Introduction

Life insurance is one of the most important financial tools that can provide security and peace of mind for you and your loved ones. However, choosing the right life insurance policy can be overwhelming due to the various options available. The right plan largely depends on your age, financial goals, dependents, and long-term aspirations.

This DIY guide will help you understand which life insurance policy suits you best at different stages of life and how you can make an informed decision without any confusion.

Understanding the Basics of Life Insurance

Before diving into different life stages, let’s first understand the two major types of life insurance policies:

1. Term Life Insurance

- Provides coverage for a specific period (10, 20, or 30 years).

- Pays a death benefit to beneficiaries if the policyholder passes away within the term.

- Lower premium costs compared to permanent insurance.

- No cash value or savings component.

2. Whole Life Insurance (Permanent Life Insurance)

- Provides lifelong coverage.

- Includes a savings component (cash value) that grows over time.

- Premiums are higher but remain consistent throughout the policy.

- Can be used as an investment tool.

Now that you understand the basics, let’s explore which policy suits you best at different life stages.

Choosing the Right Life Insurance Plan for Your Life Stage

1. Young Adults (Ages 20-30) – Starting Your Financial Journey

Why You Need Life Insurance:

- Lower premiums due to young age and good health.

- Protects family from financial burden in case of an unexpected event.

- Some policies allow you to build savings over time.

Best Insurance Option:

- Term Life Insurance: Affordable and provides necessary coverage.

- Whole Life Insurance (if budget allows): Helps in long-term financial planning and savings.

Pro Tips:

- Start early to lock in low premiums.

- Choose a policy with flexible coverage so you can increase it later.

2. Married & Young Parents (Ages 30-40) – Protecting Your Family’s Future

Why You Need Life Insurance:

- Financial protection for spouse and children.

- Helps cover outstanding debts like a mortgage or student loans.

- Ensures children’s education expenses are covered.

Best Insurance Option:

- Term Life Insurance: A 20-30 year term plan is ideal to cover major financial responsibilities.

- Whole Life Insurance: If you want lifelong coverage with an investment component.

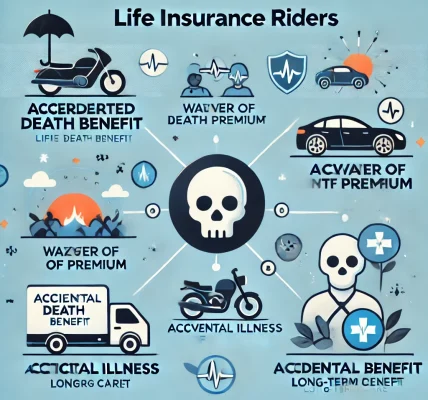

- Riders: Consider adding critical illness or accidental death benefits.

Pro Tips:

- Calculate coverage amount based on future financial needs (10-15 times your annual income).

- Choose a policy that fits within your budget but provides sufficient coverage.

3. Mid-Life & Established Families (Ages 40-50) – Securing Long-Term Stability

Why You Need Life Insurance:

- Higher financial responsibilities (mortgages, kids’ education, medical expenses).

- Need for estate planning and wealth preservation.

- Some employers provide insurance, but it may not be enough.

Best Insurance Option:

- Whole Life Insurance: Helps with estate planning and lifelong coverage.

- Universal Life Insurance: A flexible option with investment growth.

- Term Life Insurance (if not yet secured): A 10-20 year plan to cover immediate financial obligations.

Pro Tips:

- If you already have term insurance, consider converting it to a permanent policy.

- Ensure your policy covers any existing loans and liabilities.

4. Nearing Retirement (Ages 50-60) – Preparing for Legacy & Healthcare

Why You Need Life Insurance:

- Covers medical expenses and funeral costs.

- Helps in estate planning and leaving a financial legacy.

- May be necessary if you still have dependents.

Best Insurance Option:

- Whole Life or Universal Life Insurance: Provides lifelong coverage with cash value benefits.

- Final Expense Insurance: Covers end-of-life costs like funeral expenses.

Pro Tips:

- Focus on policies that offer long-term care benefits.

- Avoid expensive policies if financial dependents are minimal.

5. Post-Retirement (Ages 60+) – Ensuring Financial Peace

Why You Need Life Insurance:

- Helps with wealth transfer and legacy planning.

- Covers final expenses and medical bills.

- Can be used for charitable contributions.

Best Insurance Option:

- Guaranteed Universal Life Insurance: Offers coverage without high premiums.

- Final Expense Insurance: Specifically designed to cover end-of-life costs.

Pro Tips:

- Reevaluate existing policies to ensure they meet your current needs.

- Consider using life insurance for tax-efficient wealth transfer.

DIY Guide: How to Choose the Best Policy

Now that you know which insurance plan fits your life stage, here’s a step-by-step guide to help you make the best choice:

Step 1: Assess Your Needs

- Calculate your financial obligations (loans, dependents, future expenses).

- Determine the duration of coverage required.

Step 2: Compare Different Policies

- Get quotes from multiple insurance providers.

- Understand the policy terms, conditions, and exclusions.

Step 3: Consider Additional Benefits

- Look for riders (critical illness, disability, waiver of premium, etc.).

- Choose policies with flexible premium payment options.

Step 4: Check the Insurance Provider’s Reputation

- Research the insurer’s financial stability and claim settlement ratio.

- Read customer reviews and expert opinions.

Step 5: Consult a Financial Advisor (Optional)

- If confused, seek professional guidance to select the best plan.

Conclusion

Life insurance is a crucial financial tool that evolves as your life progresses. Whether you are just starting out, raising a family, or planning your legacy, the right policy ensures financial security for your loved ones.

Take charge today—assess your needs, compare policies, and make an informed decision. By choosing the right life insurance plan, you are not only protecting your family but also securing your financial future.

Need Help?

If you have any questions or need personalized advice, reach out to a licensed insurance expert to explore the best options available.

SEO Keywords Used: life insurance plans, best life insurance, term vs whole life insurance, financial planning, life insurance guide, family insurance, retirement insurance, estate planning.