Introduction

Financial security for widows and senior women is a critical aspect of social welfare in India. The government has introduced various pension schemes to provide financial assistance and ensure a dignified life for women who may not have a steady source of income. This blog explores different pension schemes available for widows and senior women, their eligibility criteria, benefits, and application procedures.

Importance of Pension Schemes for Women

Women, particularly widows and senior citizens, often face financial instability due to the loss of a spouse or retirement without adequate savings. Government pension schemes play a vital role in:

- Ensuring economic independence

- Reducing financial dependence on relatives

- Providing access to essential healthcare and daily needs

- Promoting social inclusion and empowerment

Government Pension Schemes for Widows

1. Indira Gandhi National Widow Pension Scheme (IGNWPS)

The Indira Gandhi National Widow Pension Scheme (IGNWPS) is a social welfare initiative under the National Social Assistance Programme (NSAP) to provide financial support to widows.

Eligibility Criteria:

- Applicant must be a widow.

- Age: 40 years and above.

- Belong to a Below Poverty Line (BPL) family.

Benefits:

- Monthly pension of ₹300 (which can increase depending on the state’s additional contribution).

- The amount is directly transferred to the beneficiary’s bank account.

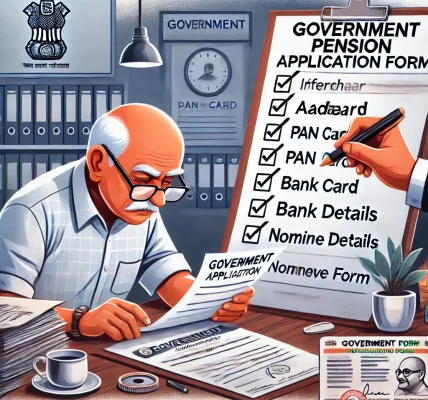

How to Apply:

- Applications can be submitted online via the National Social Assistance Programme (NSAP) portal or at local panchayat offices.

- Required documents: Aadhaar card, death certificate of the spouse, BPL certificate, and bank account details.

2. Widow Pension Scheme by State Governments

Apart from the central government scheme, many states offer additional widow pension schemes with enhanced benefits. For instance:

- Delhi Widow Pension Scheme: ₹2,500 per month.

- Uttar Pradesh Widow Pension Scheme: ₹500 per month.

- West Bengal Widow Pension Scheme: ₹1,000 per month.

Each state has its own set of eligibility criteria, and widows are encouraged to check with their local government offices for details.

Pension Schemes for Senior Women

1. Indira Gandhi National Old Age Pension Scheme (IGNOAPS)

Eligibility Criteria:

- Women aged 60 years and above.

- Must belong to a Below Poverty Line (BPL) family.

Benefits:

- ₹200 per month for women aged 60-79 years.

- ₹500 per month for women aged 80 years and above.

How to Apply:

- Applications can be submitted through local government offices or online portals.

- Required documents: Aadhaar card, age proof, bank account details, and BPL certificate.

2. Pradhan Mantri Vaya Vandana Yojana (PMVVY)

Eligibility Criteria:

- Women aged 60 years and above.

- No specific income restrictions.

Benefits:

- Assured pension with returns of 7.4% per annum.

- Monthly pension ranging from ₹1,000 to ₹10,000, depending on the investment.

- Pension disbursed for 10 years.

How to Apply:

- Available through Life Insurance Corporation (LIC) of India.

- Applications can be submitted online through LIC’s official portal.

3. Atal Pension Yojana (APY)

The Atal Pension Yojana (APY) is a voluntary pension scheme primarily aimed at unorganized sector workers, including senior women.

Eligibility Criteria:

- Women aged 18-40 years can enroll.

- Must have a savings bank account.

Benefits:

- Guaranteed pension between ₹1,000 to ₹5,000 per month after the age of 60.

- Government co-contribution for eligible subscribers.

How to Apply:

- Enrollment through banks or post offices.

- Required documents: Aadhaar card, mobile number, and bank account details.

Additional Benefits and Support for Women Pensioners

1. Healthcare Benefits

- Ayushman Bharat Yojana: Provides free health insurance up to ₹5 lakh per family per year.

- State Health Insurance Schemes: Additional health benefits for senior women and widows.

2. Financial Assistance for Daily Living

- Many states offer free ration cards and subsidized electricity bills for senior women pensioners.

3. Social Inclusion Programs

- Elderly women are encouraged to join senior citizen self-help groups and community welfare programs to stay socially active.

Conclusion

Pension schemes for widows and senior women are essential to ensure financial security, independence, and a dignified life. The Indian government, along with various state initiatives, provides multiple schemes to support these women. Eligible individuals should apply for these schemes to avail of financial benefits and secure their future.

If you or someone you know qualifies for these pension schemes, take the necessary steps to apply and ensure a financially stable life ahead