If you have no credit history, getting your first credit card can feel like a challenge. However, there are several ways to secure a credit card even without prior credit experience. Establishing credit is an essential step toward financial independence, as it helps with future loans, mortgages, and even job applications.

In this comprehensive guide, we’ll cover everything you need to know about obtaining a credit card with no credit history, the best options available, and strategies for responsible credit building.

Why Is Credit History Important?

Credit history is a record of how you’ve managed credit in the past. Lenders, banks, and credit card issuers use this information to determine your ability to repay borrowed money. A good credit history opens doors to better financial opportunities, such as lower interest rates and higher credit limits.

If you have no credit history, lenders cannot assess your risk level, making it difficult to get approved for traditional credit cards. Fortunately, there are specific credit cards and strategies designed for beginners.

Best Credit Card Options for Those with No Credit History

If you are new to credit, consider the following types of credit cards designed for beginners:

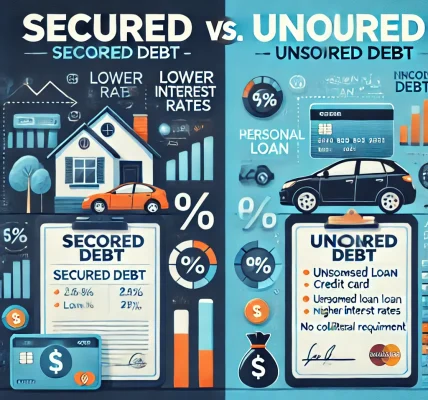

1. Secured Credit Cards

A secured credit card requires a refundable security deposit, which acts as collateral. The deposit usually determines your credit limit (e.g., a $500 deposit provides a $500 credit limit).

Pros:

- Easier approval process

- Helps build credit with responsible usage

- Security deposit is refundable after upgrading or closing the account in good standing

Cons:

- Requires an upfront deposit

- Some cards have high fees

- Lower credit limits than unsecured cards

2. Student Credit Cards

If you’re a college student, student credit cards are designed specifically for individuals with little to no credit history. These cards often come with lower credit limits and benefits like cashback rewards on everyday spending.

Pros:

- No security deposit required

- Special rewards for students

- Helps build credit at a young age

Cons:

- May require proof of student status

- Lower credit limits than traditional credit cards

3. Credit Builder Loans with Credit Card Option

Some financial institutions offer credit-builder loans, which allow you to borrow a small amount and make monthly payments to build credit. Once you establish a payment history, you may be eligible for an unsecured credit card.

Pros:

- Builds both credit and savings

- No prior credit history required

- Helps improve your financial profile over time

Cons:

- Takes time to establish a credit profile

- Funds may not be immediately available for use

4. Retail Store Credit Cards

Retail or store credit cards are often easier to get approved for than traditional credit cards. These cards can only be used at specific stores but help build credit if used responsibly.

Pros:

- Easier approval for those with no credit

- Helps establish a credit history

- May offer discounts and rewards

Cons:

- High-interest rates

- Can only be used at specific retailers

- Low credit limits

5. Become an Authorized User

If a family member or close friend has good credit, they can add you as an authorized user on their credit card. This allows you to benefit from their positive payment history without needing your own credit history.

Pros:

- No credit check required

- Helps build credit fast

- No responsibility for payments (depending on the agreement with the primary cardholder)

Cons:

- Your credit is tied to the primary account holder’s behavior

- Not all credit card issuers report authorized users to credit bureaus

How to Apply for a Credit Card with No Credit History

Follow these steps to increase your chances of approval when applying for your first credit card:

1. Check Your Eligibility

Before applying, research the eligibility requirements for different credit cards. Some issuers cater specifically to beginners with no credit history.

2. Start with a Secured or Student Credit Card

If you don’t qualify for a traditional credit card, apply for a secured or student credit card to begin your credit journey.

3. Provide Proof of Income

Card issuers want to ensure that you have the means to make payments. Be ready to provide proof of income, such as pay stubs, tax returns, or financial aid details if you’re a student.

4. Consider a Co-Signer

If you’re struggling to get approved, a co-signer with good credit can help. A co-signer agrees to take responsibility for your credit card debt if you fail to make payments.

5. Limit Applications

Applying for multiple credit cards at once can harm your credit profile. Instead, research the best option for you and apply strategically.

How to Use Your First Credit Card Responsibly

Once you receive your first credit card, using it responsibly is crucial to building a strong credit history.

1. Make On-Time Payments

Payment history accounts for 35% of your credit score. Always pay at least the minimum due amount on time to avoid late fees and negative marks on your credit report.

2. Keep Your Credit Utilization Low

Credit utilization refers to the percentage of your credit limit that you’re using. Experts recommend keeping your utilization below 30% (ideally under 10%) to maintain a healthy credit score.

3. Avoid Carrying a Balance

Carrying a balance from month to month can lead to high-interest charges. Aim to pay your balance in full whenever possible.

4. Monitor Your Credit Score and Report

Use free services like Credit Karma, Experian, or your bank’s credit monitoring tools to keep track of your credit score and report.

5. Be Mindful of Fees and Interest Rates

Understand the terms and conditions of your card, including annual fees, late payment penalties, and APR (Annual Percentage Rate).

6. Upgrade to an Unsecured Credit Card

After 6-12 months of responsible usage, you may qualify for an unsecured credit card with better rewards and benefits. Contact your card issuer to request an upgrade.

Final Thoughts

Getting a credit card with no credit history is possible if you choose the right approach. Whether you opt for a secured card, student card, or become an authorized user, these options can help you establish and grow your credit profile.

By making on-time payments, maintaining a low credit utilization rate, and monitoring your credit score, you’ll be on the right track to building a solid financial foundation for the future.