Introduction

Pension funds are a crucial financial asset for retirees, ensuring a steady income during post-retirement years. However, there are situations where individuals may need to transfer their pension funds due to a job change, relocation, or switch between pension schemes. Similarly, some may require withdrawals in emergencies or at the time of retirement.

This guide will provide step-by-step instructions on how to transfer or withdraw pension funds seamlessly while ensuring compliance with government regulations and avoiding unnecessary legal complications.

Understanding Pension Transfers and Withdrawals

Before diving into the process, let’s understand the two primary actions:

- Pension Transfer: Moving pension funds from one account to another, often due to a job change or shift between pension schemes.

- Pension Withdrawal: Taking out pension savings either after reaching the eligible age or under specific conditions like medical emergencies.

Each pension scheme has its own rules for transfers and withdrawals, making it essential to be well-informed before proceeding.

How to Transfer Your Pension Funds

If you are switching jobs, moving from one pension scheme to another, or changing from a government to a private pension plan, you may need to transfer your pension funds. Here’s how you can do it efficiently:

Step 1: Check Transfer Eligibility

- Ensure that both your existing and new pension schemes allow fund transfers.

- Some government-backed pension schemes, such as the National Pension System (NPS), allow inter-sector transfers.

- Certain schemes may have a minimum lock-in period before a transfer is permitted.

Step 2: Gather Required Documents

To initiate a transfer, you typically need:

- Pension account details (current and new provider)

- Identity proof (Aadhaar card, PAN card, etc.)

- Address proof

- Employment proof (if applicable)

- Pension scheme details

Step 3: Apply for Transfer

- Visit your current pension provider’s office or website.

- Fill out the pension transfer request form.

- Submit necessary documents and request a transfer certificate (if applicable).

Step 4: Coordinate with the New Provider

- Contact your new pension provider and inform them about the incoming transfer.

- Submit the transfer certificate and required documents.

- Ensure that the new provider acknowledges the transfer request.

Step 5: Track the Transfer Status

- Keep track of the status through your pension provider’s portal or customer service.

- Pension transfers can take 30-90 days depending on the provider and scheme.

Important Tips for Hassle-Free Transfers

✅ Ensure that both providers accept pension transfers before initiating the process. ✅ Keep copies of all submitted documents for future reference. ✅ Check if any transfer fees or penalties apply to your pension scheme.

How to Withdraw Your Pension Funds

Pension withdrawals can be categorized into two types:

- Full withdrawal: When you reach retirement age or under exceptional circumstances.

- Partial withdrawal: For specific needs such as medical emergencies, higher education, or home purchase.

Step 1: Verify Withdrawal Conditions

- Most pension schemes allow full withdrawals at the age of 60 or upon retirement.

- Some schemes allow partial withdrawals after a certain period for specific purposes.

- Tax implications vary based on the type of pension plan.

Step 2: Collect Necessary Documents

To process a withdrawal, you will need:

- Pension account details

- Identity proof

- Bank account details

- Retirement proof (if applicable)

- Medical or other supporting documents (for partial withdrawal)

Step 3: Submit the Withdrawal Request

- Visit the official pension scheme portal or service center.

- Fill out the withdrawal request form.

- Attach necessary documents and submit the application.

Step 4: Monitor the Payment Process

- Pension withdrawals are generally processed within 7-30 working days.

- Amount is directly credited to your registered bank account.

Step 5: Understand Tax Implications

- Government pension schemes like Atal Pension Yojana (APY) or Employees’ Provident Fund (EPF) may have tax benefits.

- Withdrawals from private pension plans may attract income tax based on applicable slabs.

- Consult a tax advisor to understand tax liabilities on your withdrawal amount.

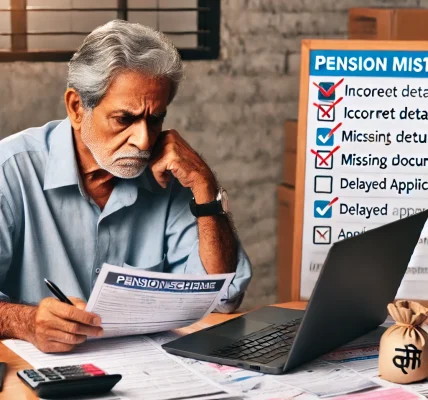

Common Reasons for Pension Withdrawal Denial

❌ Incomplete documentation. ❌ Withdrawal before the eligible age. ❌ Scheme-specific restrictions on premature withdrawals.

Comparison of Pension Transfer & Withdrawal Rules in Popular Schemes

| Pension Scheme | Transfer Allowed? | Partial Withdrawal? | Full Withdrawal Age |

|---|---|---|---|

| Atal Pension Yojana (APY) | ❌ No | ❌ No | 60 years |

| Employees’ Provident Fund (EPF) | ✅ Yes | ✅ Yes (Medical, Home, Education) | 58 years |

| National Pension System (NPS) | ✅ Yes | ✅ Yes (Medical, Higher Education) | 60 years |

| Public Provident Fund (PPF) | ❌ No | ✅ Yes (After 5 years) | 15 years maturity |

Conclusion

Transferring or withdrawing pension funds requires careful planning to ensure compliance with government regulations and avoid financial penalties. Understanding the rules of your pension scheme, preparing the necessary documents, and following the step-by-step process can make the transition smooth and hassle-free.

✅ For transfers, always check the eligibility and ensure both providers accept transfers. ✅ For withdrawals, verify the terms and tax implications to maximize your benefits.

By staying informed and proactive, you can secure your financial future while making the most of your pension funds