Introduction

Planning for retirement is one of the most crucial financial decisions you’ll make. While traditional retirement plans like 401(k)s, IRAs, and pension funds are vital, life insurance can play a significant role in securing your retirement. A well-structured life insurance policy can provide financial security, supplement your income, and ensure your loved ones are protected even after you retire.

In this guide, we’ll explore how life insurance can be a powerful tool in retirement planning, its various options, benefits, and how you can incorporate it into your financial strategy.

1. The Role of Life Insurance in Retirement Planning

Many people view life insurance solely as a way to provide financial support for dependents after their passing. However, it can also be a valuable asset for your retirement strategy. Here’s how:

✔ Providing Financial Protection – Ensures that your spouse or dependents have financial stability in case of an unexpected event. ✔ Generating Cash Value – Certain life insurance policies accumulate cash value over time, which can be used during retirement. ✔ Supplementing Retirement Income – You can borrow against the cash value of permanent life insurance to supplement your retirement income. ✔ Covering Long-Term Care Costs – Some policies offer riders that cover long-term care expenses, reducing the financial burden in old age. ✔ Reducing Tax Liabilities – Life insurance can provide tax-advantaged benefits, helping to optimize your retirement savings.

2. Types of Life Insurance for Retirement Planning

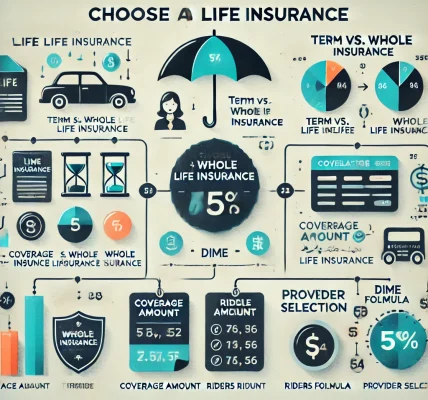

Different types of life insurance policies serve different purposes in a retirement strategy. Let’s explore the most effective options:

2.1 Term Life Insurance

✔ Provides coverage for a set period (10, 20, or 30 years).

✔ More affordable than permanent life insurance.

✔ Suitable for individuals who need coverage only until they retire.

❌ No cash value accumulation or payout after the term expires.

Best for: Young professionals securing their families while building traditional retirement savings.

2.2 Whole Life Insurance

✔ Provides lifelong coverage with a guaranteed death benefit.

✔ Accumulates cash value that grows over time.

✔ Premiums remain fixed throughout the policy.

❌ Higher premiums than term life insurance.

Best for: Individuals who want a long-term safety net with cash accumulation.

2.3 Universal Life Insurance

✔ Offers flexible premiums and death benefits.

✔ Cash value grows based on investment performance.

✔ Can be adjusted to meet changing financial needs.

❌ Returns depend on market conditions, making it riskier.

Best for: People who want flexibility in their policy to adjust contributions over time.

2.4 Indexed Universal Life Insurance

✔ Cash value growth is linked to a stock market index (S&P 500, etc.).

✔ Provides potential higher returns compared to traditional universal life.

✔ Offers downside protection with a guaranteed minimum interest rate.

❌ Policy performance depends on market fluctuations.

Best for: Individuals who want market-linked growth potential with controlled risk.

2.5 Variable Life Insurance

✔ Investment-focused policy where cash value is invested in stocks, bonds, or mutual funds.

✔ Higher growth potential compared to other life insurance types.

✔ Provides tax-deferred cash value growth.

❌ High fees and investment risks involved.

Best for: Experienced investors looking for aggressive growth in their life insurance policy.

3. How Life Insurance Can Support Your Retirement Goals

3.1 Using Cash Value as a Retirement Fund

Many permanent life insurance policies allow you to build cash value over time. You can:

- Withdraw money from your policy (subject to policy limits).

- Take a loan against the accumulated cash value, which can serve as a tax-free income source.

- Surrender the policy and receive the cash value if you no longer need coverage.

3.2 Tax Benefits of Life Insurance in Retirement

Life insurance offers several tax advantages:

- Tax-free death benefit for beneficiaries.

- Tax-deferred growth on cash value accumulation.

- Potentially tax-free loans taken against the policy.

3.3 Covering Healthcare & Long-Term Care Expenses

- Some life insurance policies include living benefits or long-term care riders that help cover healthcare costs.

- This ensures you don’t have to dip into your retirement savings to pay for medical expenses.

3.4 Supplementing Social Security & Pension Income

- If your pension or Social Security benefits aren’t enough, cash value withdrawals from life insurance can supplement your income without impacting your retirement savings.

3.5 Estate Planning & Wealth Transfer

- Life insurance can help preserve and transfer wealth to your heirs without heavy tax implications.

- It can also help pay estate taxes, preventing your family from having to sell assets.

4. Strategies to Integrate Life Insurance into Your Retirement Plan

4.1 Buy a Policy Early

- The younger and healthier you are, the lower your premiums will be.

- Buying a policy early allows more time for cash value accumulation.

4.2 Maximize Policy Contributions

- If you have a permanent life insurance policy, contributing more to the cash value portion can provide additional financial flexibility in retirement.

4.3 Use Life Insurance Alongside Other Investments

- Combine life insurance with 401(k), IRA, and Roth IRA plans for a diversified retirement portfolio.

- Consider using indexed or variable life insurance for additional market-linked growth potential.

4.4 Re-Evaluate Your Policy Periodically

- As retirement approaches, adjust your policy to reflect your changing financial needs.

- Consider converting term life to whole life if long-term coverage is needed.

5. Frequently Asked Questions

Q1: Can I Use Life Insurance Instead of a Retirement Plan?

Not entirely. Life insurance should be used as a supplement to traditional retirement savings rather than a replacement.

Q2: How Much Life Insurance Do I Need for Retirement?

It depends on your financial obligations, expected retirement income, and the level of financial security you want for your family.

Q3: What Happens If I Can’t Pay My Premiums in Retirement?

- If you have a cash value policy, you can use accumulated funds to cover premiums.

- Some policies allow premium flexibility, so you can adjust payments if needed.

Q4: Are Life Insurance Loans Taxable?

Loans taken from a cash value policy are not taxed as long as the policy remains active.

Conclusion: Strengthen Your Retirement with Life Insurance

Life insurance isn’t just about providing for your family after your passing—it can also play a vital role in securing your retirement. From supplementing income to covering long-term care and reducing tax liabilities, integrating life insurance into your retirement strategy can offer financial stability and peace of mind.

Final Action Steps:

✅ Assess your retirement needs and financial goals

✅ Choose the right life insurance policy based on your situation

✅ Work with a financial advisor to maximize benefits

✅ Start planning early to take advantage of lower premiums