Introduction

A loan moratorium is a temporary suspension of loan repayment that allows borrowers to defer their payments without being considered in default. Moratoriums are often introduced during financial crises, pandemics, or economic downturns to provide relief to individuals and businesses facing financial hardships.

This guide explores loan moratorium policies, their benefits and drawbacks, eligibility criteria, and key considerations for borrowers.

What is a Loan Moratorium?

A loan moratorium is a period during which borrowers are not required to make regular loan repayments. However, interest may still accrue on the outstanding balance, which could impact the total repayment amount.

Key Features of a Loan Moratorium:

- Temporary pause on loan EMIs (Equated Monthly Installments).

- Interest may continue to accumulate.

- Does not affect the borrower’s credit score unless stated otherwise.

- Usually granted during economic crises or under specific lender policies.

- Applicable to various types of loans, including personal, home, auto, and business loans.

Benefits of Loan Moratorium Policies

Loan moratoriums can be a financial lifesaver during difficult times. Here’s how borrowers can benefit:

1. Financial Relief During Hardship

Borrowers experiencing financial distress due to job loss, medical emergencies, or economic downturns can benefit from a temporary pause in their loan repayments.

2. Prevention of Loan Defaults

A moratorium helps borrowers avoid defaulting on loans, preventing legal action and financial penalties.

3. No Immediate Credit Score Impact

Lenders may not report missed payments during the moratorium period, protecting borrowers’ credit scores.

4. Flexibility in Financial Planning

Borrowers can use the relief period to reorganize their finances, secure alternate income sources, or prioritize essential expenses.

5. Support for Businesses

Businesses facing cash flow issues can use the moratorium to manage operational expenses and stabilize financial conditions.

Drawbacks of Loan Moratorium Policies

While a loan moratorium offers short-term relief, it can have long-term financial implications. Here are some potential drawbacks:

1. Interest Accumulation Increases Debt

Most loan moratoriums continue to accrue interest, which is added to the loan balance, resulting in higher overall repayment costs.

2. Extended Loan Tenure

To compensate for deferred payments, lenders may extend the loan term, increasing the overall repayment period.

3. Higher EMI or Increased Total Payable Amount

After the moratorium, borrowers may face higher EMIs if they choose to maintain the original loan tenure.

4. Not Always Free of Charges

Some lenders charge additional processing fees for granting a moratorium, adding to the cost.

5. Limited Eligibility

Not all borrowers qualify for a moratorium. Lenders may impose eligibility criteria based on credit history, loan type, and financial status.

How Loan Moratoriums Work

Understanding the mechanics of a loan moratorium helps borrowers make informed decisions. Here’s a step-by-step overview:

1. Application Process

Borrowers typically need to apply for a moratorium with supporting documents proving financial hardship.

2. Approval by the Lender

The lender evaluates the borrower’s eligibility based on income status, repayment history, and economic conditions.

3. Interest Accrual During the Moratorium

Lenders clarify whether interest will be simple or compound during the suspension period.

4. Resumption of Payments

After the moratorium, borrowers must resume regular payments, often with adjusted EMIs or an extended loan tenure.

Loan Moratorium Eligibility Criteria

Not all borrowers automatically qualify for a moratorium. Common eligibility criteria include:

- Significant loss of income due to unforeseen circumstances.

- Good repayment track record before requesting the moratorium.

- Type of loan and lender-specific policies.

- Supporting financial documents, such as income statements or bank records.

Key Considerations Before Opting for a Moratorium

Before deciding on a moratorium, borrowers should assess the long-term financial impact.

1. Assess Your Financial Condition

Determine whether you genuinely need a moratorium or if you can continue making payments to avoid accumulating additional interest.

2. Understand the Cost Implications

Calculate how much extra interest you will pay and whether your EMI will increase after the moratorium ends.

3. Check the Lender’s Terms and Conditions

Different lenders have varying moratorium policies, including processing fees, interest calculation methods, and eligibility requirements.

4. Explore Alternative Financial Solutions

Instead of opting for a moratorium, consider loan restructuring, negotiating with your lender, or using savings to cover EMIs.

Alternatives to Loan Moratoriums

If a loan moratorium isn’t the best option, borrowers can explore alternative financial solutions:

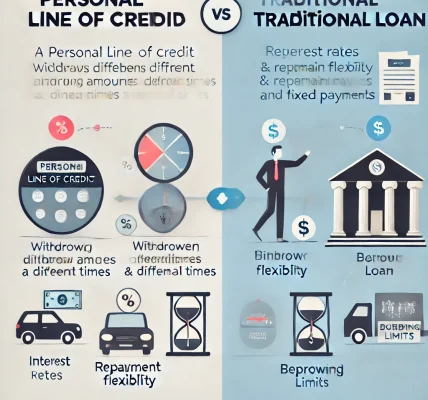

- Loan Restructuring: Modify the loan terms to reduce the EMI burden.

- Debt Consolidation: Merge multiple loans into a single, lower-interest loan.

- Emergency Savings: Use available funds to continue making payments.

- Negotiation with Lender: Request a lower interest rate or flexible repayment plan.

Legal and Regulatory Aspects of Loan Moratoriums

Loan moratorium policies are often regulated by central banks or financial authorities. Borrowers should be aware of the legal implications, including:

- Regulatory Guidelines: Governments may introduce moratorium policies during economic crises.

- Lender Discretion: Some moratoriums are mandatory, while others are at the lender’s discretion.

- Contractual Agreements: Ensure that the moratorium terms are documented in the loan agreement to avoid future disputes.

Conclusion

Loan moratorium policies offer much-needed relief to borrowers during financial crises. However, they come with costs, including accumulated interest, extended loan tenure, and potentially higher EMIs. Before opting for a moratorium, borrowers should assess their financial situation, understand the lender’s policies, and consider alternative solutions. By making informed decisions, borrowers can manage their loans effectively while minimizing long-term financial burdens.