Introduction

If you’re struggling with high-interest credit card debt, a balance transfer credit card could be a powerful tool to help you pay off your debt faster and save money on interest. These cards allow you to move existing debt to a new card with a 0% introductory APR for a limited period, giving you time to make payments without accumulating additional interest.

However, using a balance transfer card effectively requires careful planning and financial discipline. This guide will walk you through everything you need to know, from how balance transfers work to best strategies for paying off your debt faster while avoiding common pitfalls.

What Is a Balance Transfer Credit Card?

A balance transfer credit card is a type of credit card that allows you to move debt from one or more existing credit cards to a new card with a low or 0% introductory interest rate for a set period (often 6 to 24 months). This means your payments go directly toward reducing your principal balance instead of being consumed by high-interest charges.

Key Features of Balance Transfer Cards:

- Introductory 0% APR Period: A set period (e.g., 12-18 months) with no interest charges on the transferred balance.

- Balance Transfer Fee: Usually 3%-5% of the transferred amount.

- Credit Limit: You can only transfer up to your approved credit limit.

- Standard APR After Promo Period: Once the 0% APR period ends, a regular interest rate applies.

Benefits of Using a Balance Transfer Card

- Save Money on Interest – The primary advantage of a balance transfer is avoiding high-interest charges, allowing you to pay down your principal faster.

- Simplify Debt Repayment – Consolidating multiple credit card balances into one payment makes managing your debt easier.

- Pay Off Debt Faster – Without interest accumulation, your payments directly reduce your debt balance.

- Improve Your Credit Score – By reducing credit utilization and making on-time payments, your credit score can improve over time.

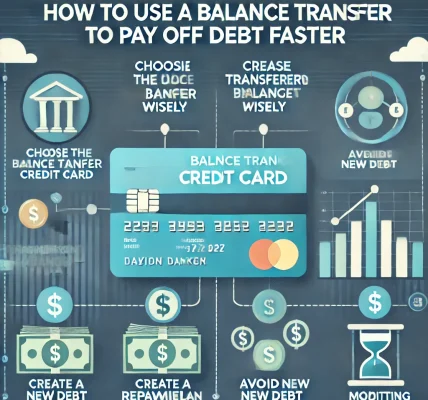

How to Use a Balance Transfer Credit Card Wisely

1. Choose the Right Balance Transfer Card

Not all balance transfer credit cards are the same. Here’s what to look for when choosing one:

- 0% Introductory APR Duration: Longer is better (e.g., 18-24 months).

- Balance Transfer Fee: Some cards charge a 3%-5% transfer fee, while others offer no-fee transfers.

- Regular APR After Promo Ends: Ensure you can pay off your balance before the intro rate expires to avoid high interest.

- Credit Score Requirements: Balance transfer cards often require good to excellent credit (670+ FICO score).

2. Calculate If a Balance Transfer Makes Financial Sense

Before transferring your balance, calculate whether the savings outweigh the cost of fees.

Example Calculation:

- Debt Amount: $5,000

- Current Credit Card Interest Rate: 18%

- Balance Transfer Fee: 3% ($150)

- New Card 0% APR for 18 months

Without a balance transfer, you could pay over $900 in interest annually. By transferring, you pay only the $150 fee, saving over $750!

3. Transfer Your Balance Correctly

Once approved, initiate the transfer by:

- Providing details of your existing credit card debts.

- Ensuring the balance transfer covers all or most of your high-interest debt.

- Waiting for the transfer to process (usually 7-10 days).

- Continuing to make minimum payments on old accounts until the transfer is confirmed.

4. Pay Off the Balance Before the 0% APR Period Ends

A balance transfer only works if you pay off the full amount before the introductory period expires. Here’s a plan to ensure you succeed:

- Divide your total balance by the promo period months to set a fixed monthly payment.

- Example: If you transfer $5,000 to a 0% APR card with an 18-month promo period, you must pay $278/month to clear your debt before interest kicks in.

5. Avoid New Purchases on the Balance Transfer Card

Many balance transfer cards do not offer 0% APR on new purchases, meaning new transactions may accrue interest at the regular APR. Avoid using the card for anything other than paying off transferred debt.

6. Close or Keep Old Credit Accounts?

After transferring your balance, you might consider closing your old credit card accounts. However, closing an account can lower your credit score due to:

- Reduced credit history length

- Increased credit utilization ratio

A better strategy is to keep the old account open (with a $0 balance) to maintain your credit score, but avoid using it for new spending.

Common Mistakes to Avoid

- Missing Payments – Late payments can trigger penalties and cancel the 0% APR offer.

- Not Paying Off Debt Before Promo Ends – If you don’t clear your balance in time, you’ll be stuck with a high-interest rate.

- Ignoring Transfer Fees – Factor in the balance transfer fee when calculating savings.

- Using the Card for New Purchases – This could lead to additional debt.

- Applying for Too Many Balance Transfer Cards – Multiple applications can lower your credit score.

Alternative Strategies to Pay Off Debt Faster

If a balance transfer isn’t the right option for you, consider these alternatives:

- Debt Snowball Method – Pay off the smallest debts first for psychological motivation.

- Debt Avalanche Method – Focus on paying off debts with the highest interest rates first.

- Debt Consolidation Loan – A personal loan with a lower interest rate to consolidate debt.

- Negotiating with Creditors – Request lower interest rates or structured repayment plans.

Conclusion

Balance transfer credit cards can be a powerful debt repayment tool, but they require discipline and strategic planning. By choosing the right card, making consistent payments, and avoiding common pitfalls, you can pay off your debt faster while saving on interest.

If used wisely, balance transfers can set you on the path to financial freedom and better credit health. Always read the terms carefully and make sure the strategy aligns with your financial goals.