Debt can feel overwhelming, but balance transfer credit cards offer a potential solution for paying off high-interest credit card debt efficiently. These cards allow you to transfer your existing balances to a new card with a lower or 0% introductory interest rate, helping you save money on interest and pay off debt faster.

This guide will explore how balance transfer credit cards work, their pros and cons, and whether they are the right solution for your financial situation.

What is a Balance Transfer Credit Card?

A balance transfer credit card is a financial tool that allows you to move existing high-interest credit card debt to a new card, often with a promotional 0% interest period. This introductory period typically lasts between 6 to 21 months, during which you can pay off your balance without incurring additional interest.

However, balance transfer cards often come with fees, specific eligibility requirements, and certain limitations you should consider before applying.

How Do Balance Transfers Work?

- Apply for a Balance Transfer Credit Card: Choose a card with a low or 0% introductory APR and a sufficient credit limit.

- Transfer Your Existing Debt: After approval, move your balance(s) from high-interest credit cards to the new card.

- Pay Off the Balance During the Promotional Period: Avoid accumulating new debt and focus on repaying the transferred balance before the 0% APR period expires.

- Watch for Fees and Interest Rate Increases: Balance transfers often have fees (typically 3-5% of the transferred amount), and once the promotional period ends, the regular interest rate applies to any remaining balance.

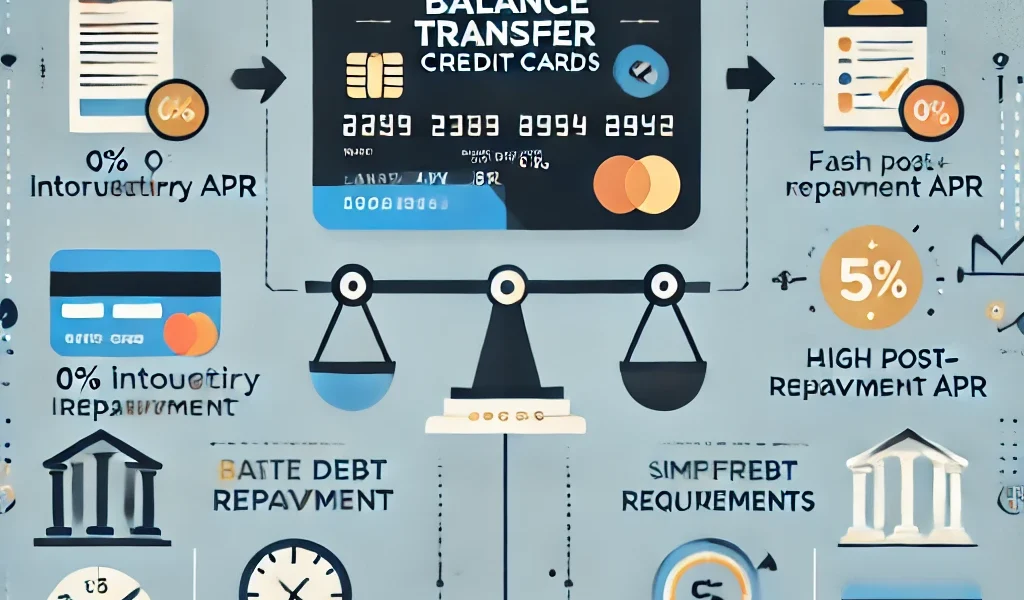

Pros of Balance Transfer Credit Cards

✅ Lower or 0% Interest Rates: Reduces the amount you pay in interest, allowing more of your payment to go toward the principal balance.

✅ Faster Debt Repayment: Without high-interest charges, you can pay off your balance quicker.

✅ Simplified Debt Management: Consolidating multiple debts into one payment makes budgeting and tracking easier.

✅ Potential Credit Score Boost: Paying off balances can lower your credit utilization ratio, which may improve your credit score.

Cons of Balance Transfer Credit Cards

❌ Balance Transfer Fees: Most cards charge a fee (usually 3-5%) for transferring a balance, which can add up.

❌ High Interest After Promo Period: If you don’t pay off the balance before the 0% APR expires, the remaining debt may be subject to high interest rates.

❌ Strict Qualification Requirements: Approval often requires a good or excellent credit score (typically 670+).

❌ Temptation to Spend More: If you don’t change spending habits, you might accumulate new debt on top of your transferred balance.

When is a Balance Transfer Credit Card a Good Option?

A balance transfer credit card can be an effective tool if:

- You have high-interest credit card debt and want to save on interest.

- You have a solid repayment plan to clear the balance before the promotional APR expires.

- You qualify for a low or 0% APR offer based on your credit score.

- You can avoid accumulating new debt while paying off the transferred balance.

Alternatives to Balance Transfer Credit Cards

If a balance transfer isn’t the right fit, consider these alternatives:

🔹 Debt Consolidation Loan: A personal loan with a lower interest rate can help consolidate and pay off debt.

🔹 Credit Counseling: A non-profit credit counseling agency can help negotiate better repayment terms with creditors.

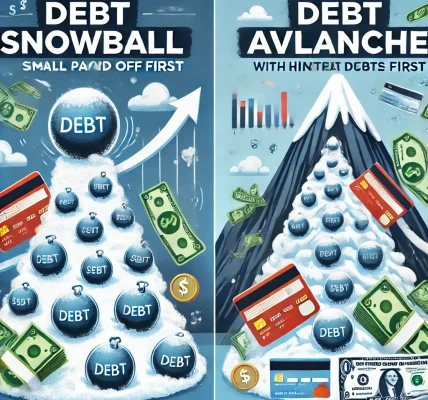

🔹 Snowball or Avalanche Repayment Methods: These strategies focus on prioritizing smaller debts first (snowball) or highest-interest debts first (avalanche) to speed up debt payoff.

🔹 Negotiating with Creditors: Some credit card issuers may be willing to lower interest rates or offer hardship programs if you contact them directly.

Final Thoughts: Is a Balance Transfer Credit Card Right for You?

Balance transfer credit cards can be a smart way to manage and eliminate debt—but only if used strategically. If you qualify for a good offer and can pay off the balance before the promotional period ends, this can be an excellent way to save on interest and become debt-free faster. However, if you don’t have a repayment plan or struggle with overspending, other debt management strategies may be a better fit.

Key Takeaways: ✅ A balance transfer card can help you save on interest and pay off debt faster. ✅ Be aware of balance transfer fees and high post-introductory interest rates. ✅ Consider alternatives like personal loans, debt counseling, or structured repayment plans if a balance transfer isn’t the right fit. ✅ The key to success is paying off the balance before the 0% APR period ends to avoid future financial trouble.

Disclaimer:

This article is for informational purposes only and should not be considered financial or legal advice. Always consult a financial expert before making debt repayment decisions.