Introduction

Pension schemes play a crucial role in ensuring financial security for retired individuals. In India, both the Central Government and State Governments offer pension schemes to support employees and citizens post-retirement. However, there are notable differences in their structures, benefits, and eligibility criteria. Understanding these differences can help individuals make informed decisions regarding their retirement planning.

This article provides a detailed comparison between Central Government Pension Schemes and State Government Pension Schemes, covering eligibility, benefits, contribution structures, and more.

1. Understanding Government Pension Schemes

Central Government Pension Schemes

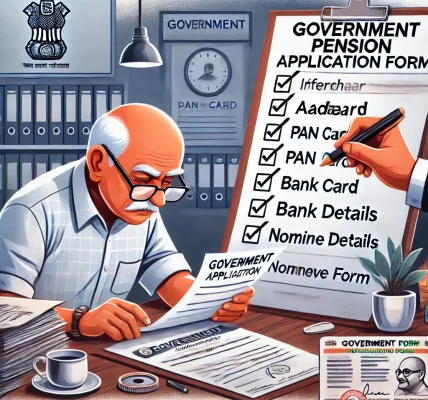

The Central Government offers pension schemes to employees working under its various departments. These schemes include:

- National Pension System (NPS) (For government employees post-2004)

- Employees’ Pension Scheme (EPS) (For employees under EPFO)

- Pradhan Mantri Vaya Vandana Yojana (PMVVY) (For senior citizens)

- Senior Citizens Savings Scheme (SCSS) (For retirees looking for assured returns)

State Government Pension Schemes

Each State Government has its own pension schemes for employees and citizens. Some states follow the Old Pension Scheme (OPS), while others have adopted the National Pension System (NPS). Additionally, various state-specific pension schemes exist, such as:

- State Government Employee Pension Schemes

- State-Specific Social Pension Schemes (e.g., Old Age Pension, Widow Pension, Disability Pension)

- Chief Minister’s Pension Schemes (varying by state)

2. Key Differences Between Central and State Government Pension Schemes

| Feature | Central Government Pension Schemes | State Government Pension Schemes |

|---|---|---|

| Applicability | Central Government employees and citizens | State Government employees and state residents |

| Pension System | NPS (mandatory for employees after 2004), EPS, PMVVY, SCSS | OPS in some states, NPS in others, State-specific pension schemes |

| Funding | Centrally funded | State-funded (sometimes with Central assistance) |

| Pension Calculation | Based on NPS corpus and EPS contributions | OPS (50% of last drawn salary) or NPS-based |

| Retirement Age | Typically 60 years | Varies between 58-62 years depending on state |

| Contribution System | Employees contribute 10% of salary + 14% employer contribution (for NPS) | Contribution-based for NPS, government-funded for OPS |

| Tax Benefits | Tax benefits under Section 80C & 80CCD(1B) for NPS | Similar tax benefits for NPS participants |

| Pension Payment Mode | Direct transfer to pensioner’s bank account | Direct transfer for NPS, manual processing for OPS |

| Survivor Benefits | Pension to spouse/nominee in case of the pensioner’s death | Similar provisions in most state schemes |

| Portability | NPS can be continued anywhere in India | State-specific pensions may not be transferable |

3. In-Depth Comparison: Central vs. State Government Pensions

A. Pension Scheme Structure

- The Central Government has shifted to the National Pension System (NPS) for employees who joined after January 1, 2004.

- Some State Governments continue the Old Pension Scheme (OPS), while others have also transitioned to NPS.

- OPS provides a fixed pension, whereas NPS offers market-linked returns with annuity options.

B. Financial Contribution & Benefits

- Under NPS, employees contribute 10% of their salary, while the government contributes 14%.

- Under OPS (for states still following it), employees receive 50% of their last drawn salary as a pension without contributing during service.

- Central pensioners under EPS receive a fixed monthly pension from EPFO.

C. Stability & Market Risk

- OPS (State Govt.) ensures a fixed pension amount, making it more stable but financially burdensome for the government.

- NPS (Central & State Govt.) depends on market performance, leading to variable pension amounts.

D. Retirement Age & Withdrawal Rules

- The retirement age for Central Government employees is 60 years, while some states allow retirement at 58 or 62 years.

- NPS allows partial withdrawals for emergencies, but OPS provides a fixed pension without requiring corpus withdrawal.

E. Survivor & Family Pension Benefits

- Both Central and State pension schemes include family pension benefits.

- Under OPS, the spouse receives 50% of the pension after the pensioner’s death.

- Under NPS, the nominee receives the accumulated corpus.

F. Taxation Benefits

- NPS contributions are tax-deductible under Section 80C and 80CCD(1B).

- OPS pensions are taxable as per the recipient’s income slab.

4. Which Pension Scheme is Better?

Central Government Pension Schemes are better if:

✔️ You prefer a market-linked pension with investment growth. ✔️ You want government contributions towards your retirement. ✔️ You prefer tax benefits under NPS provisions. ✔️ You want portability across states.

State Government Pension Schemes are better if:

✔️ You work in a state that still follows OPS and want a fixed pension. ✔️ You qualify for social security pension schemes offered by some states. ✔️ You don’t want exposure to market risks in your retirement savings.

5. Recent Developments in Government Pension Schemes

- Some state governments are considering a return to OPS due to employee demands.

- NPS reforms include higher government contributions and flexible withdrawal rules.

- Technology improvements have made online pension scheme management easier.

Conclusion

Both Central and State Government Pension Schemes offer unique benefits depending on the employment type and financial goals of individuals. While NPS provides long-term growth with market-linked returns, OPS guarantees fixed pensions but is available only in select states. Employees should carefully evaluate these schemes based on financial security, risk appetite, and government policies before making retirement decisions.

Key Takeaways:

✅ OPS (State Govt.) offers stability but is available only in some states. ✅ NPS (Central & State Govt.) provides market-based growth and tax benefits. ✅ EPS & SCSS provide additional pension security options. ✅ Consider tax benefits, survivor benefits, and withdrawal flexibility before choosing. ✅ Stay updated on government policies that might affect pension structures in the future.

By understanding these factors, individuals can make better retirement planning choices and ensure financial security in their golden years.