Introduction

Old-age poverty is a pressing issue worldwide, and India is no exception. As individuals age, they face several challenges, including deteriorating health, lack of income sources, and financial dependence on family members. In many cases, this leads to economic hardships and poor living conditions for senior citizens. To address this concern, pension schemes have been introduced as a financial safety net to ensure a dignified life for the elderly.

This blog explores the crucial role pension schemes play in reducing old-age poverty, their benefits, and the various government schemes available in India to support senior citizens.

Understanding Old-Age Poverty

Old-age poverty refers to the financial hardship faced by individuals who have retired or are unable to work due to aging-related issues. Several factors contribute to old-age poverty, including:

- Lack of savings or financial planning during the working years.

- Absence of social security measures in informal employment sectors.

- High medical expenses due to age-related health issues.

- Dependency on family members who may also struggle financially.

- Inflation and rising cost of living, making survival on limited income difficult.

Pension schemes are designed to address these issues by providing a steady income to senior citizens, ensuring they can meet their basic needs without financial distress.

The Role of Pension Schemes in Reducing Old-Age Poverty

Pension schemes play a vital role in alleviating financial distress among the elderly. Here’s how:

1. Providing Financial Security

Pension schemes ensure that individuals have a regular income after retirement, reducing their dependency on family members or charitable organizations. This financial support allows them to live with dignity and independence.

2. Ensuring Healthcare Access

Many pension schemes come with healthcare benefits or allow beneficiaries to afford medical expenses. As medical needs increase with age, having a stable income helps senior citizens seek proper treatment without financial stress.

3. Reducing Economic Dependence

Without a pension, many elderly individuals have to rely on their children or relatives for financial support. Pension schemes help reduce this dependence, fostering self-reliance and a sense of dignity among senior citizens.

4. Encouraging Long-Term Savings

Government and private pension schemes encourage individuals to save and invest for their retirement years. This ensures they have a financial cushion when they are no longer earning an active income.

5. Mitigating Inflation Impact

Inflation gradually erodes purchasing power, making it difficult for retirees to afford necessities. Pension schemes that offer periodic increments help beneficiaries keep up with rising living costs.

6. Reducing Burden on the Government

By ensuring that senior citizens have a steady income, pension schemes reduce the financial burden on welfare programs and social assistance initiatives.

Key Government Pension Schemes in India

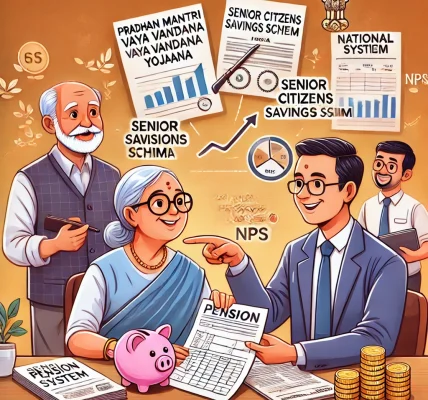

The Indian government has launched several pension schemes to support senior citizens. Below are some of the most effective ones:

1. Pradhan Mantri Vaya Vandana Yojana (PMVVY)

- Managed by the Life Insurance Corporation (LIC).

- Provides a guaranteed pension with an annual return of 7.4%.

- Available for individuals aged 60 years and above.

- Policy term: 10 years.

2. Atal Pension Yojana (APY)

- Targeted at unorganized sector workers.

- Allows individuals aged 18-40 years to contribute towards their retirement.

- Provides a fixed pension of ₹1,000 to ₹5,000 per month post-retirement.

- Government co-contribution for eligible subscribers.

3. Indira Gandhi National Old Age Pension Scheme (IGNOAPS)

- Part of the National Social Assistance Programme (NSAP).

- Available for individuals aged 60 years and above from Below Poverty Line (BPL) families.

- Provides a monthly pension of ₹200 to ₹500, depending on the beneficiary’s age.

4. National Pension System (NPS)

- Available for all Indian citizens aged 18-70 years.

- Market-linked returns with multiple investment options.

- Provides a lump sum at retirement and a monthly pension through annuities.

- Tax benefits under Section 80CCD(1B) of the Income Tax Act.

5. State-Specific Pension Schemes

Several state governments have their own pension programs to provide additional financial support to senior citizens. Examples include:

- Delhi Old Age Pension Scheme – ₹2,000-₹2,500 monthly pension for eligible seniors.

- West Bengal Joy Bangla Pension Scheme – ₹1,000 per month for SC/ST senior citizens.

- Tamil Nadu Chief Minister’s Farmers Security Scheme – Pension for retired farmers.

Challenges Faced by Pension Schemes

While pension schemes offer significant benefits, there are some challenges that need to be addressed:

1. Lack of Awareness

Many eligible individuals, especially in rural areas, are unaware of available pension schemes and their benefits.

2. Insufficient Pension Amounts

Some government pension schemes provide minimal monthly amounts that may not be sufficient to cover all expenses.

3. Delayed Disbursements

Administrative inefficiencies often lead to delays in pension payments, causing financial distress to beneficiaries.

4. Complex Application Process

The lengthy documentation and bureaucratic processes discourage many eligible individuals from applying.

5. Exclusion of Informal Sector Workers

Although some schemes like APY cater to the unorganized sector, many daily wage workers still lack access to pension benefits.

How to Improve Pension Schemes?

To make pension schemes more effective in combating old-age poverty, the following measures should be considered:

1. Increase Pension Amounts

The government should increase minimum pension payouts to align with rising living costs.

2. Simplify Enrollment Procedures

A more user-friendly, digital, and paperless application process can help more people enroll in pension schemes.

3. Enhance Awareness Campaigns

Government and financial institutions should conduct mass awareness programs to educate individuals about pension benefits.

4. Timely Disbursement of Funds

Automating pension payments and reducing bureaucratic delays will ensure timely fund disbursal.

5. Incentivize Private Pension Contributions

Tax benefits and employer participation should be encouraged to promote private pension investments.

Conclusion

Pension schemes play a critical role in reducing old-age poverty by providing financial security, healthcare support, and economic independence to senior citizens. By ensuring a steady income stream, these schemes empower individuals to live their retirement years with dignity and stability.

While challenges exist, improving pension schemes through better implementation, increased benefits, and wider awareness can help India move toward a socially secure and poverty-free future for the elderly. If you or someone you know is eligible for a pension scheme, it is advisable to enroll today and secure a financially stable future.