Introduction:

Managing debt can be a daunting task, especially when trying to maintain a healthy credit score. Debt accumulation is common, but handling it efficiently without jeopardizing your credit rating is crucial. Whether you’re dealing with credit card debt, loans, or other financial obligations, understanding the balance between repaying debt and safeguarding your credit score is essential for your long-term financial health.

1. Understanding Your Credit Score and Debt Relationship

Before diving into strategies, it’s important to understand what a credit score is and how it relates to your debt management.

- What is a Credit Score? A credit score is a three-digit number ranging from 300 to 850, reflecting your creditworthiness. It’s calculated based on your credit history, including payment history, credit utilization, length of credit history, types of credit used, and recent credit inquiries. The higher your score, the better your financial reputation is.

- How Debt Affects Your Credit Score Debt can affect your credit score in various ways:

- Credit Utilization Ratio: This is the ratio of your credit card balances to your credit limits. High balances relative to your credit limit can negatively impact your score.

- Payment History: Missing payments or making late payments can severely damage your credit score.

- Debt-to-Income Ratio: A high debt-to-income ratio can signal financial strain, affecting both your credit score and future borrowing ability.

2. Create a Budget and Track Expenses

Effective debt management starts with a clear understanding of your finances. Creating a budget will help you track your expenses, allocate funds for debt repayment, and avoid overspending.

- Steps to Create a Budget:

- List Your Income Sources: Calculate your total monthly income, including salary, business income, and passive income.

- Categorize Your Expenses: List fixed expenses (rent, utilities, loan repayments) and variable expenses (entertainment, food, etc.).

- Identify Areas to Cut Back: Look for non-essential expenses you can reduce or eliminate to free up more funds for debt repayment.

- Set Realistic Debt Repayment Goals: Determine how much you can realistically allocate each month towards paying down debt while maintaining your lifestyle.

3. Prioritize High-Interest Debts

One of the most effective strategies to manage debt without harming your credit score is to prioritize paying off high-interest debts, particularly credit card debt.

- Why Prioritize High-Interest Debt?

- Interest Costs: High-interest debts accumulate faster, making it harder to pay off the principal. By tackling these first, you reduce the overall interest burden, freeing up more funds for other debts.

- Impact on Credit Utilization: Reducing high-interest debt also helps improve your credit utilization ratio, which can have a positive impact on your credit score.

4. Make Timely Payments

The most important factor affecting your credit score is your payment history. Late or missed payments can hurt your credit score significantly.

- Set Up Automated Payments: Automating your bill payments ensures you never miss a payment deadline.

- Use Alerts and Reminders: Set up payment reminders for upcoming due dates, and consider using your bank’s mobile app or third-party services for alerts.

- Pay More Than the Minimum: If possible, always try to pay more than the minimum payment required. This helps reduce your debt faster and improves your credit score over time.

5. Use a Debt Snowball or Debt Avalanche Method

Two popular methods for managing debt are the debt snowball and debt avalanche methods. Both are effective, but their approaches differ slightly.

- Debt Snowball Method:

- Focus on paying off your smallest debt first, while making minimum payments on other debts.

- Once the smallest debt is paid off, move on to the next smallest debt.

- This method can give you a psychological boost as you achieve small wins, which can be motivating.

- Debt Avalanche Method:

- Focus on paying off the debt with the highest interest rate first.

- After clearing that, move to the next highest interest rate debt.

- This method saves you more money on interest in the long run but may take longer to see small victories.

6. Consider Debt Consolidation or Refinancing

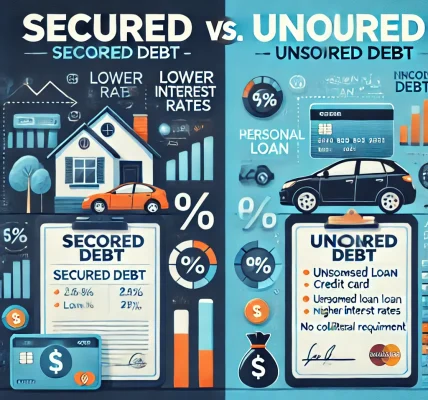

If you’re juggling multiple debts, consolidating them into one monthly payment could make it easier to manage. Debt consolidation and refinancing options can also help reduce interest rates and streamline payments.

- Debt Consolidation Loans: These loans allow you to combine all your debts into one with a fixed monthly payment. Ensure that the new loan offers a lower interest rate than your current debts to save on interest.

- Refinancing: If you have a mortgage or personal loan, refinancing could help you reduce your interest rate or extend the repayment term, which could lower your monthly payments and make managing debt easier.

7. Avoid Taking on New Debt

While you’re working on paying down existing debt, it’s crucial to avoid accumulating more debt. New debts will increase your credit utilization ratio and can hinder your ability to improve your credit score.

- Cut Back on Credit Card Usage: If possible, avoid using credit cards until you’ve paid off the existing balances.

- Avoid Unnecessary Loans: Only take on new loans if they’re absolutely necessary, and be sure you can afford the payments.

8. Build an Emergency Fund

Having an emergency fund is crucial for managing unexpected expenses without resorting to new debt. This fund can serve as a buffer when life’s surprises arise, preventing you from relying on credit cards or loans.

- Start Small: Aim to save at least $500–$1,000 as a starter emergency fund. Gradually build it up to cover three to six months of living expenses.

- Separate Account: Keep your emergency fund in a separate savings account to avoid the temptation of using it for non-emergencies.

9. Seek Professional Help When Needed

If your debt becomes unmanageable or you find yourself struggling to make progress, it might be time to seek help from a financial advisor or a credit counseling service.

- Debt Counseling Services: These nonprofit organizations provide financial education and can assist you in creating a debt management plan.

- Debt Settlement: In extreme cases, debt settlement may be an option, but be cautious as it can affect your credit score and should only be pursued with professional advice.

10. Regularly Monitor Your Credit Report

Regularly checking your credit report helps you stay informed about your credit status and ensures there are no errors or fraudulent activities affecting your score.

- Get Free Reports: You can request a free copy of your credit report annually from all three major credit bureaus: Equifax, Experian, and TransUnion.

- Dispute Errors: If you notice any inaccuracies, dispute them with the credit bureaus to ensure your credit report reflects the correct information.

Conclusion:

Managing debt without negatively impacting your credit score requires a disciplined approach, a clear understanding of your finances, and effective strategies for repayment. By prioritizing high-interest debts, making timely payments, and avoiding new debt, you can regain control over your financial future and protect your credit score for years to come. With patience, consistency, and the right tools, you can successfully manage your debt while keeping your credit score intact.