Understanding Emergency Health Insurance Claims

Medical emergencies are unpredictable, and having health insurance that covers emergency treatments and ambulance charges is crucial. However, filing claims for such expenses requires proper documentation and adherence to the insurer’s guidelines.

What Expenses Are Covered?

- Emergency Room (ER) Charges: Covers doctor consultations, diagnostic tests, and treatment expenses.

- Ambulance Charges: Includes transportation to the nearest hospital in case of an emergency.

- ICU & Critical Care: If hospitalization is required, insurance policies may cover intensive care expenses.

- Surgical & Procedural Costs: Emergency surgeries and life-saving procedures are generally included.

Step-by-Step Guide to Claiming Emergency Treatment & Ambulance Charges

Step 1: Inform Your Insurance Provider

Contact your insurer immediately or within the stipulated timeframe to notify them about the emergency hospitalization.

Step 2: Keep Essential Documents Ready

Ensure you have:

- Hospital bills and discharge summary

- Ambulance bill and receipt

- Doctor’s prescription and emergency admission reports

- Health insurance policy details

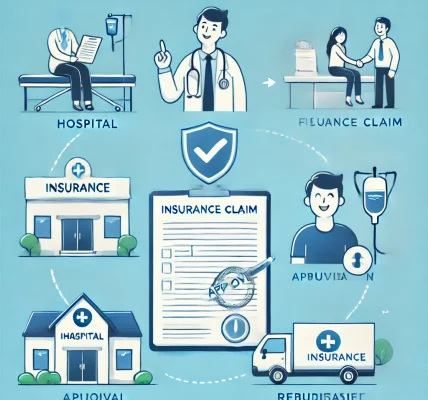

Step 3: Choose Between Cashless or Reimbursement Claim

Cashless Claim: If admitted to a network hospital, your insurer will directly settle the bill.

Reimbursement Claim: For non-network hospitals, pay the bill first and submit claims later.

Common Reasons for Claim Rejections & How to Avoid Them

- Incomplete Documentation: Ensure all necessary documents are submitted.

- Policy Exclusions: Check if ambulance or emergency treatments are covered.

- Delayed Notification: Inform the insurer promptly about the emergency admission.

Conclusion

Claiming insurance for emergency treatments and ambulance charges is a straightforward process if done correctly. Always review your policy, keep documents ready, and follow your insurer’s guidelines for a hassle-free claim experience.