How to Avoid Common Mistakes While Applying for a Government Pension Scheme

Introduction

Applying for a government pension scheme is a crucial step in securing financial stability post-retirement. However, many applicants make mistakes during the application process, leading to delays, rejections, or reduced benefits. Understanding these common pitfalls and knowing how to avoid them can help ensure a smooth and successful application.

In this blog, we will discuss the most common mistakes people make while applying for a government pension scheme and provide practical tips to avoid them.

1. Not Understanding Eligibility Criteria

One of the biggest mistakes applicants make is not checking the eligibility criteria before applying. Each government pension scheme has specific age, income, and employment requirements.

How to Avoid:

- Carefully read the eligibility criteria mentioned in the scheme’s official guidelines.

- Check for age limits, contribution requirements, and sector-specific eligibility (e.g., private vs. government employees).

- Seek professional guidance if you are unsure about your eligibility.

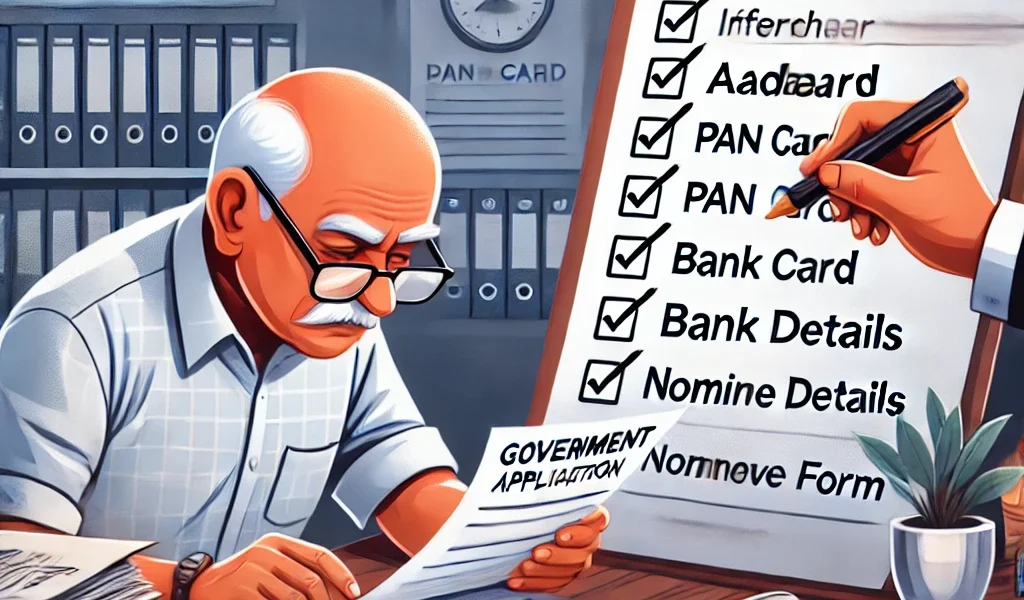

2. Submitting Incomplete or Incorrect Documents

Missing or incorrect documents are among the primary reasons for pension application rejection. Errors in personal details, missing identification proof, or incorrect banking details can delay or deny your pension benefits.

How to Avoid:

- Double-check all required documents before submission.

- Ensure that all personal details (such as name, date of birth, and address) match your official records.

- Keep multiple copies of all important documents.

- Verify your bank details carefully to avoid issues with pension disbursement.

3. Delay in Application Submission

Many individuals wait too long before applying for a pension, resulting in delayed benefits. Some pension schemes require continuous contributions or have deadlines for enrollment.

How to Avoid:

- Start the pension application process well before retirement.

- Keep track of submission deadlines and contribution requirements.

- Consult with a financial planner to ensure timely enrollment.

4. Not Linking Aadhaar and PAN with Pension Account

Government pension schemes often require linking Aadhaar and PAN for verification purposes. Failure to do so can lead to delays or rejection of the application.

How to Avoid:

- Ensure that your Aadhaar and PAN details are correctly linked with your pension account.

- Update your KYC (Know Your Customer) details as per the latest government regulations.

- Regularly check for updates in government policies regarding document linking.

5. Choosing the Wrong Pension Scheme

Many applicants choose a pension scheme without assessing whether it aligns with their retirement goals. Selecting an inappropriate plan may result in insufficient retirement benefits.

How to Avoid:

- Compare different government pension schemes before making a decision.

- Consider factors such as monthly pension amount, withdrawal flexibility, and tax benefits.

- Consult with a financial advisor for personalized recommendations.

6. Ignoring Tax Implications

Pension schemes come with tax benefits and liabilities, which many applicants overlook. Some pension withdrawals are taxable, while others offer exemptions.

How to Avoid:

- Understand the tax implications of your chosen pension scheme.

- Keep track of tax deductions available under relevant sections (such as Section 80CCD for NPS).

- Consult a tax expert to optimize your retirement tax planning.

7. Not Keeping Track of Application Status

Many applicants submit their pension applications and forget to follow up, leading to delays due to unnoticed errors or missing documents.

How to Avoid:

- Regularly check the status of your application through the official government pension portal.

- Follow up with the concerned authorities if there is a delay in processing.

- Maintain a record of all application receipts and communications.

8. Failing to Nominate a Beneficiary

A common mistake is not nominating a beneficiary for the pension scheme. In case of the applicant’s demise, this can lead to legal complications and difficulties in fund transfer.

How to Avoid:

- Ensure that you nominate a beneficiary at the time of application.

- Update the nominee details whenever there is a significant life change (such as marriage or the birth of a child).

