Life Insurance for Millennials: Why It’s Important and How to Get Started

Introduction Life insurance is often overlooked by millennials, as many believe it’s unnecessary at a young age. However, securing life insurance early can offer long-term financial benefits, protection for loved ones, and even serve as an investment tool. This guide…

Understanding Life Insurance Riders: What Are They and Do You Need Them?

Introduction When purchasing a life insurance policy, many people focus only on the basic coverage and premium costs. However, life insurance policies can be customized with additional benefits known as riders. These riders offer policyholders added protection, flexibility, and peace…

How to Choose the Best Life Insurance Policy for Your Family

Life insurance is one of the most crucial financial decisions you can make for your family’s future. Choosing the right policy can ensure that your loved ones are protected and financially secure in case of unforeseen circumstances. However, with so…

The Hidden Benefits of Life Insurance Beyond Financial Security

Life insurance is often viewed as a financial safety net, ensuring that loved ones are taken care of in the event of an untimely passing. While financial security is a key component, life insurance offers a range of lesser-known benefits…

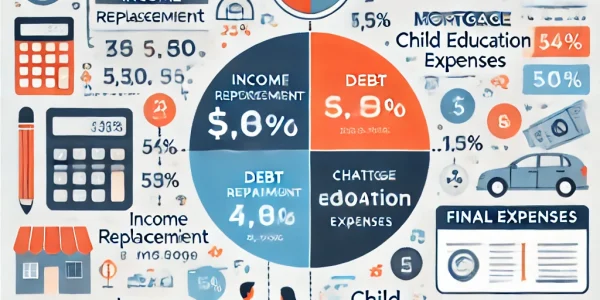

How Much Life Insurance Do You Really Need?

Life insurance is one of the most important financial tools to protect your loved ones in case of an unexpected tragedy. But determining how much coverage you actually need can be a daunting task. If you purchase too little coverage,…

Debt Snowball vs. Debt Avalanche: Which Repayment Method is Right for You?

Debt repayment can feel overwhelming, but choosing the right strategy can make a significant difference in how quickly and efficiently you become debt-free. Two of the most popular and effective methods are the Debt Snowball and Debt Avalanche approaches. Each…

Hidden Factors That Impact Your Credit Score (And How to Fix Them)

Your credit score plays a crucial role in your financial life, affecting everything from loan approvals to interest rates and even job applications. While most people know that late payments and high credit utilization negatively impact their scores, several lesser-known…

How to Negotiate Credit Card Debt and Reduce Your Payments

Managing credit card debt can feel overwhelming, but negotiating your debt can help reduce payments, lower interest rates, and even settle balances for less than you owe. Credit card companies are often willing to work with you, but knowing how…

The Pros and Cons of Debt Consolidation Loans: Is It Worth It?

Debt can be overwhelming, especially when you have multiple loans and credit card balances with high interest rates. A debt consolidation loan is one way to simplify your financial situation by combining multiple debts into a single loan with a…

How Late Payments Affect Your Credit Score (And How to Recover)

Your credit score plays a crucial role in your financial well-being, influencing everything from loan approvals to interest rates. One of the most significant factors that impact your credit score is payment history, and late payments can have long-lasting effects…