Your credit report plays a crucial role in your financial health, influencing your ability to get loans, credit cards, and even housing or employment opportunities. However, errors on your credit report can negatively impact your credit score, potentially leading to higher interest rates or denied applications. Fortunately, you have the right to dispute inaccurate information and improve your credit score. In this guide, we’ll walk you through the steps to dispute errors effectively and maintain a strong credit profile.

Understanding Credit Report Errors

Credit report errors can occur for various reasons, such as clerical mistakes, identity theft, or outdated information. Common errors include:

- Incorrect Personal Information: Misspelled names, wrong addresses, or incorrect Social Security numbers.

- Accounts That Don’t Belong to You: A result of identity theft or mixed credit files.

- Incorrect Account Status: Accounts reported as late or delinquent when they were paid on time.

- Duplicate Accounts: The same debt appearing multiple times.

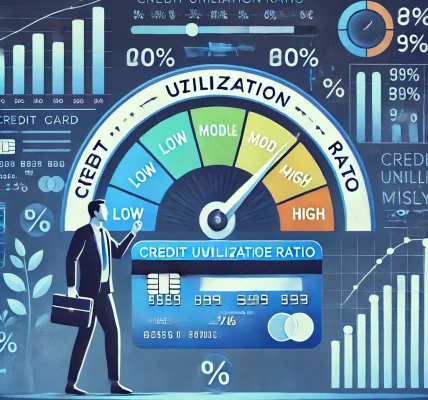

- Incorrect Balance or Credit Limit: Reporting errors that affect your credit utilization ratio.

- Old Debts Still on Your Report: Negative items that should have been removed after the reporting time limit (usually seven years for most negative marks).

Step 1: Obtain Your Credit Reports

Before disputing errors, you need to review your credit reports from the three major credit bureaus: Experian, Equifax, and TransUnion.

You can get a free copy of your credit report from each bureau once a year at AnnualCreditReport.com. Due to recent changes, you may now be eligible for free weekly reports.

Step 2: Identify Errors and Gather Supporting Evidence

Once you have your credit reports, carefully examine each section and highlight any incorrect information. Gather documentation to support your dispute, such as:

- Bank statements or payment confirmations.

- Loan agreements or account statements.

- Correspondence with lenders or credit card companies.

- Identity verification documents if needed.

Step 3: Dispute Errors with the Credit Bureaus

You can dispute errors directly with each credit bureau online, by phone, or via mail. Below are their contact details:

Online Dispute Portals:

- Experian: Dispute online

- Equifax: Dispute online

- TransUnion: Dispute online

Mailing Addresses for Disputes:

- Experian: P.O. Box 4500, Allen, TX 75013

- Equifax: P.O. Box 740256, Atlanta, GA 30374-0256

- TransUnion: P.O. Box 2000, Chester, PA 19016

How to Write a Credit Dispute Letter

Your dispute letter should include:

- Your full name, address, and contact information.

- A clear description of the error (e.g., incorrect late payment on a specific account).

- Supporting documents proving the error.

- A request for correction or removal.

Example Dispute Letter:

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Your Email]

[Date]

Credit Bureau Name

[Mailing Address]

[City, State, ZIP Code]

Subject: Credit Report Dispute – Incorrect Information

Dear [Credit Bureau Name],

I am writing to dispute an error on my credit report. The following item is incorrect and needs to be corrected:

- **Creditor Name:** [Lender Name]

- **Account Number:** [Account Number]

- **Error:** [Explain the mistake, e.g., "This account is marked as late, but I made the payment on time."]

- **Supporting Documents:** [List enclosed copies of statements, payment records, etc.]

I request that you investigate this matter and correct the error. Please provide a written confirmation of your findings. Thank you for your prompt attention to this matter.

Sincerely,

[Your Name] Step 4: Contact the Creditor Directly

In addition to disputing with credit bureaus, consider reaching out to the creditor (bank, lender, or credit card company) that reported the incorrect information. Most creditors have a dispute resolution department that can help rectify errors faster.

Step 5: Wait for Investigation and Follow Up

Credit bureaus typically have 30 days to investigate and respond to your dispute. If the error is corrected, you’ll receive an updated credit report. If the dispute is denied, you have the right to:

- Request an explanation of the decision.

- Provide additional evidence.

- File a complaint with the Consumer Financial Protection Bureau (CFPB) if the error remains unresolved (Submit a complaint).

Step 6: Monitor Your Credit Regularly

After disputing errors, continue to monitor your credit score and reports regularly to ensure no new inaccuracies appear. Consider using:

- Credit monitoring services (e.g., Credit Karma, Experian, TransUnion).

- Alerts from your bank or credit card issuer to track credit changes.

How Disputing Errors Can Improve Your Credit Score

Correcting inaccuracies on your credit report can lead to an immediate boost in your credit score, especially if errors involved late payments, high balances, or collections. A better credit score can help you:

- Qualify for loans with lower interest rates.

- Get approved for credit cards and rental applications.

- Improve your financial stability and purchasing power.

Final Thoughts

Disputing errors on your credit report is your right under the Fair Credit Reporting Act (FCRA). By following the steps outlined above, you can correct inaccuracies, protect your credit score, and improve your financial well-being. Always review your credit reports, act quickly on errors, and maintain good credit habits for a healthier financial future.

By taking these proactive steps, you can ensure your credit report accurately reflects your financial responsibility and opens doors to better financial opportunities.