When applying for a loan, whether it’s a mortgage, personal loan, or auto loan, your credit report plays a crucial role in determining whether lenders approve your application. Understanding how lenders evaluate your credit report can help you improve your chances of approval and secure better loan terms. This DIY guide breaks down the key factors lenders examine before making a loan decision.

What is a Credit Report?

A credit report is a detailed record of your credit history compiled by credit bureaus such as Experian, Equifax, and TransUnion. It contains information about your borrowing and repayment habits, helping lenders assess your creditworthiness.

Your credit report includes:

- Personal information (name, address, social security number)

- Credit accounts (loans, credit cards, balances, payment history)

- Public records (bankruptcies, liens, judgments)

- Credit inquiries (requests from lenders when you apply for credit)

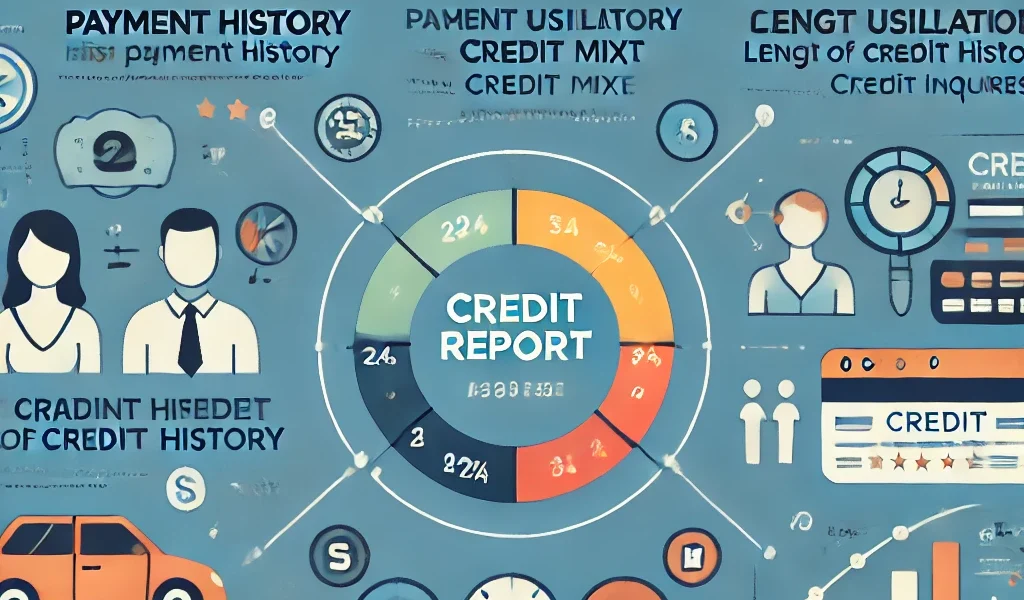

Key Factors Lenders Look for in Your Credit Report

1. Payment History (35% of Credit Score)

Lenders check if you have a history of on-time payments or late/missed payments. A strong payment history improves your chances of loan approval, while late payments, defaults, or collections can hurt your creditworthiness.

✅ Positive Impact: Paying bills on time, no defaults, no collections ❌ Negative Impact: Late payments, charge-offs, accounts in collections

2. Credit Utilization Ratio (30% of Credit Score)

This refers to how much of your available credit you’re using. Lenders prefer a low credit utilization ratio, typically below 30%.

✅ Positive Impact: Keeping credit utilization under 30% ❌ Negative Impact: Maxing out credit cards, carrying high balances

3. Length of Credit History (15% of Credit Score)

The longer your credit history, the better. Lenders prefer borrowers with well-established credit accounts over those with a short history.

✅ Positive Impact: Oldest account age over 5 years, maintaining long-term accounts ❌ Negative Impact: Short credit history, recently opened accounts

4. Credit Mix (10% of Credit Score)

Lenders like to see a diverse mix of credit accounts, such as credit cards, installment loans, and mortgages.

✅ Positive Impact: Having a mix of revolving credit (credit cards) and installment loans (auto loans, mortgages) ❌ Negative Impact: Only one type of credit account, no history of installment loans

5. Recent Credit Inquiries (10% of Credit Score)

Lenders check how many hard inquiries are on your credit report. Too many applications in a short time can signal financial distress.

✅ Positive Impact: Few hard inquiries, spaced-out credit applications ❌ Negative Impact: Multiple loan applications in a short period

How to Improve Your Credit Report Before Applying for a Loan

1. Check Your Credit Report Regularly

Obtain a free credit report from AnnualCreditReport.com and review it for errors or discrepancies. If you find inaccuracies, dispute them with the credit bureau.

2. Pay Your Bills On Time

Set up automatic payments or reminders to ensure you never miss due dates. On-time payments are crucial for maintaining a strong credit history.

3. Reduce Your Credit Utilization

Pay down credit card balances to keep your utilization below 30%. Consider requesting a credit limit increase to lower your utilization percentage.

4. Avoid Opening Too Many New Accounts

Each new credit application triggers a hard inquiry, which can temporarily lower your score. Only apply for new credit when necessary.

5. Maintain Older Credit Accounts

Closing old accounts shortens your credit history, which can negatively impact your score. Keep older accounts open, even if you don’t use them frequently.

6. Diversify Your Credit Mix

If you only have credit cards, consider adding an installment loan (such as a personal or auto loan) to improve your credit mix.

How Lenders Use Your Credit Report to Make Decisions

Lenders analyze your credit report to answer the following questions:

- Is the borrower financially responsible? (Payment history)

- Can they afford additional debt? (Credit utilization)

- Do they have a stable borrowing history? (Length of credit history)

- Have they handled different types of credit responsibly? (Credit mix)

- Are they aggressively seeking new credit? (Recent inquiries)

If you meet these criteria, you are more likely to receive loan approval with favorable interest rates.

Final Thoughts: Take Control of Your Credit Report

Your credit report is a powerful financial tool that can determine your loan eligibility and borrowing costs. By understanding what lenders look for and taking proactive steps to improve your credit report, you can increase your chances of securing loans with better terms.