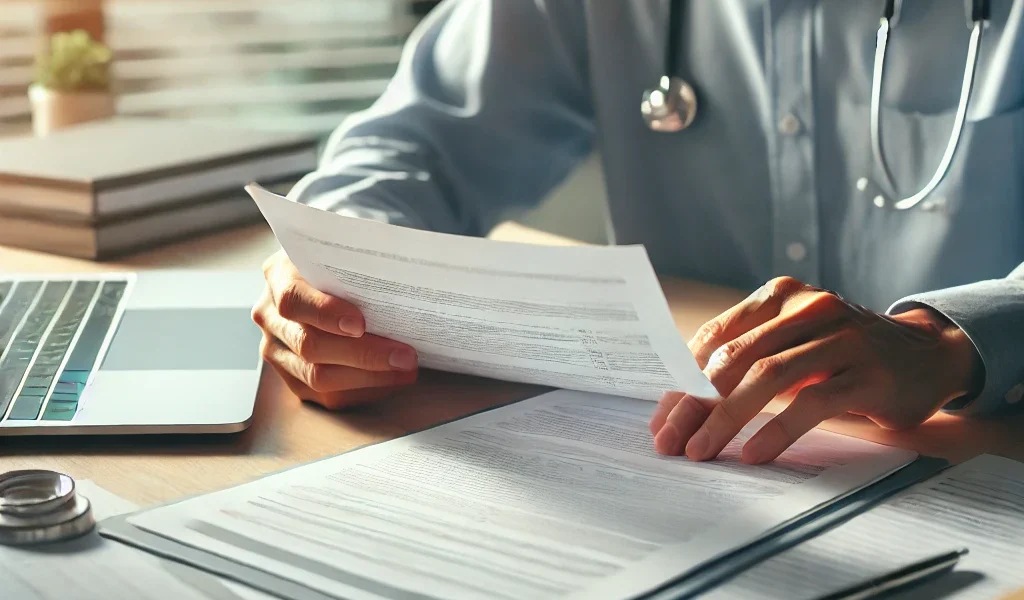

Medical insurance is designed to help cover healthcare expenses, but filing a claim can sometimes be a confusing and time-consuming process. A smooth and successful claim submission requires an understanding of your policy, accurate documentation, and proper communication with your insurer. This guide will walk you through the essential steps, common mistakes to avoid, and tips to maximize your medical insurance claim approval.

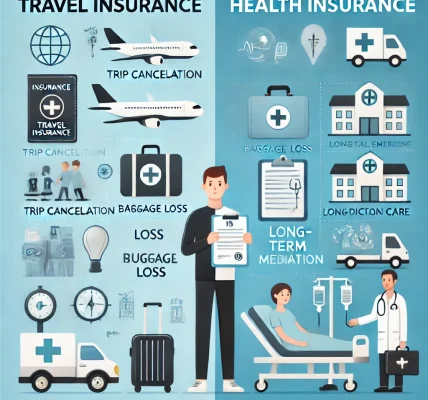

Understanding Medical Insurance Claims

A medical insurance claim is a request for payment submitted to your insurer for covered healthcare services. Depending on your policy, claims can be filed either by your healthcare provider or by you directly.

Types of Medical Insurance Claims

- Cashless Claims – The hospital directly coordinates with the insurer, and you do not have to pay upfront for covered treatments.

- Reimbursement Claims – You pay for the medical expenses and then submit a claim to the insurance company for reimbursement.

Steps to File a Medical Insurance Claim

1. Review Your Insurance Policy

Understanding your coverage is crucial before seeking treatment or filing a claim. Check for:

- Covered treatments and procedures

- Exclusions and limitations

- Claim submission deadlines

- Required documentation

2. Receive Treatment at a Network Hospital (for Cashless Claims)

If your policy offers cashless claims, ensure the hospital is in the insurer’s network. Inform the hospital’s insurance desk, and they will handle the claim directly with your insurer.

3. Gather Necessary Documentation (for Reimbursement Claims)

For reimbursement claims, collect:

- Original hospital bills and receipts

- Doctor’s prescriptions and medical reports

- Discharge summary

- Diagnostic test results

- Insurance policy details

4. Fill Out the Claim Form Accurately

Obtain the claim form from your insurer’s website or office. Complete the form with accurate details, including:

- Policy number

- Treatment details

- Hospital information

5. Submit the Claim on Time

Timely submission is critical. Send the claim form and required documents within the insurer’s specified deadline to avoid delays or rejection.

6. Follow Up on Your Claim

Check the status of your claim regularly with your insurer. If additional documents are requested, provide them promptly to prevent processing delays.

Common Mistakes to Avoid When Filing a Medical Insurance Claim

- Not Understanding Your Policy – Know what your insurance covers before seeking treatment.

- Submitting Incomplete Documents – Missing receipts, prescriptions, or reports can lead to claim rejection.

- Delaying the Claim Submission – Submit claims within the insurer’s deadline to avoid denial.

- Receiving Treatment at a Non-Network Hospital (for Cashless Claims) – This can lead to unexpected out-of-pocket expenses.

- Providing Incorrect Information – Ensure all details on the claim form are accurate to prevent delays.

- Not Keeping Copies of Documents – Always keep copies of bills and claim forms for future reference.

How to Maximize Your Claim Approval Chances

- Read Your Policy Thoroughly – Understand your coverage, exclusions, and claim process.

- Maintain Clear Medical Records – Keep organized records of past treatments, prescriptions, and bills.

- Consult Your Insurer Before Major Treatments – Pre-authorization can help ensure coverage for expensive procedures.

- Be Prompt with Submissions – File your claims as soon as possible after treatment.

- Communicate Clearly with Your Insurer – Respond quickly to any queries from the insurance company.

How Long Does a Medical Insurance Claim Take to Process?

The processing time depends on the type of claim:

- Cashless Claims – Usually approved within 24 to 48 hours.

- Reimbursement Claims – Can take a few weeks, depending on the insurer and completeness of documents submitted.

If there are delays, contact your insurer for updates and clarification.

Final Thoughts

Filing a medical insurance claim does not have to be stressful. By understanding your policy, organizing documents, and following the correct procedures, you can ensure a smooth claim process. Avoid common mistakes and stay proactive in communicating with your insurer. If needed, seek assistance from your insurance provider to clarify doubts and resolve issues efficiently.

This guide ensures legally safe information without providing specific legal or financial advice. If you need modifications or additional details, let me know.