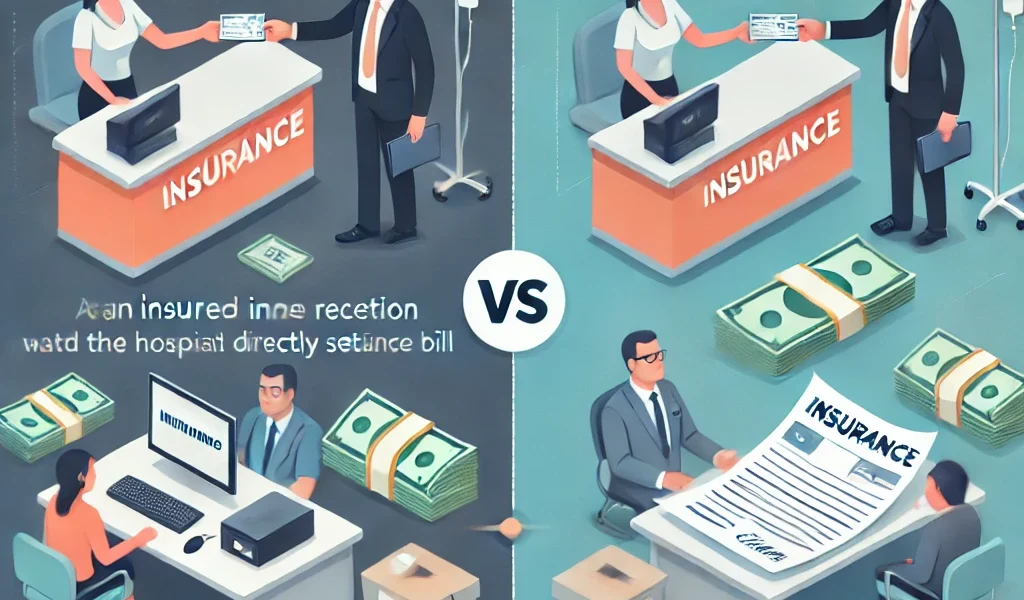

When it comes to settling insurance claims, policyholders generally have two options: Cashless Claims and Reimbursement Claims. Each method has its own benefits and limitations, and understanding the differences can help you make the right choice when filing a claim.

This guide provides a detailed breakdown of both types of claims, the steps involved, their advantages and disadvantages, and tips to ensure a hassle-free claim process.

What is a Cashless Insurance Claim?

A cashless claim is a type of insurance claim where the insurance company directly settles the bill with the hospital, garage, or service provider. The policyholder does not need to pay for the expenses out-of-pocket, except for any costs not covered under the policy.

How Does a Cashless Claim Work?

- Visit a network hospital or service provider listed by your insurer.

- Show your insurance policy details and ID proof.

- The hospital or provider sends a pre-authorization request to the insurance company.

- The insurer reviews the request and grants approval.

- The insured receives the required services without paying out-of-pocket (except deductibles and uncovered expenses).

- The insurer settles the bill directly with the hospital or service provider.

Pros of Cashless Insurance Claims

✅ No Immediate Financial Burden: The insurer pays the provider directly, reducing out-of-pocket expenses. ✅ Quick and Convenient: Minimal paperwork and hassle for the insured. ✅ Ideal for Emergencies: Faster processing ensures immediate treatment or service. ✅ Transparency: No need to negotiate hospital bills or repair costs.

Cons of Cashless Insurance Claims

❌ Limited to Network Providers: Only hospitals or service providers within the insurer’s network are covered. ❌ Pre-Authorization Delays: Some cases require insurer approval, which may take time. ❌ Partial Coverage: Expenses like consumables and registration fees may not be included.

What is a Reimbursement Insurance Claim?

A reimbursement claim requires the policyholder to pay for the expenses upfront and later request a refund from the insurance company.

How Does a Reimbursement Claim Work?

- Avail treatment, repairs, or services at any provider of your choice.

- Pay all expenses out-of-pocket at the time of service.

- Collect and organize all bills, receipts, and supporting documents.

- Submit a reimbursement claim form to the insurer along with necessary documents.

- The insurer reviews the claim and verifies the documents.

- The approved claim amount is reimbursed to the policyholder’s bank account.

Pros of Reimbursement Insurance Claims

✅ Freedom to Choose Any Provider: No restrictions on hospital or service center choice. ✅ No Need for Pre-Authorization: Immediate service without waiting for insurer approval. ✅ Useful When Network Providers Are Unavailable: Beneficial in areas without network providers.

Cons of Reimbursement Insurance Claims

❌ Financial Burden on the Policyholder: Must pay upfront before claiming reimbursement. ❌ Longer Processing Time: Insurers take time to review and approve claims. ❌ Extensive Documentation Required: Every bill and report must be submitted for verification.

Key Differences Between Cashless and Reimbursement Claims

| Feature | Cashless Claim | Reimbursement Claim |

|---|---|---|

| Payment Mode | Direct insurer payment | Paid first by insured, then reimbursed |

| Hospital Choice | Limited to network hospitals | Any hospital or service provider |

| Pre-Authorization Required? | Yes | No |

| Paperwork | Minimal | Extensive |

| Processing Time | Faster | Slower |

| Financial Burden | Low (except uncovered expenses) | High (initial payment required) |

Which Type of Claim is Better?

The best claim method depends on your situation:

- Choose Cashless Claims if you want quick and hassle-free settlement without upfront expenses.

- Choose Reimbursement Claims if you need the flexibility to visit any provider or if network options are unavailable.

How to Ensure a Smooth Insurance Claim Process?

✅ Read Your Policy Terms: Understand coverage, exclusions, and claim limits. ✅ Keep Your Insurance Card Handy: For easy verification at hospitals. ✅ Choose Network Hospitals for Cashless Claims: This ensures direct settlement by the insurer. ✅ Maintain Medical and Repair Records: Even for cashless claims, keep copies of all documents. ✅ Inform Your Insurer Immediately: Delays in notifying the insurer may lead to rejection. ✅ Follow the Correct Process: Each insurer has specific claim submission guidelines. ✅ Check Your Claim Status Regularly: Keep track of approvals and pending requirements.

Frequently Asked Questions (FAQs)

Q1: Can I switch from a reimbursement claim to a cashless claim?

No, once the service has been availed and paid for, the claim must be processed as a reimbursement.

Q2: How long does a reimbursement claim take?

It can take 7 to 30 days, depending on insurer processing time and document verification.

Q3: What happens if my cashless claim is denied?

You can still file a reimbursement claim, provided you have all required documents.

Q4: Will my insurance premium increase after filing a claim?

Possibly, depending on policy terms and the nature of the claim.

Q5: What should I do if my claim is rejected?

Check the rejection reason, submit additional documents if needed, and appeal the decision.

Final Thoughts

Both cashless and reimbursement claims serve different purposes. Knowing their differences can help you make the right decision when filing a claim. Always stay informed about your policy coverage, maintain necessary records, and follow proper claim procedures to avoid delays or rejections.

By planning ahead and understanding your rights, you can ensure a smooth insurance claim experience.