- Keep a copy of the nominee form for future reference.

9. Ignoring Periodic Updates and Contribution Monitoring

Many pension schemes require periodic contributions, and missing payments can impact the final pension amount. Additionally, failing to update details like address changes can lead to communication issues.

How to Avoid:

- Regularly check your contribution status and update personal details as needed.

- Sign up for SMS/email alerts to receive updates on your pension scheme.

- Ensure that your contact information is up-to-date in official records.

10. Falling for Pension Scheme Frauds

Scammers often take advantage of individuals unfamiliar with the pension process. Fake agents and fraudulent pension schemes can lead to financial losses.

How to Avoid:

- Only apply through official government websites or authorized centers.

- Verify the credentials of any pension consultant you consult.

- Never share personal or banking details with unknown sources.

Conclusion

Applying for a government pension scheme requires careful planning and attention to detail. By avoiding these common mistakes, you can ensure a smooth application process and secure a financially stable retirement. Always stay updated with the latest government regulations and seek expert advice when needed.

Are you planning to apply for a government pension scheme? Let us know your questions in the comments below!Introduction

Applying for a government pension scheme is a crucial step in securing financial stability post-retirement. However, many applicants make mistakes during the application process, leading to delays, rejections, or reduced benefits. Understanding these common pitfalls and knowing how to avoid them can help ensure a smooth and successful application.

In this blog, we will discuss the most common mistakes people make while applying for a government pension scheme and provide practical tips to avoid them.

1. Not Understanding Eligibility Criteria

One of the biggest mistakes applicants make is not checking the eligibility criteria before applying. Each government pension scheme has specific age, income, and employment requirements.

How to Avoid:

- Carefully read the eligibility criteria mentioned in the scheme’s official guidelines.

- Check for age limits, contribution requirements, and sector-specific eligibility (e.g., private vs. government employees).

- Seek professional guidance if you are unsure about your eligibility.

2. Submitting Incomplete or Incorrect Documents

Missing or incorrect documents are among the primary reasons for pension application rejection. Errors in personal details, missing identification proof, or incorrect banking details can delay or deny your pension benefits.

How to Avoid:

- Double-check all required documents before submission.

- Ensure that all personal details (such as name, date of birth, and address) match your official records.

- Keep multiple copies of all important documents.

- Verify your bank details carefully to avoid issues with pension disbursement.

3. Delay in Application Submission

Many individuals wait too long before applying for a pension, resulting in delayed benefits. Some pension schemes require continuous contributions or have deadlines for enrollment.

How to Avoid:

- Start the pension application process well before retirement.

- Keep track of submission deadlines and contribution requirements.

- Consult with a financial planner to ensure timely enrollment.

4. Not Linking Aadhaar and PAN with Pension Account

Government pension schemes often require linking Aadhaar and PAN for verification purposes. Failure to do so can lead to delays or rejection of the application.

How to Avoid:

- Ensure that your Aadhaar and PAN details are correctly linked with your pension account.

- Update your KYC (Know Your Customer) details as per the latest government regulations.

- Regularly check for updates in government policies regarding document linking.

5. Choosing the Wrong Pension Scheme

Many applicants choose a pension scheme without assessing whether it aligns with their retirement goals. Selecting an inappropriate plan may result in insufficient retirement benefits.

How to Avoid:

- Compare different government pension schemes before making a decision.

- Consider factors such as monthly pension amount, withdrawal flexibility, and tax benefits.

- Consult with a financial advisor for personalized recommendations.

6. Ignoring Tax Implications

Pension schemes come with tax benefits and liabilities, which many applicants overlook. Some pension withdrawals are taxable, while others offer exemptions.

How to Avoid:

- Understand the tax implications of your chosen pension scheme.

- Keep track of tax deductions available under relevant sections (such as Section 80CCD for NPS).

- Consult a tax expert to optimize your retirement tax planning.

7. Not Keeping Track of Application Status

Many applicants submit their pension applications and forget to follow up, leading to delays due to unnoticed errors or missing documents.

How to Avoid:

- Regularly check the status of your application through the official government pension portal.

- Follow up with the concerned authorities if there is a delay in processing.

- Maintain a record of all application receipts and communications.

8. Failing to Nominate a Beneficiary

A common mistake is not nominating a beneficiary for the pension scheme. In case of the applicant’s demise, this can lead to legal complications and difficulties in fund transfer.

How to Avoid:

- Ensure that you nominate a beneficiary at the time of application.

- Update the nominee details whenever there is a significant life change (such as marriage or the birth of a child).

- Keep a copy of the nominee form for future reference.

9. Ignoring Periodic Updates and Contribution Monitoring

Many pension schemes require periodic contributions, and missing payments can impact the final pension amount. Additionally, failing to update details like address changes can lead to communication issues.

How to Avoid:

- Regularly check your contribution status and update personal details as needed.

- Sign up for SMS/email alerts to receive updates on your pension scheme.

- Ensure that your contact information is up-to-date in official records.

10. Falling for Pension Scheme Frauds

Scammers often take advantage of individuals unfamiliar with the pension process. Fake agents and fraudulent pension schemes can lead to financial losses.

How to Avoid:

- Only apply through official government websites or authorized centers.

- Verify the credentials of any pension consultant you consult.

- Never share personal or banking details with unknown sources.

Conclusion

Applying for a government pension scheme requires careful planning and attention to detail. By avoiding these common mistakes, you can ensure a smooth application process and secure a financially stable retirement. Always stay updated with the latest government regulations and seek expert advice when needed.

Are you planning to apply for a government pension scheme? Let us know your questions in the comments below!