How to Use a Balance Transfer Credit Card to Manage Debt Effectively

Managing debt can be overwhelming, but one strategic way to take control is by using a balance transfer credit card. This financial tool allows you to consolidate high-interest debt onto a new credit card with a lower or 0% introductory…

The Truth About Payday Loans: Are They Worth the Risk?

Payday loans are often marketed as quick and easy solutions for financial emergencies. They promise fast cash without the hassle of credit checks or lengthy application processes. However, beneath the surface, payday loans come with high-interest rates and hidden fees…

How to Dispute Errors on Your Credit Report and Improve Your Score

Your credit report plays a crucial role in your financial health, influencing your ability to get loans, credit cards, and even housing or employment opportunities. However, errors on your credit report can negatively impact your credit score, potentially leading to…

Impact of Credit Inquiries on Your Credit Score: Hard vs. Soft Pulls

Your credit score is one of the most important financial metrics that lenders, landlords, and even employers consider when assessing your financial reliability. One key factor that influences your credit score is credit inquiries. Understanding the difference between hard and…

How to Get Out of Debt Faster: Smart Repayment Strategies

Debt can feel overwhelming, but with the right strategies, you can regain financial control and achieve debt freedom faster than you think. Whether it’s credit card debt, student loans, or personal loans, a structured repayment plan can help you eliminate…

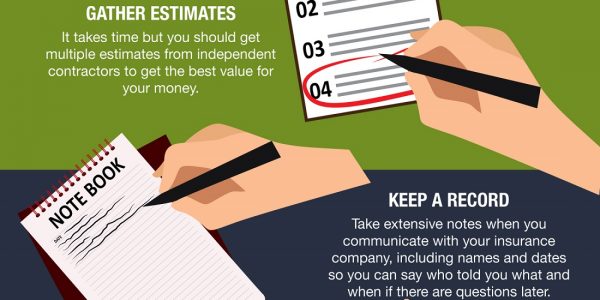

Insurance Claim Process: Step-by-Step Guide for Beginners

Understand Your Policy CoverageThoroughly review your insurance policy to comprehend the extent of your coverage, including any exclusions or limitations. This knowledge is crucial when filing a claim. theguardian.com Promptly Report the Incident Document Everything Thoroughly Collect comprehensive evidence, such…

Retirement Planning Mistakes: Common Errors to Avoid for a Secure Future

Retirement planning is one of the most crucial financial responsibilities that individuals must undertake to ensure a comfortable and stress-free post-working life. However, many people make critical mistakes that jeopardize their financial security in retirement. Understanding and avoiding these pitfalls…

Insurance Claim Process Simplified: Step-by-Step Guide for Beginners

Insurance claims can feel overwhelming, especially for beginners. Whether it’s a health, auto, home, or any other type of insurance, understanding the claim process is crucial to ensuring a smooth experience. This guide simplifies the insurance claim process, helping you…

How to Improve Your Credit Score Quickly in 3 Months

A good credit score opens doors to better financial opportunities, including lower interest rates, higher credit limits, and easier loan approvals. If you need to boost your credit score quickly, a three-month plan can make a significant difference. While improving…

The Importance of Accurate Information When Filing an Insurance Claim

Introduction Filing an insurance claim can be a crucial step in recovering from financial losses due to accidents, property damage, or health-related issues. However, one of the most critical aspects of a successful claim is providing accurate and truthful information….