Introduction

Filing a home insurance claim after property damage can be overwhelming, especially if you’re unfamiliar with the process. However, knowing how to navigate your claim efficiently can make a significant difference in the payout you receive. Insurers evaluate claims based on policy terms, documentation, and the extent of the damage. This guide will provide step-by-step instructions to help homeowners maximize their payout while ensuring a smooth claims process.

1. Understanding Your Home Insurance Policy

Before filing a claim, it is crucial to understand what your home insurance policy covers. Policies generally include coverage for:

- Dwelling Coverage: Protects the structure of your home from covered perils such as fire, storms, and vandalism.

- Personal Property Coverage: Covers belongings inside the home, including furniture, electronics, and clothing.

- Additional Living Expenses (ALE): Covers temporary housing costs if your home becomes uninhabitable.

- Liability Coverage: Provides protection if someone is injured on your property.

Tips to Maximize Your Claim

- Review your policy to know your coverage limits and exclusions.

- Understand deductibles and how they impact your claim.

- Consider endorsements or riders for high-value items.

2. Immediate Steps to Take After Property Damage

a. Ensure Safety First

- If the damage is severe (e.g., fire, flooding, or structural collapse), evacuate your home and contact emergency services.

- Turn off utilities if necessary to prevent further damage.

b. Document the Damage

- Take clear, high-quality photos and videos of the damaged areas from multiple angles.

- Make an inventory of damaged items, including their estimated value.

- Gather receipts or proof of purchase for expensive belongings.

c. Prevent Further Damage

- Take temporary measures to mitigate additional damage (e.g., covering broken windows, tarping the roof).

- Keep receipts for any temporary repairs as they may be reimbursed by your insurer.

3. Filing Your Insurance Claim

a. Notify Your Insurance Company Promptly

- Contact your insurer as soon as possible to report the damage.

- Provide an initial assessment of the damage and request claim forms.

b. Submit a Detailed Claim Report

- Fill out the claim forms accurately and attach necessary documents.

- Include photographic evidence, inventory lists, and repair estimates.

- Mention any additional costs incurred due to displacement.

c. Cooperate with the Insurance Adjuster

- An insurance adjuster will inspect the damage to determine the payout.

- Be present during the inspection and provide supporting evidence.

- Keep a record of all conversations and emails with the adjuster.

4. Maximizing Your Insurance Payout

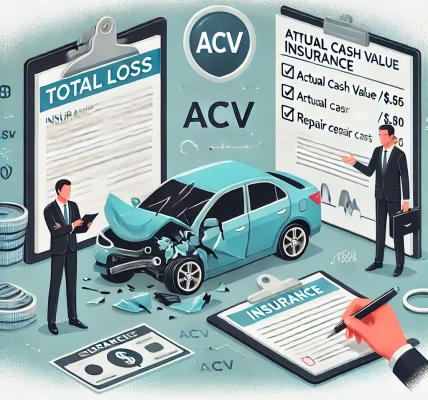

a. Get Multiple Repair Estimates

- Obtain at least three quotes from licensed contractors to ensure you get a fair repair estimate.

- Present these estimates to your insurance adjuster for negotiation.

b. Negotiate Your Settlement

- If the initial offer is lower than expected, provide additional proof of damage.

- Consider hiring a public adjuster if your claim is complex or undervalued.

- Be persistent and escalate the issue if necessary.

c. Utilize Additional Coverage

- If you have ALE coverage, claim temporary housing expenses.

- Use any policy endorsements for special damages (e.g., flood, earthquake, or valuable items coverage).

5. Common Mistakes to Avoid

- Delaying the claim: Report the damage immediately to avoid complications.

- Inadequate documentation: Insufficient proof of damage can result in a lower payout.

- Accepting the first offer too quickly: Negotiate for a fair settlement.

- Not reviewing policy details: Knowing your rights and coverage helps prevent disputes.

- Failing to keep records: Always document communications with your insurer.

6. What to Do If Your Claim Is Denied

If your claim is denied, you can:

- Request a written explanation from your insurer.

- Review your policy to check for any discrepancies.

- Gather additional evidence to support your claim.

- File an appeal with your insurer.

- Consult a lawyer or public adjuster if necessary.

7. Conclusion

Maximizing your home insurance claim payout requires preparation, documentation, and negotiation. By understanding your policy, submitting a well-documented claim, and actively engaging in the settlement process, you can ensure a fair payout. Stay informed, act promptly, and protect your financial interests.