Step-by-Step Guide to Getting a Loan Against Property

Introduction A Loan Against Property (LAP) is a secured loan where borrowers pledge their residential, commercial, or industrial property as collateral to secure funds. This type of loan can be used for various purposes such as business expansion, debt consolidation,…

How to Negotiate Better Loan Terms with Lenders

Introduction Securing a loan with favorable terms can make a significant difference in your financial health. Whether it’s a mortgage, personal loan, business loan, or auto loan, negotiating better loan terms can save you money and make repayment more manageable….

Personal Line of Credit vs. Traditional Loans: Key Differences

Introduction When borrowing money, individuals have several options, including a personal line of credit and a traditional loan. While both options provide financial assistance, they work differently in terms of repayment, flexibility, and cost. Understanding these differences is crucial for…

Balloon Payment Loans: What Borrowers Should Know

A balloon payment loan is a type of loan where the borrower makes small regular payments over a specified period and then pays a large lump sum, known as the balloon payment, at the end of the loan term. This…

Financial Planning

Introduction When planning to take a loan, one of the most critical aspects to consider is how much you will need to pay every month. Loan Equated Monthly Installment (EMI) calculators are valuable tools that help individuals assess their repayment…

Understanding the Role of Credit Bureaus in Loan Approval

Introduction When applying for a loan, lenders assess various factors to determine whether an applicant qualifies for financing. One of the most critical elements in this evaluation process is the applicant’s creditworthiness, which is largely determined by credit bureaus. These…

Loan Pre-Approval vs. Pre-Qualification: What’s the Difference?

Introduction When applying for a loan, especially a mortgage or a personal loan, you may come across the terms pre-approval and pre-qualification. While they may seem similar, they serve different purposes in the lending process. Understanding the distinction between loan…

Loan Fraud and Scams: How to Protect Yourself from Predatory Lenders

Introduction In today’s financial landscape, obtaining a loan has become easier than ever, thanks to digital lending platforms and various financial institutions offering quick and accessible credit. However, this ease of access also makes individuals more vulnerable to loan fraud…

Small Business Loans: How to Secure Funding for Your Startup

Introduction Starting a small business requires capital, and for many entrepreneurs, securing a loan is a crucial step in turning their vision into reality. However, navigating the world of small business loans can be challenging. Understanding the types of loans…

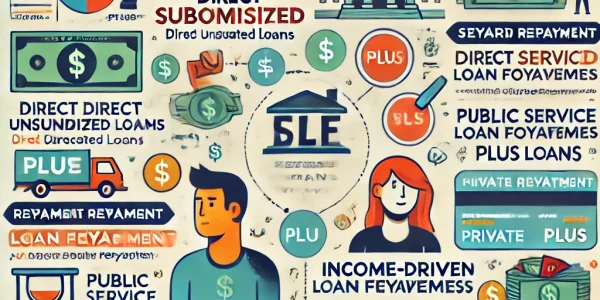

Understanding Student Loans: Types, Repayment, and Forgiveness Programs

Introduction Higher education can be expensive, making student loans a necessity for many students. While student loans provide access to education, understanding their types, repayment options, and forgiveness programs is crucial for managing debt responsibly. This guide covers the different…