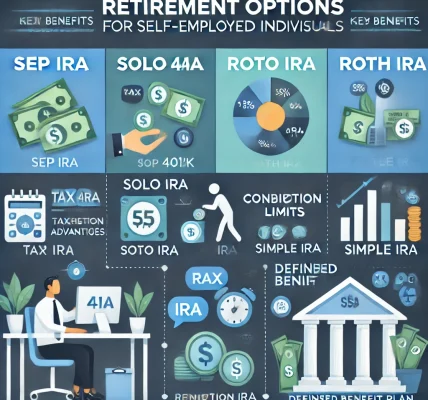

Best Retirement Plans for Self-Employed Individuals

1. Solo 401(k) Plan

A Solo 401(k) is a retirement savings plan designed for self-employed individuals and small business owners with no employees (except a spouse).

Features:

- Allows contributions as both employer and employee.

- Higher contribution limits than traditional IRAs.

- Offers both Roth (after-tax) and Traditional (pre-tax) options.

Contribution Limits (2024):

- Employee: Up to $23,000 (under 50) or $30,500 (50+).

- Employer: Up to 25% of net earnings.

- Total max contribution: $69,000 (under 50) or $76,500 (50+).

Tax Benefits:

- Traditional Solo 401(k): Tax-deductible contributions, but withdrawals are taxed.

- Roth Solo 401(k): No immediate tax deduction, but tax-free withdrawals.

Best for: Self-employed individuals with high earnings who want high contribution limits and tax advantages.

2. SEP IRA (Simplified Employee Pension IRA)

A SEP IRA is a flexible and easy-to-manage retirement account for self-employed individuals and small business owners.

Features:

- Employer-only contributions (you contribute for yourself).

- Higher limits than a traditional IRA.

- Simple setup and minimal paperwork.

Contribution Limits (2024):

- Up to 25% of net earnings, capped at $69,000.

Tax Benefits:

- Contributions are tax-deductible.

- Investments grow tax-deferred until withdrawal.

Best for: Freelancers and small business owners who want high contribution limits without the administrative complexity of a 401(k).

3. SIMPLE IRA (Savings Incentive Match Plan for Employees)

A SIMPLE IRA is ideal for self-employed individuals with a small number of employees.

Features:

- Employer must match employee contributions.

- Lower contribution limits than a Solo 401(k) or SEP IRA.

Contribution Limits (2024):

- Employee: Up to $16,000 (under 50) or $19,500 (50+).

- Employer: Must match up to 3% of employee salary or contribute 2% of salary for all employees.

Tax Benefits:

- Contributions are tax-deductible.

- Investments grow tax-deferred until withdrawal.

Best for: Self-employed individuals with employees looking for a simple and low-cost retirement plan.

4. Traditional or Roth IRA

For those just starting or who want an additional retirement savings option, Traditional and Roth IRAs are excellent choices.

Features:

- Easy to set up and maintain.

- Lower contribution limits than employer-sponsored plans.

Contribution Limits (2024):

- Up to $7,000 (under 50) or $8,000 (50+).

Tax Benefits:

- Traditional IRA: Tax-deductible contributions, but taxed withdrawals.

- Roth IRA: No immediate tax deduction, but tax-free withdrawals.

Best for: Self-employed individuals who want a low-cost, flexible option with tax benefits.

How to Choose the Right Retirement Plan

1. Consider Your Income Level

- Higher-income earners: Solo 401(k) or SEP IRA.

- Lower-income earners: Traditional IRA or Roth IRA.

2. Think About Tax Benefits

- If you want tax deductions now, choose Traditional IRA, SEP IRA, or Solo 401(k).

- If you prefer tax-free withdrawals in retirement, choose Roth IRA or Roth Solo 401(k).

3. Do You Have Employees?

- If you have employees, a SIMPLE IRA is a great option.

- If you’re a solo business owner, a Solo 401(k) or SEP IRA works best.

4. Flexibility in Contributions

- If your income fluctuates, a SEP IRA offers flexible contributions.

- If you want to contribute a fixed amount, SIMPLE IRA or Solo 401(k) is better.

Final Thoughts

Retirement planning is just as crucial for self-employed individuals as it is for traditional employees. With multiple retirement savings options available, choosing the right plan depends on your income, tax preferences, and whether you have employees.

Best Plan Based on Needs:

✅ High contribution limits & flexibility? → Solo 401(k) or SEP IRA ✅ Want tax-free withdrawals later? → Roth IRA or Roth 401(k) ✅ Have employees? → SIMPLE IRA ✅ Just starting out? → Traditional or Roth IRA

The earlier you start saving, the more you’ll benefit from compounded growth and tax advantages. Choose the best retirement plan today and secure your financial future!