Introduction

Planning for retirement is a crucial financial decision, and government pension plans provide a reliable and secure option for long-term savings. Apart from offering financial security after retirement, these pension plans also come with significant tax benefits that help investors save money while planning for the future.

In this article, we will explore the various tax benefits associated with investing in government pension plans, how they work, and why they make an excellent choice for individuals looking to optimize their savings while enjoying tax exemptions.

1. Understanding Government Pension Plans

Government pension plans are retirement schemes sponsored or regulated by the government to provide post-retirement financial stability. Some of the most popular government pension plans in India include:

- National Pension System (NPS)

- Employees’ Provident Fund (EPF)

- Employees’ Pension Scheme (EPS)

- Atal Pension Yojana (APY)

- Public Provident Fund (PPF)

Each of these pension plans offers distinct benefits, including tax advantages, which make them attractive to investors seeking retirement security and tax efficiency.

2. Tax Benefits Under Different Sections of the Income Tax Act

Government pension plans provide tax exemptions under various sections of the Income Tax Act, 1961. Let’s take a closer look at these tax benefits:

A. Tax Benefits Under Section 80C

Section 80C allows deductions of up to ₹1.5 lakh per financial year on eligible investments, including contributions to certain government pension schemes.

Eligible Pension Plans Under 80C:

- Employees’ Provident Fund (EPF)

- Public Provident Fund (PPF)

- National Pension System (NPS) – Tier I

- Atal Pension Yojana (APY)

These deductions reduce the taxable income of investors, effectively lowering their income tax liability.

B. Additional Tax Benefit Under Section 80CCD(1B) for NPS Investors

NPS subscribers get an additional tax deduction of ₹50,000 under Section 80CCD(1B) over and above the ₹1.5 lakh deduction available under Section 80C. This means that an investor in NPS Tier I can claim a total deduction of ₹2 lakh per year.

C. Employer’s Contribution to NPS – Section 80CCD(2)

If your employer contributes to your NPS account, you can claim additional deductions under Section 80CCD(2). The maximum deduction allowed is:

- 10% of Basic Salary + DA for private-sector employees.

- 14% of Basic Salary + DA for central government employees.

This deduction is over and above the limits of Section 80C and 80CCD(1B), making NPS one of the most tax-efficient pension schemes available.

D. Tax-Free Withdrawals and Maturity Benefits

Some government pension plans also offer tax-free maturity benefits:

- Public Provident Fund (PPF): PPF follows the Exempt-Exempt-Exempt (EEE) model, meaning that contributions, interest earned, and withdrawals are all tax-free.

- National Pension System (NPS): Upon retirement, 60% of the NPS corpus can be withdrawn tax-free, while the remaining 40% must be used to purchase an annuity, which is taxable as per the individual’s income slab.

- EPF Maturity Amount: If an EPF account has been held for at least 5 years, the entire maturity amount is tax-free.

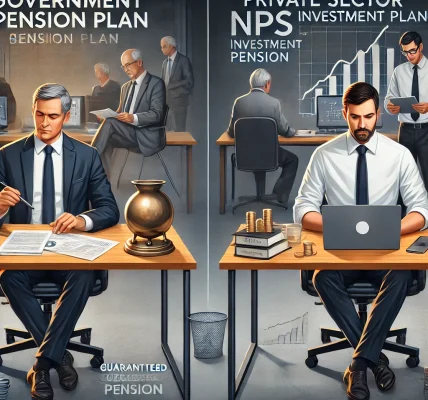

3. Comparison of Tax Benefits Across Different Government Pension Plans

| Pension Plan | Tax Deduction on Contributions | Tax on Maturity | Additional Tax Benefits |

|---|---|---|---|

| NPS | ₹1.5 lakh under 80C + ₹50,000 under 80CCD(1B) | 60% tax-free withdrawal, 40% taxed as annuity | Employer’s contribution deductible under 80CCD(2) |

| EPF | ₹1.5 lakh under 80C | Tax-free after 5 years | High interest rate |

| PPF | ₹1.5 lakh under 80C | Fully tax-free | Follows EEE model |

| APY | ₹1.5 lakh under 80C | Pension taxable | Government co-contribution for eligible subscribers |

4. How Tax Benefits Help Maximize Retirement Savings

Investing in government pension plans helps individuals reduce their tax liabilities while also building a secure retirement corpus. Here’s how:

- Lower Taxable Income: Claiming deductions under Sections 80C, 80CCD(1B), and 80CCD(2) can significantly reduce taxable income, lowering tax outgo.

- Tax-Free Growth: Pension funds, especially PPF and EPF, provide tax-free interest accumulation, ensuring higher returns.

- Compounding Benefits: Tax savings, when reinvested, can further enhance wealth accumulation over time.

- Government Contributions: Some schemes like APY and NPS (for government employees) offer additional government contributions, adding to retirement savings.

5. Who Should Invest in Government Pension Plans?

Government pension plans are beneficial for:

- Salaried Employees: Who want tax deductions and employer contributions (NPS, EPF, PPF).

- Self-Employed Individuals: Who seek tax-free long-term savings (PPF, NPS).

- Low-Income Earners & Workers in Unorganized Sector: Who want government-backed retirement benefits (APY).

- Risk-Averse Investors: Who prefer guaranteed returns and tax-free benefits.

6. Recent Changes in Taxation of Pension Schemes (2024 Updates)

- Higher Exemption Limit for NPS Withdrawals: The government has increased the tax-free withdrawal limit on NPS Tier I from 40% to 60%.

- Employer’s NPS Contribution Increased: For central government employees, employer contribution deduction limit has increased from 10% to 14% under Section 80CCD(2).

- EPF Interest Rate Increased: The EPF interest rate has been raised from 8.1% to 8.5% for 2024-25.

Conclusion

Government pension plans offer multiple tax benefits that make them attractive for individuals looking to secure their financial future. Whether you invest in NPS, EPF, PPF, or APY, these schemes help you save taxes, build a retirement corpus, and enjoy financial stability in your later years.

To maximize your tax benefits, it’s essential to choose the right pension plan based on your income, risk appetite, and retirement goals.

Start investing today and take full advantage of the tax benefits provided by government pension schemes!