Introduction

Inflation is a key economic factor that affects both borrowers and lenders. It influences the cost of borrowing by impacting loan interest rates, making it an essential consideration for individuals and businesses seeking financing. When inflation rises, central banks often adjust interest rates to stabilize the economy. This article explores the relationship between inflation and loan interest rates, how it affects borrowers, and strategies to navigate these financial changes.

Understanding Inflation and Its Causes

Inflation refers to the increase in the general price level of goods and services over time, reducing the purchasing power of money. Several factors contribute to inflation, including:

- Demand-Pull Inflation: When demand for goods and services exceeds supply, prices rise.

- Cost-Push Inflation: Higher production costs (e.g., wages, raw materials) lead to increased prices.

- Monetary Policy: An excessive supply of money in the economy can fuel inflation.

- Global Factors: Changes in oil prices, supply chain disruptions, and geopolitical events can impact inflation.

The Relationship Between Inflation and Interest Rates

Interest rates are one of the primary tools used by central banks, such as the Federal Reserve (U.S.) or the Reserve Bank of India, to control inflation. The relationship between inflation and interest rates can be understood through the following mechanisms:

1. Central Bank Policies

When inflation rises, central banks typically increase interest rates to reduce excessive spending and borrowing. This helps slow down inflation by making loans more expensive, thereby reducing consumer and business demand.

2. Real Interest Rates vs. Nominal Interest Rates

- Nominal Interest Rate: The stated rate on a loan, which does not account for inflation.

- Real Interest Rate: The interest rate adjusted for inflation (Real Interest Rate = Nominal Interest Rate – Inflation Rate).

- High inflation erodes real interest rates, reducing the effective cost of borrowing for existing loans but making new loans more expensive.

3. Market Reactions and Bond Yields

- When inflation is high, investors demand higher yields on bonds, influencing the interest rates banks charge on loans.

- Market expectations of future inflation also play a crucial role in determining loan rates.

Impact of Inflation on Different Loan Types

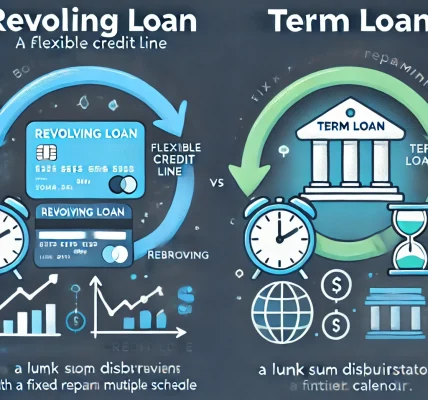

Inflation affects various types of loans differently. Here’s how:

1. Home Loans (Mortgages)

- Higher inflation can lead to increased mortgage rates, making home loans more expensive.

- Existing fixed-rate mortgage borrowers benefit as inflation erodes the real value of their repayments.

2. Personal Loans

- Inflation-driven rate hikes can increase EMIs (Equated Monthly Installments) for variable-rate personal loans.

- Borrowers with fixed-rate personal loans remain unaffected by rate fluctuations.

3. Business Loans

- Higher borrowing costs can discourage businesses from taking loans, impacting expansion and investments.

- Small businesses may face greater challenges due to higher working capital costs.

4. Student Loans

- Federal student loan interest rates may rise in response to inflation.

- Private student loans with variable rates could see increased repayment burdens.

5. Auto Loans

- Auto loan rates may rise with inflation, making vehicle purchases more expensive.

- Consumers may delay buying new cars due to higher interest payments.

How Borrowers Can Navigate Inflation’s Impact on Loans

While inflation can increase loan costs, borrowers can take steps to manage their finances effectively:

1. Choose Fixed-Rate Loans Over Variable-Rate Loans

- Fixed-rate loans lock in interest rates, protecting borrowers from future rate hikes.

- Variable-rate loans may seem attractive initially but can become costly as inflation rises.

2. Consider Refinancing

- If interest rates are expected to decline in the future, refinancing existing loans can help secure lower rates.

- Homeowners with high-interest mortgages may benefit from refinancing options.

3. Pay Off High-Interest Debt

- Prioritize repaying credit cards and personal loans that carry high-interest rates.

- Reducing debt burden can minimize financial stress during inflationary periods.

4. Improve Credit Score

- A higher credit score can help borrowers secure better loan terms even when interest rates are high.

- Timely payments, low credit utilization, and avoiding multiple loan applications can boost credit scores.

5. Build an Emergency Fund

- Having savings can help cover increased costs due to inflation and avoid reliance on high-interest loans.

- Emergency funds should cover at least 3–6 months’ worth of expenses.

6. Explore Alternative Investment Options

- Investing in inflation-protected securities or assets like real estate can help offset rising borrowing costs.

- Diversifying investments can provide financial stability.

Conclusion

Inflation significantly impacts loan interest rates, affecting borrowers across various sectors. Understanding how inflation influences borrowing costs can help individuals and businesses make informed financial decisions. By opting for fixed-rate loans, refinancing when necessary, and maintaining financial discipline, borrowers can mitigate the adverse effects of inflation on their loans.