What to Do If You’re Being Harassed by Debt Collectors

Introduction Dealing with debt collectors can be stressful, especially if they use aggressive or unethical tactics. However, it’s important to know that you have legal rights that protect you from harassment. In this guide, we’ll explore how to handle debt…

Credit Myths Debunked: The Truth About Credit Scores and Reports

Introduction Credit scores and reports play a vital role in personal finance, influencing everything from loan approvals to interest rates. Unfortunately, many misconceptions surround credit, leading people to make financial decisions based on myths rather than facts. This guide will…

Personal Loans vs. Credit Cards: Which is Better for Managing Debt?

Introduction When it comes to managing debt, two common financial tools people consider are personal loans and credit cards. Both options can provide quick access to funds, but they work in different ways and come with distinct advantages and drawbacks….

How to Remove Errors from Your Credit Report and Improve Your Score

Introduction Your credit report plays a crucial role in determining your financial health, influencing everything from loan approvals to interest rates. Unfortunately, credit report errors are common and can unfairly lower your credit score. Identifying and correcting these mistakes is…

Good Debt vs. Bad Debt: How to Make Smart Borrowing Decisions

Introduction Debt is often viewed negatively, but not all debt is bad. In fact, when used strategically, certain types of debt can help build wealth, improve financial stability, and create opportunities for growth. Understanding the difference between good debt and…

How Late Payments Affect Your Credit Score (and How to Recover)

Introduction Late payments can have a severe impact on your credit score, making it harder to secure loans, credit cards, and even rental agreements. Missing a due date by just a few days might not seem like a big deal,…

The Debt Snowball vs. Debt Avalanche Method: Which Works Best?

Introduction Debt can feel overwhelming, but with the right strategy, you can take control of your finances. Two of the most effective methods to pay off debt are the Debt Snowball and Debt Avalanche methods. Each has its own advantages,…

How to Negotiate Lower Interest Rates on Your Credit Cards

Introduction High-interest rates on credit cards can drain your finances, making it harder to pay off debt and achieve financial freedom. The good news? You can negotiate lower interest rates! Many people don’t realize that credit card companies are often…

Understanding Credit Utilization: Why It Matters for Your Credit Score

Introduction Credit utilization is one of the most important factors affecting your credit score, yet many people overlook its significance. It plays a crucial role in determining your financial health and can either help you build a strong credit profile…

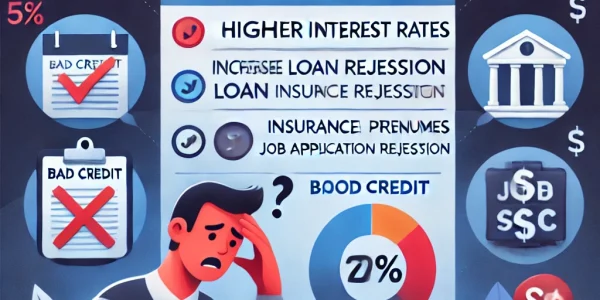

The Hidden Costs of Bad Credit and How to Fix It

A poor credit score can cost you more than just loan approvals—it can impact various aspects of your financial life, from higher interest rates to limited housing options. Many people don’t realize just how expensive bad credit can be until…