Bad Credit Loans: Are They Worth It or Just a Debt Trap?

Introduction Bad credit loans are often marketed as a lifeline for individuals struggling with low credit scores. While they can offer quick financial relief, they also come with risks that may lead borrowers into deeper financial trouble. In this guide,…

How Student Loan Debt Affects Your Credit Score and Future Finances

Student loan debt is a reality for millions of people worldwide. Whether you’re currently in school, recently graduated, or still repaying your loans, understanding how student debt impacts your credit score and financial future is crucial. Many borrowers are unaware…

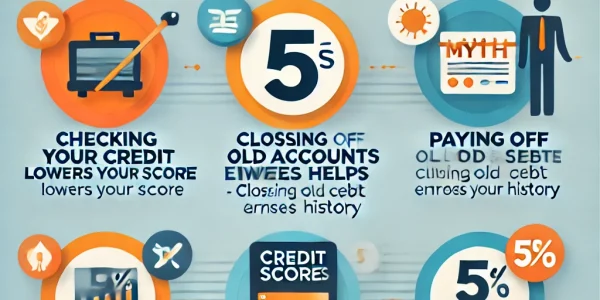

Top 5 Myths About Credit Scores You Should Stop Believing

Your credit score plays a crucial role in your financial life, influencing your ability to secure loans, get approved for credit cards, rent an apartment, or even land a job. However, despite its importance, there are many misconceptions surrounding credit…

How to Remove Negative Items from Your Credit Report Legally

A poor credit report filled with negative items can be a major roadblock to financial success. Whether it’s late payments, charge-offs, or collections, these negative marks can lower your credit score and impact your ability to secure loans, get approved…

The Role of Credit Utilization Ratio in Your Credit Score

Your credit score plays a vital role in your financial health, affecting your ability to secure loans, credit cards, and even rental agreements. One of the key factors that influence your credit score is the credit utilization ratio. Understanding what…

Secured vs. Unsecured Debt: What’s the Difference and Why It Matters

Debt is an integral part of personal and business finance, but not all debt is the same. Understanding the differences between secured and unsecured debt can help you make better financial decisions, manage risk, and improve your creditworthiness. This guide…

How to Negotiate Debt with Creditors and Reduce Your Payments

Dealing with debt can be overwhelming, but you don’t have to face it alone. Many creditors are willing to negotiate and work with you to reduce your payments, lower interest rates, or even settle your debt for less than you…

The Truth About Minimum Credit Card Payments and Why They Trap You in Debt

Credit cards offer convenience and financial flexibility, but they can also become a financial burden if not managed correctly. One of the biggest traps that many credit card users fall into is making only the minimum payment each month. While…

Personal Loans vs. Credit Cards: Which is Better for Debt Management?

Debt management is a critical aspect of financial well-being, and choosing between personal loans and credit cards can significantly impact how effectively you handle your debt. While both options have their advantages and drawbacks, understanding their differences can help you…

Hidden Credit Card Fees You Should Be Aware Of

Credit cards can be a convenient tool for managing expenses, building credit, and even earning rewards. However, many users unknowingly fall into the trap of hidden fees, which can quickly add up and affect their financial health. Being aware of…