Retirement planning is one of the most critical financial decisions in life. Choosing the right pension scheme can ensure financial security, a stable income, and a stress-free retirement. With various government-backed pension schemes available in India, it is essential to evaluate and compare different options before making an informed decision.

In this comprehensive guide, we will help you understand the factors to consider while selecting a pension scheme and explore different government pension options suited for your retirement needs.

Why is Choosing the Right Pension Scheme Important?

Selecting an appropriate pension scheme helps in:

- Ensuring a steady income after retirement.

- Covering medical and living expenses without financial stress.

- Maximizing tax benefits while planning your investments.

- Providing long-term security for you and your dependents.

A well-planned pension scheme safeguards against inflation and helps maintain your standard of living post-retirement.

Key Factors to Consider Before Choosing a Pension Scheme

1. Eligibility Criteria

Each government pension scheme has specific eligibility requirements based on factors such as age, employment type, income level, and contributions. Before selecting a scheme, check if you meet the eligibility criteria.

2. Investment Tenure and Contribution Amount

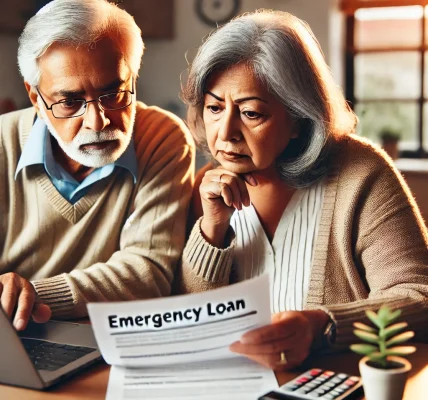

Some pension schemes require long-term contributions, while others offer flexibility in deposits. Choose a plan that aligns with your financial capacity and retirement goals.

3. Pension Benefits and Withdrawal Flexibility

Compare the pension payout options, withdrawal rules, and the financial support provided to beneficiaries. Some schemes offer monthly payouts, while others provide a lump sum upon retirement.

4. Tax Benefits

Government pension schemes offer tax exemptions under Section 80C, 80CCD(1), and 80CCD(1B) of the Income Tax Act. Understanding these benefits can help in reducing taxable income and maximizing savings.

5. Government vs. Private Pension Plans

While government schemes offer safety and stability, private pension plans may provide higher returns but with market-linked risks. Compare these options based on security, returns, and flexibility.

6. Inflation Protection and Growth

A pension scheme must keep pace with inflation to ensure adequate financial support in the future. Market-linked schemes like NPS provide better growth potential.

Best Government Pension Schemes in India for Retirement

1. National Pension System (NPS)

Overview:

The NPS is a voluntary retirement savings scheme managed by the Pension Fund Regulatory and Development Authority (PFRDA). It provides market-linked returns, making it a good option for long-term wealth accumulation.

Key Features:

- Open to individuals aged 18 to 70 years.

- Flexible contributions with Tier-I (mandatory) and Tier-II (optional) accounts.

- Partial withdrawal allowed for emergencies.

- Pension fund selection between Equity, Corporate Bonds, and Government Securities.

- Tax benefits:

- Up to Rs. 1.5 lakh deduction under Section 80CCD(1).

- Additional Rs. 50,000 deduction under Section 80CCD(1B).

Best For:

- Individuals looking for higher returns with moderate risk.

- Salaried employees, self-employed professionals, and investors planning early retirement.

2. Pradhan Mantri Vaya Vandana Yojana (PMVVY)

Overview:

The PMVVY is a government-backed pension scheme exclusively for senior citizens (60 years and above), offering assured returns.

Key Features:

- Investment limit: Rs. 15 lakhs per senior citizen.

- Tenure: 10 years.

- Guaranteed return of 7.4% per annum.

- Monthly, quarterly, half-yearly, or annual pension payouts.

- Tax benefits and no GST applicable.

Best For:

- Retirees seeking guaranteed fixed income.

- Senior citizens looking for low-risk investment options.

3. Atal Pension Yojana (APY)

Overview:

The APY is a social security pension scheme primarily for individuals in the unorganized sector.

Key Features:

- Entry age: 18 to 40 years.

- Fixed pension: Rs. 1,000 to Rs. 5,000 per month.

- Government co-contributes for eligible subscribers.

- Tax benefits under Section 80CCD(1).

Best For:

- Low-income individuals planning for basic retirement security.

- Workers in unorganized sectors.

4. Employees’ Pension Scheme (EPS)

Overview:

The EPS is for employees covered under the Employees’ Provident Fund (EPF), ensuring post-retirement financial stability.

Key Features:

- Minimum pension: Rs. 1,000 per month.

- No separate contributions required (part of EPF contributions).

- Pension payable after 10 years of service.

- Family pension benefits for spouse and children.

Best For:

- Salaried employees enrolled in the EPF scheme.

5. Senior Citizens’ Savings Scheme (SCSS)

Overview:

The SCSS is a fixed-income retirement scheme backed by the Government of India, ideal for senior citizens looking for safe investment options.

Key Features:

- Minimum deposit: Rs. 1,000.

- Maximum deposit: Rs. 30 lakhs.

- Interest rate: ~8% (subject to change quarterly).

- Tenure: 5 years (extendable by 3 years).

- Tax benefits under Section 80C.

Best For:

- Retirees seeking fixed and secure returns.

How to Enroll in a Government Pension Scheme?

- Select the scheme that aligns with your retirement goals.

- Visit a bank, post office, or the official online portal for enrollment.

- Provide required documents such as:

- Aadhaar card

- PAN card

- Age proof

- Bank account details

- Complete the application process and start contributing.

Conclusion

Choosing the right pension scheme is a crucial step in securing financial independence post-retirement. Before investing, assess eligibility, contribution amount, tax benefits, risk factors, and pension payout flexibility. Government-backed options like NPS, PMVVY, SCSS, and EPS offer stable returns, security, and tax-saving benefits.

Plan early, invest wisely, and ensure a comfortable retirement lifestyle.