Introduction

Loans are a fundamental part of personal and business finance, helping individuals and organizations meet financial needs. However, choosing the right type of loan can be crucial to ensuring financial stability and minimizing risks. Loans are primarily classified into two categories: secured loans and unsecured loans. Understanding their differences, advantages, and disadvantages can help borrowers make informed decisions. This article explores the key aspects of secured and unsecured loans, their pros and cons, and how to determine which one suits your financial situation best.

What is a Secured Loan?

A secured loan is a loan that requires collateral, such as property, a vehicle, or any other valuable asset, to secure the borrowed amount. If the borrower fails to repay the loan, the lender has the legal right to seize the collateral to recover the outstanding balance.

Examples of Secured Loans:

- Home Loans (Mortgages): The house purchased acts as collateral.

- Auto Loans: The vehicle bought with the loan is the collateral.

- Secured Business Loans: Business assets or property are used as collateral.

- Gold Loans: Gold assets are pledged for financing.

Pros of Secured Loans:

- Lower Interest Rates: Since the lender has collateral to secure the loan, interest rates are generally lower.

- Higher Borrowing Limits: Borrowers can obtain higher loan amounts compared to unsecured loans.

- Longer Repayment Terms: Many secured loans offer longer repayment periods, making EMIs more affordable.

- Easier Approval Process: Lenders are more willing to approve secured loans since they have an asset to recover funds if needed.

Cons of Secured Loans:

- Risk of Asset Seizure: If the borrower defaults, the lender can seize the collateral.

- Longer Processing Time: Due to the asset verification and legal processes involved, approval might take longer.

- Limited Flexibility: The loan amount is often restricted to the value of the collateral provided.

What is an Unsecured Loan?

An unsecured loan does not require any collateral. Instead, lenders approve the loan based on the borrower’s creditworthiness, income, and financial stability. Since there is no collateral involved, unsecured loans often carry higher risks for lenders.

Examples of Unsecured Loans:

- Personal Loans: Borrowed without any asset backing, based purely on income and credit score.

- Credit Cards: A revolving credit facility with no collateral requirement.

- Student Loans: Educational loans that do not require collateral in many cases.

- Unsecured Business Loans: Business financing without asset backing, based on company revenue and financials.

Pros of Unsecured Loans:

- No Collateral Required: Borrowers don’t need to risk losing their assets.

- Faster Approval Process: Since no asset verification is needed, these loans get approved faster.

- Flexibility in Usage: Unsecured loans can be used for multiple purposes like medical emergencies, travel, or education.

Cons of Unsecured Loans:

- Higher Interest Rates: Since lenders take more risks, the interest rates are usually higher.

- Lower Loan Limits: The borrowing amount is generally lower compared to secured loans.

- Strict Eligibility Criteria: Requires a high credit score and strong financial stability for approval.

- Shorter Repayment Tenure: Loan terms are often shorter, leading to higher EMI amounts.

Key Differences Between Secured and Unsecured Loans

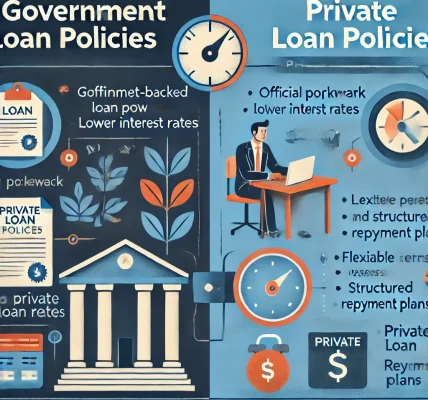

| Feature | Secured Loan | Unsecured Loan |

|---|---|---|

| Collateral Required | Yes | No |

| Interest Rate | Lower | Higher |

| Loan Amount | Higher | Lower |

| Approval Process | Longer (due to asset verification) | Faster |

| Risk for Borrower | High (loss of collateral if defaulted) | Low (no asset loss, but credit score impact) |

| Repayment Tenure | Longer | Shorter |

| Best For | Large financial needs like home, car, or business | Quick financing for personal or emergency needs |

Which Loan Should You Choose?

Choose a Secured Loan If:

- You need a large loan amount for purposes like buying a house or expanding a business.

- You have collateral to pledge and are comfortable taking the risk.

- You want lower interest rates and longer repayment terms.

- You are looking for a higher loan eligibility limit based on your asset value.

Choose an Unsecured Loan If:

- You don’t have any collateral or don’t want to risk assets.

- You need quick approval and funding for emergencies.

- You are okay with higher interest rates for easier access to credit.

- You require a small or medium loan amount with flexible usage options.

How to Apply for a Loan Wisely

Regardless of whether you choose a secured or unsecured loan, consider these steps before applying:

- Assess Your Financial Needs: Determine the loan amount required and the purpose of borrowing.

- Check Your Credit Score: A high credit score improves chances of loan approval, especially for unsecured loans.

- Compare Interest Rates: Different banks and financial institutions offer varying rates. Compare and choose wisely.

- Evaluate Repayment Capacity: Ensure you can manage monthly EMIs without financial strain.

- Read Loan Terms and Conditions: Check for hidden charges, prepayment penalties, and loan tenure before signing the agreement.

- Consider Future Financial Goals: Ensure that taking the loan does not disrupt your long-term financial plans.

Conclusion

Both secured and unsecured loans serve distinct financial purposes, and choosing the right one depends on your financial situation, risk appetite, and repayment ability. Secured loans are beneficial for those looking for lower interest rates and higher amounts, provided they have collateral. On the other hand, unsecured loans are ideal for quick financial assistance without risking assets but come at higher interest rates.

Before making a final decision, assess your financial stability, loan requirements, and repayment capability. Seeking guidance from a financial advisor can help you make an informed and legally sound choice that aligns with your long-term financial goals.