Introduction

Criminal law plays a critical role in preventing and addressing hate crimes and discrimination, ensuring equal access to financial resources, including loans. Discriminatory lending practices and financial exclusion based on race, religion, gender, or other protected characteristics can lead to systemic inequalities. Criminal law provides protections against such injustices by penalizing unlawful acts, ensuring financial fairness, and protecting victims from bias-motivated offenses.

This blog explores how criminal law addresses hate crimes and discrimination in loan policies, ensuring justice and financial equality for all individuals.

Understanding Hate Crimes and Discrimination in Loan Policies

Hate crimes are criminal acts motivated by bias against a person’s race, ethnicity, religion, gender, disability, or other identity markers. Discrimination in financial services, particularly in loan policies, occurs when lenders unfairly deny or impose unfavorable terms on borrowers based on these characteristics.

Types of Discrimination in Loan Policies

- Redlining – Denying loans to individuals from specific neighborhoods based on racial composition.

- Predatory Lending – Targeting marginalized groups with high-interest loans and unfair terms.

- Loan Denial Based on Bias – Refusing loans due to race, gender, or other non-financial factors.

- Higher Interest Rates for Minority Borrowers – Charging unfairly high interest rates to certain groups.

Legal Protections Against Hate Crimes and Discrimination in Loans

1. Anti-Discrimination Laws in Financial Lending

Many countries have established legal frameworks to prevent discrimination in lending practices. These laws prohibit bias-based loan denials and ensure fair access to financial services:

- Equal Credit Opportunity Act (ECOA) – Prohibits discrimination in credit decisions based on race, color, religion, national origin, sex, marital status, or age.

- Fair Housing Act – Addresses discrimination in housing-related loans and mortgages.

- Consumer Protection Laws – Prevents predatory lending and unfair financial practices targeting minorities.

2. Criminal Law and Hate Crimes in Financial Sectors

Hate crimes extend beyond physical violence; they also include discriminatory financial practices that target individuals based on their identity. Criminal law addresses such violations through:

- Prosecution of Bias-Motivated Financial Crimes – Legal action against lenders who engage in discriminatory lending practices.

- Strict Penalties for Hate Crimes in Financial Transactions – Harsher consequences for lenders found guilty of discrimination.

- Law Enforcement Investigations into Financial Bias – Special investigations into institutions accused of systematic discrimination.

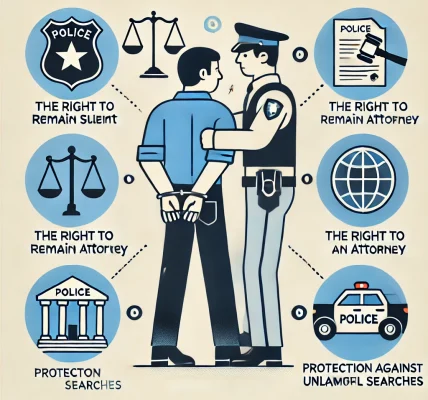

How Victims Can Seek Justice

Victims of financial discrimination have several legal avenues to pursue justice:

1. Filing Complaints with Regulatory Agencies

Victims can report discriminatory practices to agencies such as:

- Financial Consumer Protection Bureaus – Investigate unfair loan policies.

- Human Rights Commissions – Address violations of anti-discrimination laws.

2. Pursuing Legal Action

Victims can take legal steps against discriminatory lenders, including:

- Civil Lawsuits for Financial Damages – Compensation for monetary losses due to discrimination.

- Class-Action Lawsuits – Collective legal action against financial institutions engaging in bias.

3. Seeking Legal Aid and Advocacy Support

Non-profit organizations and legal aid services provide free assistance to victims of discrimination, helping them navigate legal challenges.

Role of Law Enforcement and Government Policies

Government agencies play a crucial role in enforcing anti-discrimination laws and preventing hate crimes in financial transactions. Their responsibilities include:

- Conducting audits of lending institutions.

- Prosecuting lenders who engage in discriminatory practices.

- Implementing financial education programs to promote awareness.

Conclusion

Criminal law provides essential protections against hate crimes and discrimination in loan policies, ensuring financial justice and equal access to credit. By enforcing strict legal measures, supporting victims, and promoting fair lending practices, legal frameworks help combat financial bias and promote social equality.

Ongoing legal reforms and awareness efforts are vital in creating an inclusive financial system, where everyone has equal opportunities regardless of race, gender, or background. Understanding these legal protections empowers individuals to challenge discrimination and seek justice in financial matters.