Social Security and Your Retirement Plan: How to Maximize Benefits

Introduction Planning for retirement is one of the most critical financial decisions you will make in your lifetime. Social Security benefits play a crucial role in providing financial stability during your retirement years. However, to maximize these benefits and ensure…

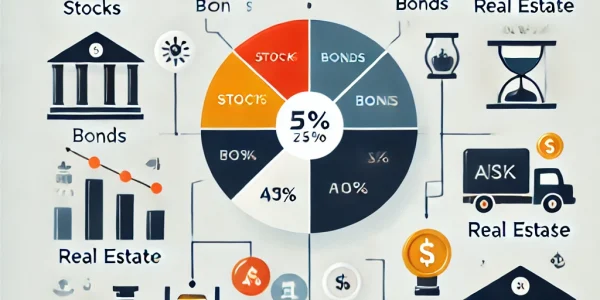

The Importance of Diversification in Your Retirement Portfolio: Which One Offers the Best Returns?

Introduction When planning for retirement, one of the most crucial investment strategies is diversification. A well-diversified retirement portfolio can mitigate risks, improve returns, and provide long-term financial stability. However, many investors either overlook diversification or fail to implement it effectively….

How Much Should You Save for Retirement? Understanding the Right Savings Rate

Introduction Retirement planning is a crucial part of financial security, yet many individuals struggle with the question: “How much should I save for retirement?” The answer is not one-size-fits-all, as it depends on various factors like lifestyle goals, expected retirement…

Retirement Planning Mistakes to Avoid and How to Fix Them – Which One Offers the Best Returns?

Introduction Planning for retirement can be overwhelming. With so many options available, it’s easy to make mistakes that could harm your financial future. Whether you’re just starting to save or you’re nearing retirement, making the wrong decisions can have a…

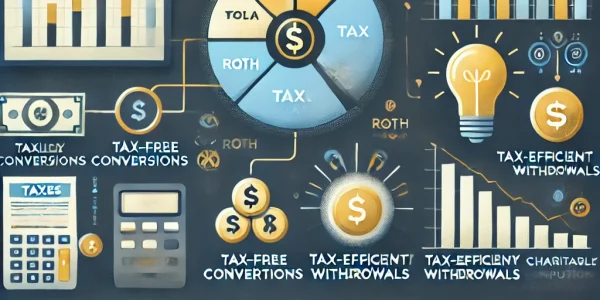

The Impact of Taxes on Your Retirement Savings and How to Minimize It

Introduction One of the biggest challenges in retirement planning is understanding how taxes impact your savings. Many retirees are shocked to learn that a significant portion of their 401(k), IRA, and Social Security income can be taxed. Without a proper…

How to Transition from Accumulation to Distribution in Retirement Plans: Which One Offers the Best Returns?

Introduction Retirement planning is a two-phase journey: While many people focus on saving for retirement, fewer pay attention to how they will effectively withdraw their savings to ensure financial security. A poor distribution strategy can lead to higher taxes, premature…

Is a Roth IRA the Right Choice for Your Retirement Strategy? Which One Offers the Best Returns?

Introduction When planning for retirement, choosing the right investment strategy is crucial. One of the most popular options is a Roth IRA, a tax-advantaged retirement account that allows for tax-free withdrawals in retirement. But is it the right choice for…

Retirement Planning for Women: Why It’s Essential to Start Early – Which One Offers the Best Returns?

Introduction Retirement planning is crucial for everyone, but for women, it comes with unique challenges. Women often live longer than men, face income disparities, and may take career breaks for caregiving. These factors make it essential to start saving early…

The Role of Health Savings Accounts (HSAs) in Retirement Planning – Which One Offers the Best Returns?

Introduction Retirement planning is not just about building a solid nest egg; it’s also about managing future healthcare expenses. One of the most underutilized yet powerful tools for retirement is the Health Savings Account (HSA). An HSA is a tax-advantaged…

How Inflation Affects Retirement Planning and What to Do About It – Which One Offers the Best Returns?

Retirement planning is all about ensuring financial security in your golden years, but one critical factor that often gets overlooked is inflation. Inflation erodes the purchasing power of money over time, meaning the savings you accumulate today might not be…