Introduction

Choosing the right loan policy is crucial for ensuring financial stability and achieving your personal or business goals. With multiple options available, selecting the best loan policy can be overwhelming. This guide will help you understand key factors to consider when choosing the right loan policy tailored to your needs.

Understanding Loan Policies

Loan policies vary depending on the lender and the type of loan. They outline the terms, interest rates, repayment schedules, and borrower eligibility criteria. Before selecting a loan policy, it’s important to analyze these factors carefully to avoid financial strain.

Key Factors to Consider When Choosing a Loan Policy

1. Determine Your Financial Needs

- Assess why you need the loan (personal, business, education, or investment).

- Calculate the exact loan amount required to avoid unnecessary debt.

2. Compare Interest Rates

- Interest rates significantly impact the total loan cost.

- Choose between fixed interest rates (stable payments) and variable interest rates (fluctuating payments based on market conditions).

3. Check Loan Tenure

- Short-term loans have higher EMIs but lower overall interest payments.

- Long-term loans offer lower EMIs but increase total interest paid over time.

4. Understand Repayment Terms

- Look for flexible repayment options that match your financial capacity.

- Check if prepayment or foreclosure charges apply.

5. Evaluate Additional Fees and Charges

- Processing fees, late payment charges, and hidden costs can add to the loan burden.

- Read the fine print to avoid unexpected expenses.

6. Review Eligibility Criteria

- Lenders consider factors such as credit score, income stability, employment status, and existing debts.

- A good credit score can help you secure loans at lower interest rates.

7. Assess the Credibility of the Lender

- Choose a reputable financial institution or investment platform.

- Read customer reviews and ratings to ensure transparency and reliability.

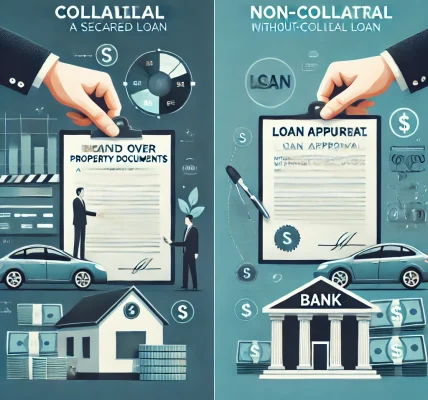

Types of Loan Policies

- Personal Loans – Ideal for personal expenses with flexible usage.

- Home Loans – Designed for property purchases, usually with longer repayment tenures.

- Business Loans – Offered to entrepreneurs for business expansion.

- Auto Loans – Specifically for vehicle purchases.

- Education Loans – Tailored for financing higher education.

- Investment Loans – Used for investing in assets like real estate or stocks.

Tips for Choosing the Best Loan Policy

- Use online loan comparison tools to evaluate different policies.

- Consult a financial advisor if needed.

- Always negotiate terms with lenders for better interest rates and flexible repayment plans.

Conclusion

Selecting the right loan policy requires careful consideration of multiple factors, including interest rates, repayment terms, tenure, and additional costs. By thoroughly analyzing your financial needs and lender policies, you can make an informed decision that aligns with your long-term financial goals.