Introduction

A balance transfer credit card can be a powerful tool for paying off high-interest debt more efficiently. By transferring your existing credit card balance to a card with a lower or 0% introductory interest rate, you can save on interest and focus on repaying your debt faster. However, if not managed properly, balance transfers can lead to more financial trouble. This guide will walk you through how to use a balance transfer credit card effectively and avoid common pitfalls.

What is a Balance Transfer Credit Card?

A balance transfer credit card allows you to move your existing credit card debt to a new card with a lower interest rate, often 0% APR for a promotional period. This can help you save money on interest and pay off your debt more quickly if used strategically.

Benefits of a Balance Transfer Credit Card

1. Lower Interest Rates

Many balance transfer credit cards offer 0% interest for an introductory period (typically 12-18 months), allowing you to pay off your debt without accruing additional interest.

2. Faster Debt Repayment

Since you’re not paying high interest, more of your payment goes toward reducing the principal balance, helping you become debt-free faster.

3. Simplified Payments

If you transfer multiple credit card balances to one card, you can consolidate your debt and manage a single payment each month instead of multiple due dates.

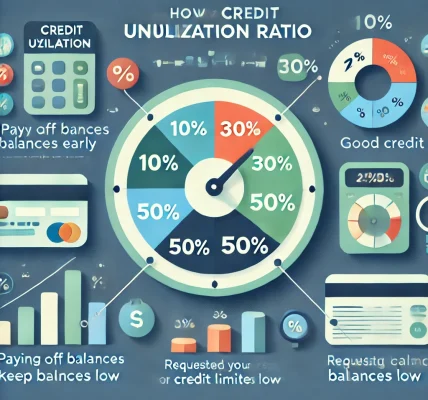

4. Potential Credit Score Improvement

Paying off debt efficiently and making timely payments can improve your credit utilization ratio and boost your credit score over time.

How to Use a Balance Transfer Credit Card Effectively

Step 1: Choose the Right Balance Transfer Card

- Look for a card with a 0% introductory APR period that lasts at least 12-18 months.

- Check for balance transfer fees (usually 3-5% of the transferred amount) and ensure the savings outweigh the cost.

- Avoid cards with high post-introductory interest rates, as any remaining balance after the promo period will accrue interest.

Step 2: Transfer Your Balance Wisely

- Request a balance transfer as soon as you receive your new card.

- Transfer as much debt as possible while staying within the card’s credit limit.

- Continue making payments on your old card until the balance transfer is complete to avoid missed payments.

Step 3: Create a Repayment Plan

- Divide your total debt by the number of months in the 0% APR period and set a monthly payment goal.

- Prioritize making at least the minimum payment each month to avoid penalties.

- If possible, pay more than the minimum to clear the debt before the promotional period ends.

Step 4: Avoid New Debt

- Resist the temptation to use your old credit card for new purchases.

- If you must use credit, ensure you have a repayment plan to avoid accumulating more debt.

Step 5: Monitor Your Progress

- Regularly check your balance transfer card statement to track your payments and remaining balance.

- Set reminders for payment due dates to avoid late fees or penalties.

Common Mistakes to Avoid

1. Ignoring the Balance Transfer Fee

While a balance transfer can save you money, many cards charge a 3-5% transfer fee. Ensure that the savings outweigh this cost before proceeding.

2. Making Late Payments

Missing even one payment could void the 0% APR offer and trigger high-interest rates. Always pay on time.

3. Not Paying Off the Balance Before the Promo Period Ends

If you don’t pay off your balance within the introductory period, the remaining amount will start accruing interest at the regular APR.

4. Using the Old Credit Card for New Purchases

Avoid running up more debt on your old card, or you’ll find yourself in a worse financial situation.

5. Choosing the Wrong Card

Selecting a card with a short promo period, high fees, or high post-introductory APR can minimize your savings. Compare multiple options before deciding.

Alternatives to a Balance Transfer Credit Card

- Debt Consolidation Loan – A personal loan used to pay off multiple debts at a lower interest rate.

- Credit Counseling Programs – Professional financial guidance to help manage and reduce debt.

- Negotiating with Creditors – Contacting your creditors to request lower interest rates or payment plans.

- Budgeting and Cutting Expenses – Adjusting your spending habits to free up more money for debt repayment.

Conclusion

A balance transfer credit card can be an excellent strategy for paying off debt faster, but it requires careful planning and discipline. By selecting the right card, making on-time payments, and avoiding new debt, you can take full advantage of the 0% APR period and move toward financial freedom. However, if mismanaged, it can lead to further financial stress. Be proactive, stay committed to your repayment plan, and make informed financial choices to achieve a debt-free future.