Managing debt can be overwhelming, but one strategic way to take control is by using a balance transfer credit card. This financial tool allows you to consolidate high-interest debt onto a new credit card with a lower or 0% introductory APR, helping you save money and pay off your debt faster. In this comprehensive guide, we will explore how balance transfer credit cards work, their benefits, potential risks, and the best strategies for maximizing their effectiveness.

What Is a Balance Transfer Credit Card?

A balance transfer credit card is a type of credit card that allows you to transfer existing credit card debt from one or multiple high-interest accounts to a new card with a lower or 0% introductory interest rate. These cards often come with a promotional period (usually 6 to 24 months) during which no interest is charged on the transferred balance.

How It Works:

- Apply for a Balance Transfer Card – Choose a credit card with a 0% or low-interest introductory offer and favorable terms.

- Transfer Your Debt – Move your high-interest debt to the new card, often for a balance transfer fee (typically 3%–5% of the transferred amount).

- Make Monthly Payments – Pay off the transferred balance before the introductory period ends to avoid high interest rates.

- Save on Interest – Without interest accruing, more of your payment goes toward reducing the principal debt.

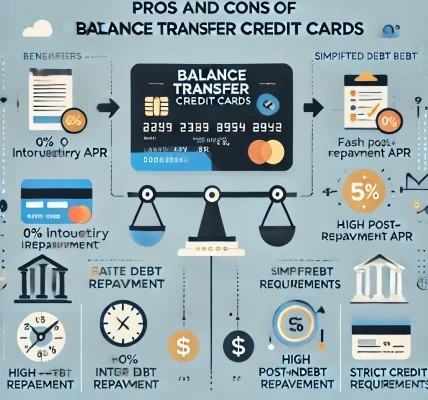

Benefits of Using a Balance Transfer Credit Card

1. Lower Interest Rates

The primary advantage of a balance transfer credit card is the ability to avoid high-interest rates, making it easier to pay down debt faster.

2. Debt Consolidation

Instead of managing multiple credit card payments, you can consolidate your debt into a single account, simplifying your financial management.

3. Faster Debt Repayment

With little or no interest accumulating, you can focus on paying off the principal amount, reducing your debt burden significantly.

4. Improved Credit Score

Reducing credit utilization and making timely payments can positively impact your credit score over time.

Risks and Considerations

While balance transfer credit cards can be highly beneficial, there are some risks to be aware of:

1. Balance Transfer Fees

Most credit cards charge a balance transfer fee of 3% to 5% of the transferred amount. This cost should be factored into your decision.

2. Limited Introductory Period

After the promotional period ends, the interest rate may increase significantly. It’s crucial to pay off as much debt as possible before this happens.

3. Temptation to Accumulate More Debt

Transferring your balance doesn’t erase your debt; it only moves it. If you continue using your old credit cards without discipline, you could end up in deeper financial trouble.

4. Impact on Credit Score

Applying for a new credit card can temporarily lower your credit score due to the hard inquiry on your credit report.

Steps to Use a Balance Transfer Credit Card Effectively

Step 1: Assess Your Debt

Before applying for a balance transfer card, review your outstanding balances, interest rates, and repayment ability. Calculate whether the balance transfer fees are worth the potential savings.

Step 2: Choose the Right Balance Transfer Card

Look for a card with:

- A 0% introductory APR for the longest period possible.

- A low or no balance transfer fee.

- A reasonable regular APR after the promotional period.

- No annual fees if possible.

Step 3: Transfer Your Debt

Once approved, initiate the balance transfer process by providing your new credit card issuer with the details of your existing debt. The transfer may take a few days to complete.

Step 4: Create a Debt Repayment Plan

To maximize the benefit of a balance transfer credit card, create a structured repayment plan. Divide your total debt by the number of months in the 0% APR period to determine your ideal monthly payment.

For example:

- If you transfer $6,000 to a card with a 12-month 0% APR, aim to pay $500 per month to clear the balance before interest kicks in.

Step 5: Make Timely Payments

Missing payments can lead to penalty fees, loss of the promotional interest rate, and a negative impact on your credit score. Set up automatic payments or reminders to ensure timely payments.

Step 6: Avoid New Debt

One common mistake is continuing to use old credit cards, increasing overall debt. Close old accounts if necessary, or keep them open to maintain a low credit utilization ratio.

Alternative Debt Management Strategies

If a balance transfer credit card isn’t the right option for you, consider these alternatives:

1. Debt Snowball Method

Pay off your smallest debts first while making minimum payments on larger ones. This builds momentum and motivation.

2. Debt Avalanche Method

Focus on paying off the highest-interest debts first, saving more money in the long run.

3. Debt Consolidation Loans

A personal loan with a lower interest rate can help consolidate multiple debts into one manageable monthly payment.

4. Negotiating with Creditors

Contact creditors to negotiate lower interest rates, reduced settlement amounts, or revised payment terms.

5. Credit Counseling Services

Nonprofit credit counseling agencies can provide guidance and develop personalized debt repayment plans.

Conclusion: Is a Balance Transfer Credit Card Right for You?

A balance transfer credit card can be an effective tool for managing and paying off debt when used wisely. However, it requires discipline, a solid repayment plan, and awareness of potential risks.

Key Takeaways:

✅ Choose the right balance transfer card with a long 0% APR period and low fees. ✅ Have a repayment strategy to clear the debt before the promotional period ends. ✅ Avoid accumulating new debt to prevent financial setbacks. ✅ Consider alternative debt repayment strategies if a balance transfer isn’t the best fit for your situation.

By using a balance transfer credit card responsibly, you can take control of your financial health, reduce debt faster, and move toward a debt-free future. Always read the terms and conditions carefully before committing to any financial product to ensure it aligns with your goals.