Introduction

Running a small business comes with its own set of challenges, from managing day-to-day operations to ensuring financial stability. Unlike salaried employees, small business owners do not have access to employer-sponsored retirement plans, making financial security during old age a major concern. However, government pension schemes can provide a stable income post-retirement, ensuring a worry-free future for entrepreneurs.

In this blog, we will explore how small business owners can benefit from government pension plans, the best options available, and how to enroll in them.

Why Pension Plans Are Essential for Small Business Owners?

Many small business owners overlook retirement planning due to immediate financial commitments and business expansion goals. However, having a pension plan is crucial for the following reasons:

- Financial Security After Retirement – A pension plan ensures a steady source of income post-retirement, reducing dependency on family members.

- Tax Benefits – Many pension schemes offer tax deductions on contributions, helping reduce taxable income.

- Long-Term Wealth Creation – Investing in a pension plan ensures capital appreciation over the years.

- Protection Against Inflation – A structured pension plan safeguards business owners against rising living costs.

- Self-Reliance – Unlike salaried individuals, small business owners do not have employer-backed pension benefits, making government schemes a vital financial tool.

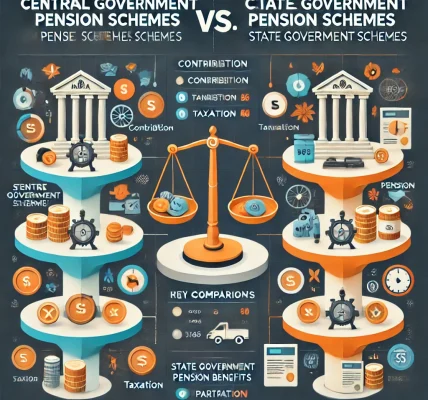

Best Government Pension Schemes for Small Business Owners

The Indian government offers various pension schemes tailored for self-employed individuals and small business owners. Here are some of the most beneficial options:

1. Atal Pension Yojana (APY)

Eligibility:

- Open to all Indian citizens aged 18-40 years.

- Must have a bank account.

- Especially beneficial for unorganized sector workers, including small business owners.

Benefits:

- Fixed pension of ₹1,000 to ₹5,000 per month after retirement.

- Government co-contribution for eligible subscribers.

- Tax benefits under Section 80CCD(1B) of the Income Tax Act.

- Guaranteed pension for lifetime after reaching 60 years.

2. National Pension System (NPS)

Eligibility:

- Open to all Indian citizens between 18-70 years.

- Self-employed individuals can contribute regularly.

Benefits:

- Market-linked returns with multiple investment options.

- 60% of the corpus is tax-free at maturity.

- 40% is used for annuity (pension), ensuring monthly income.

- Tax benefits up to ₹1.5 lakh under Section 80CCD(1) and additional ₹50,000 under Section 80CCD(1B).

3. Pradhan Mantri Shram Yogi Maandhan (PM-SYM)

Eligibility:

- Designed for self-employed individuals and small business owners earning less than ₹15,000 per month.

- Age group: 18-40 years.

Benefits:

- Monthly pension of ₹3,000 per month after 60 years.

- Government co-contribution.

- Minimum investment of ₹55-₹200 per month, making it affordable.

4. Public Provident Fund (PPF)

Eligibility:

- Available for all Indian citizens.

- Self-employed individuals can open an account with a minimum deposit of ₹500 per year.

Benefits:

- 15-year lock-in period ensures long-term wealth accumulation.

- Tax-free interest under Section 80C.

- Can be extended in blocks of 5 years.

5. Employee’s Provident Fund (EPF) for Business Owners

Although primarily for salaried employees, business owners who have registered their firms under EPF can also contribute voluntarily.

Benefits:

- Contribution of 12% of salary (if drawing a salary from their own business).

- Tax-free interest earnings.

- Partial withdrawals allowed for emergencies.

How to Enroll in a Government Pension Scheme?

Enrolling in a pension plan is now easier due to digital advancements. Here’s a step-by-step guide:

1. Choose the Right Pension Plan

Assess your financial needs, risk tolerance, and future goals before selecting a scheme.

2. Check Eligibility Criteria

Ensure you meet the age and income requirements for the chosen scheme.

3. Open a Pension Account

- For APY and PM-SYM: Visit the nearest bank or enroll through the official websites of respective schemes.

- For NPS: Register online via the NSDL portal or visit designated Point of Presence (PoP) service providers.

- For PPF: Open an account in post offices or major banks.

4. Submit Required Documents

- Aadhaar Card for identification.

- PAN Card for tax benefits.

- Bank Account Details for auto-debit facility.

- Income Proof (if required for eligibility verification).

5. Make Regular Contributions

Ensure timely payments to maximize benefits and maintain pension eligibility.

Tax Benefits of Government Pension Schemes

Government pension plans not only provide financial security but also offer significant tax advantages:

- APY & NPS Contributions: Tax-deductible under Section 80CCD.

- PPF Investments: Qualify for deductions under Section 80C.

- EPF Withdrawals: Tax-free after 5 years of continuous service.

- Pension Payouts: Partially tax-free under specific provisions.

Common Challenges Faced by Small Business Owners in Pension Planning

While pension schemes are beneficial, small business owners often face hurdles in securing retirement benefits:

- Irregular Income – Business owners often struggle with fluctuating income, making consistent contributions challenging.

- Lack of Awareness – Many entrepreneurs are unaware of the available pension schemes and their benefits.

- Short-Term Focus – Business owners tend to prioritize immediate financial needs over long-term retirement planning.

- Limited Financial Literacy – Many small business owners lack the necessary financial knowledge to invest in pension plans effectively.

How to Overcome These Challenges?

- Set Automated Contributions: Use auto-debit options to ensure consistent savings.

- Consult Financial Advisors: Seek professional guidance to choose the best plan.

- Start Early: The earlier you invest, the higher the returns.

- Diversify Retirement Savings: Combine pension schemes with other savings options like fixed deposits and mutual funds.

Conclusion

For small business owners, government pension schemes serve as a lifeline for financial stability in old age. Investing in a pension plan today ensures a secure and independent future, reducing reliance on family members and government assistance.

By understanding the available pension schemes and making informed investment decisions, small business owners can build a strong financial foundation for retirement. If you haven’t already enrolled in a pension plan, now is the best time to secure your future!